June NTR and BDC Sales

July 10, 2018 | James Sprow | Blue Vault

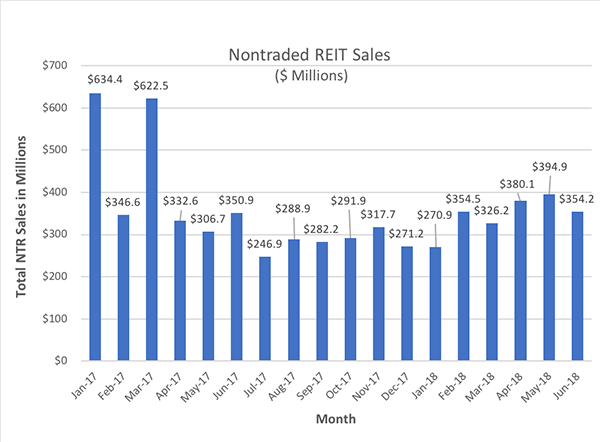

With the impact of Blackstone REIT’s decrease in sales of 12% in June versus May, 21 nontraded REIT offerings raised a total of $354.2 million in June, a 10.3% decrease from the $396.1 million raised in May. The year-to-year comparison for June shows sales increased from June 2017 by $3.3 million or approximately one percent. Blackstone REIT raised over 63% of all capital raised by all NTRs in June.

After Blackstone REIT’s June capital raise (including DRIP proceeds) of $224.9 million, the capital raise leaders among REITs in the NTR space were Griffin-American Healthcare REIT IV, Inc. with $21.0 million, Cole Real Estate Income Strategy (Daily NAV), Inc. with $18.0 million, Black Creek Industrial REIT IV, Inc. with $15.0 million, Black Creek Diversified Property Fund, Inc. with $12.2 million, and Carter Validus Mission Critical REIT II, Inc. with $8.2 million. In terms of percentage increase in capital raised between May and June, Hines Global Income Trust, Inc. led all open programs with an increase of 152%, from $1.20 million in May to $3.04 million in June.

Griffin Capital raised $23.9 million with its two effective NTR offerings in June, compared to $26.3 million in May, for a decrease of 9%. Black Creek Group’s two effective NTR offerings decreased combined capital raise by 21% from May to June. CIM (formerly Cole Capital) saw a small decrease of 4% in its total NTR capital raise for its three effective NTR offerings from May to June. The sponsor with the largest absolute increase in NTR capital raise from May to June was Cantor Fitzgerald’s Rodin Global Property Trust with capital raise increasing $5.2 million to $10.2 million.

Among the REITs with significant increases in capital raised between May and June, after Hines Global Income Trust’s 152% increase month-to-month, Rodin Global Property Trust was next with its 104% increase, followed by RREEF Property Trust’s 54% increase and Griffin Capital Essential Asset REIT II’s 20.4% increase. Interestingly, the increase in capital raised by these four REITs combined totaled just $8.9 million compared to the decrease in Blackstone REIT’s sales of $31.6 million.

Nontraded BDC sales decreased from $39.4 million in May to $30.7 million in June, a fall of 22%, with only four nontraded BDC programs raising funds in June compared to six in April and seven in February. Owl Rock Capital Advisors again led nontraded BDC sponsors with sales of $27.2 million, 88% of all nontraded BDC sales in June, but down 14% from May. MacKenzie Realty Capital was a distant second with $1.9 million in sales for a 6% share of all BDC sales, but with June sales 32% lower than in May. Terra Capital Partners and Triton Pacific Capital reported no BDC sales in June.