James Sprow | Blue Vault |

According to analysts, publicly traded U.S. equity REITs traded at a median 8.9% discount to their consensus S&P Capital IQ net asset value per-share estimates as of April-end, a further drop from the 5.2% discount at which they traded as of March-end.

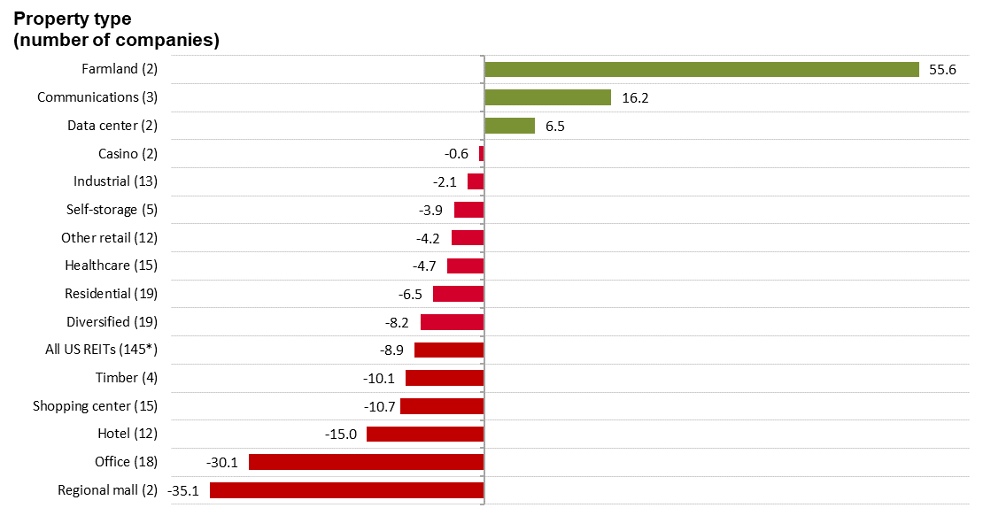

This marks a substantial reversal from the 3.1% premium to consensus S&P Global Market Intelligence net asset value (NAV) per share estimates as of January 3, 2022. Three sectors were estimated to be trading at premiums to NAV in the latest report. Farmland REITs, of which only two were in the analysis, traded at a 55.6% premium to NAV. The three Communications REITs traded at an average 16.2% premium and two Data Center REITs were trading at an average 6.5% premium to NAV. Those three categories of listed REITs were also the highest premiums to NAV as of January 3, 2022. Farmland REITs were at an average 40.6% premium in January, indicating a rise in their relative valuations by the market, but Communications REITs dropped from their 31.7% average premium in January, and Data Center REITs also dropped from 27.4% average premium in January.

The largest discounts to NAV were the two Regional Mall REITs at -35.1% in April, a drop from -14.1% in January. The 12 Hotel REITs recovered only marginally, at a -15.0% discount to NAV in April from the -16.7% discount in January. The 18 Office REITs which had the largest average discount to NAV in January at -22.1% have fallen further to a -30.1% discount in April.

Gladstone Land Corp. (NYSE: LAND) led the listed REITs with a premium to NAV of 98.8%. Bluerock Residential Growth REIT Inc. (BRG), a multifamily REIT, traded at a 29.2% premium to NAV, no doubt due to the planned acquisition by Blackstone REIT, the largest nontraded REIT, announced in December 2021 and approved by shareholders on April 12, 2022. On the announcement of the Blackstone REIT offer, BRG’s common stock immediately jumped to $26.59 per share from its previous close at $15.44. Welltower Inc., which traded at a 42.9% premium to NAV as of April 29, 2022, is a Healthcare REIT that invests in senior housing operators and post-acute providers.

Median Premium (Discount) to NAV as of April 29, 2022

Sources: S&P Global Market Intelligence, finance.yahoo.com, SEC