Mobile Infrastructure Corp.’s Listing Goes South

October 3, 2023 | James Sprow | Blue Vault

Mobile Infrastructure Corporation (formerly known as The Parking REIT, Inc.) was a nontraded REIT corporation formed on May 4, 2015. The Company focuses on acquiring, owning and leasing parking facilities and related infrastructure, including parking lots, parking garages and other parking structures throughout the United States.

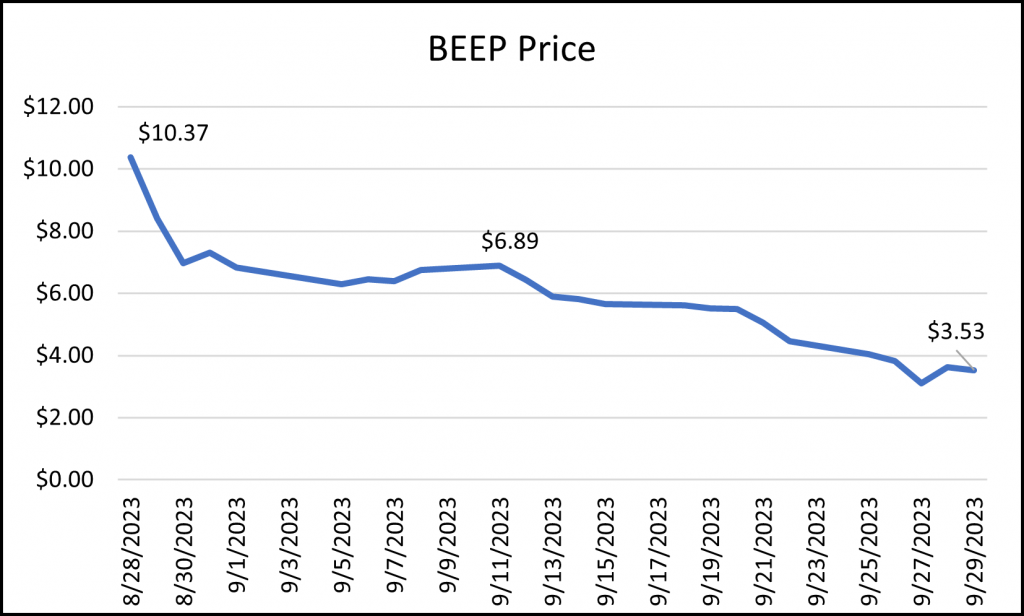

Mobile Infrastructure Corporation’s common stock commenced trading on the New York Stock Exchange American under the ticker “BEEP” on August 28, 2023.

As of June 30, 2023, the Company owned 43 parking facilities (including one property classified as held for sale) in 22 separate markets throughout the United States, with a total of 15,676 parking spaces and approximately 5.4 million square feet.

Prior to the listing, Mobile Infrastructure Corp. merged with Fifth Wall Acquisition Corp. III, a special purpose acquisition company (“SPAC”) sponsored by an affiliate of Fifth Wall, the largest venture capital firm focused on technology for the built world. The REIT announced the completion of its business combination on August 25. The transaction valued the equity of Mobile at $15.00 per share versus its published 2022 Net Asset Value (“NAV”) of $14.76 per share.

Clearly, the stock market is not buying the valuation put forward by the REIT in its public pronouncements. The listed REIT has recently traded as low as $3.53 per share after opening its trading on August 28, 2023, trading as high as $13.99 per share.

Sources: SEC, finance.yahoo.com