NAV Monitor: US equity REITs trade at 19.1% discount to NAV at August-end

September 7, 2022 | S&P Global Market Intelligence

Editor’s note: This Data Dispatch is updated monthly and was last published Aug. 3. The analysis includes current publicly traded U.S. equity real estate investment trusts that trade on the Nasdaq, NYSE or NYSE American with market capitalizations of at least $200 million.

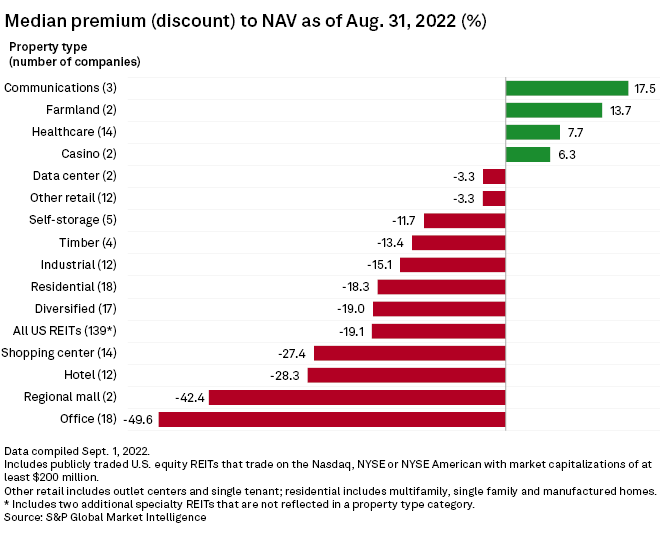

Publicly listed U.S. equity REITs traded at a median 19.1% discount to their consensus S&P Capital IQ net asset value per-share estimates as of the end of August, a further decline from the 12.9% discount at which they traded as of July-end.

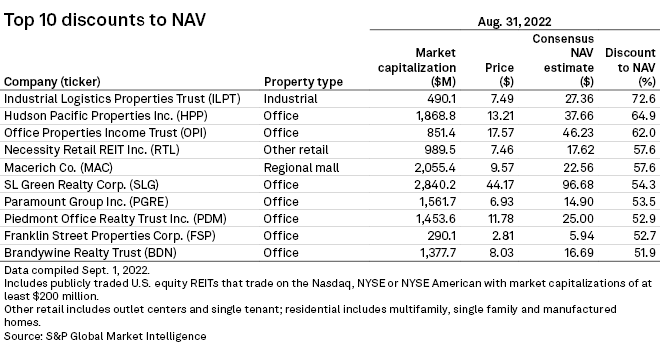

Offices got the largest median discounts

The office sector traded at the steepest median discount to NAV, at 49.6%. Office REIT Hudson Pacific Properties Inc. closed Aug. 31 at $13.21, 64.9% lower than its consensus NAV estimate of $37.66, the second-largest discount to NAV among all U.S. equity REITs with above $200 million of market capitalization. Office Properties Income Trust followed, trading at a discount of 62.0%. Five other office REITs got the sixth to 10th biggest discounts to NAV across all sectors as of August-end, including SL Green Realty Corp., Paramount Group Inc., Piedmont Office Realty Trust Inc., Franklin Street Properties Corp. and Brandywine Realty Trust.

Regional mall REITs also traded at huge discounts, at a median of 42.4%. Regional mall owner Macerich Co. traded at a discount of 57.6%, the fifth-biggest discount to NAV across all U.S. equity REITs with at least $200 million in market capitalization. Mall giant Simon Property Group Inc. traded at a discount of 27.3%.

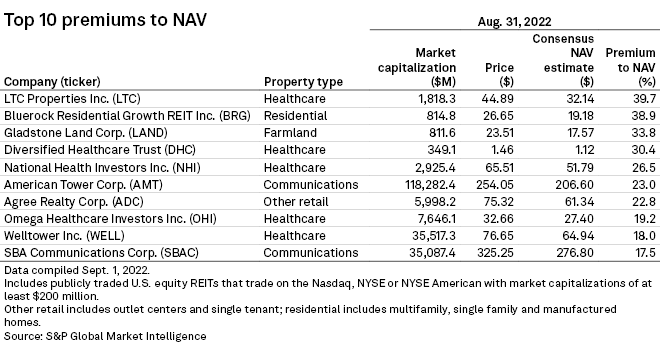

Communications nabbed the top median premium

The communications segment retained its top post on the premiums to NAV list, trading at a median of 17.5%. Within the communications sector, American Tower Corp. traded at a premium of 23.0%, the sixth-largest premium among all U.S. equity REITs above $200 million in market capitalization. SBA Communications Corp. is another communications REIT on the top premium list, which traded at a premium of 17.5%.

Next to communications is the farmland sector, trading at a median premium of 13.7%. Landowner Gladstone Land Corp. significantly raised the farmland sector’s median, trading at a premium of 33.8%, the third-largest premium to NAV. On the other hand, another farmland REIT Farmland Partners Inc. traded at a 6.4% discount, closing Aug. 31 at $14.51.

Healthcare REIT LTC Properties Inc. ranked first on the overall list of REITs with the highest premiums, trading at 39.7%, followed by multifamily-focused Bluerock Residential Growth REIT Inc. at 38.9%.