James Sprow | Blue Vault

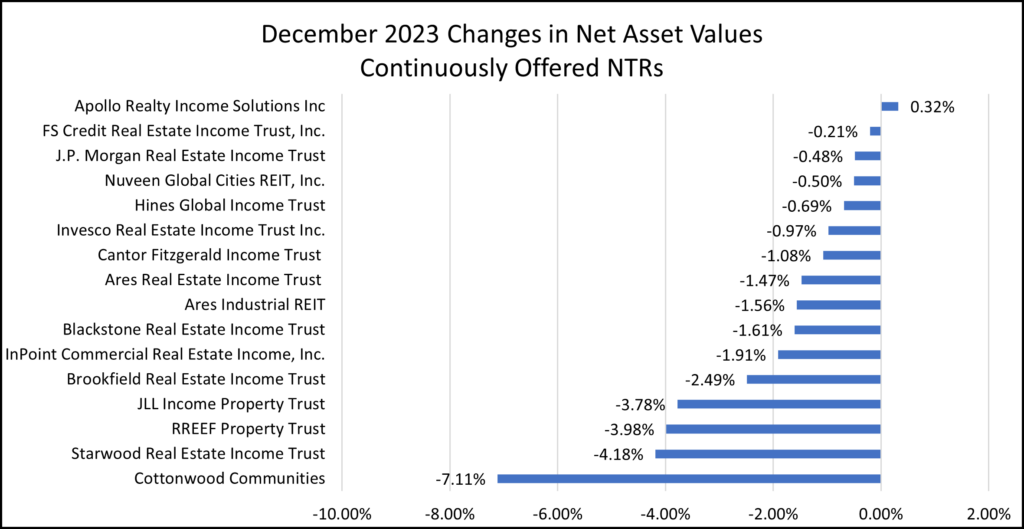

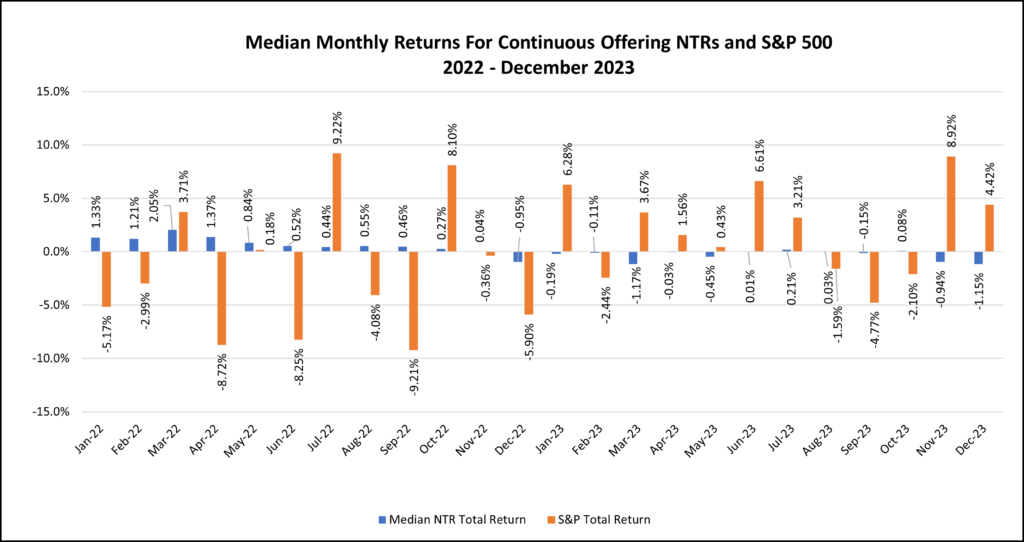

The sixteen continuously offered nontraded REIT programs suffered negative total returns almost across the board in December 2023. Only Apollo Realty Income Solutions posted a positive total return for the month. The median monthly total return for the programs was negative 1.15% and the average return for the group was negative 1.48%

Chart I

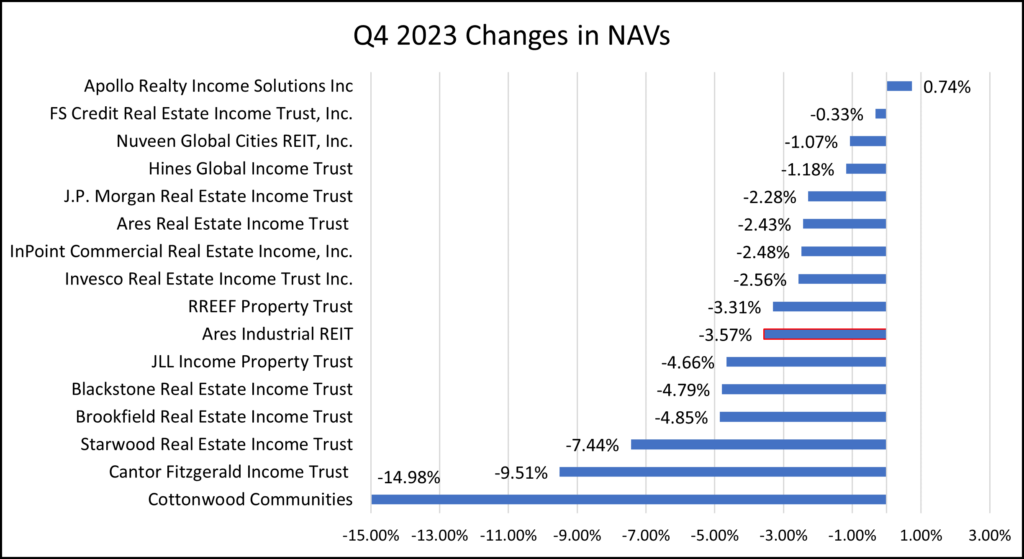

With the negative changes in December 2023, the 4th Quarter’s results were also significantly negative, with, again, only Apollo Realty Income Solutions having a positive change in its Class I NAV per share of 0.74%. The median quarterly change for the 16-NTR group was negative 2.93% and the average change was negative 4.04%, influenced significantly by the 14.98% drop in the NAV sustained by Cottonwood Communities.

Chart II

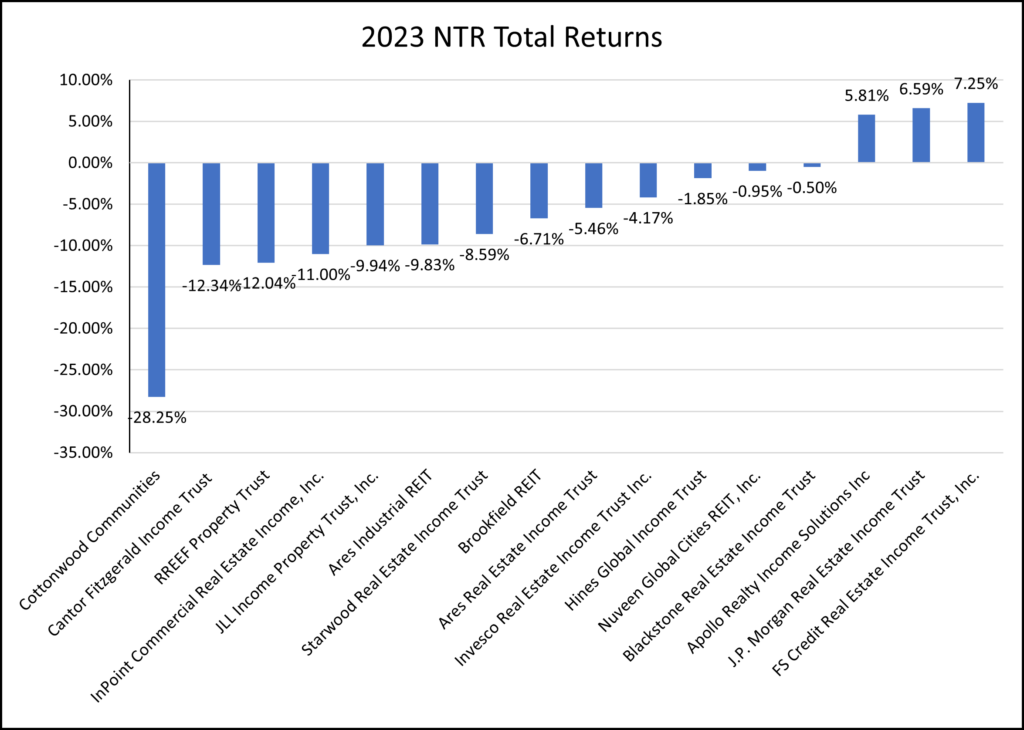

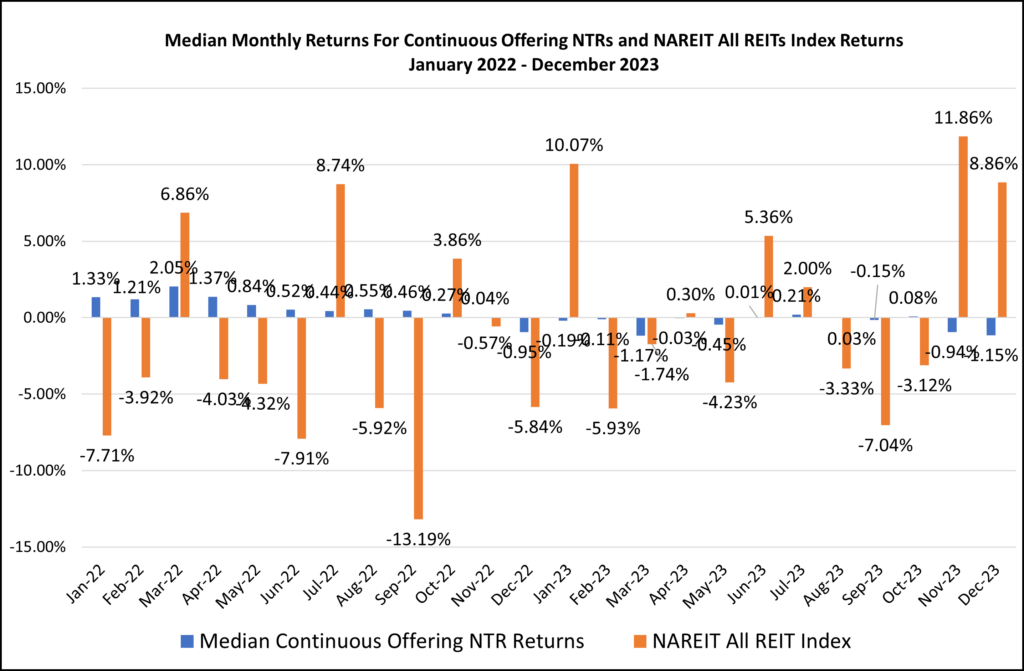

For the year 2023, 13 of the sixteen continuously offered REITs suffered negative total returns. The distributions paid by the group were sufficient to overcome the large drops in NAVs for the year for only three NTRs. FS Credit REIT had the highest distribution yield for its Class I shares in December, at 7.53%, and its investments in credit assets did relatively well for the year, resulting in a positive total return, just one of those three REITs to do so. The median total return for 2023 for the sixteen nontraded REITs was negative 6.09% and the average return was negative 5.75%.

Chart III

Chart IV

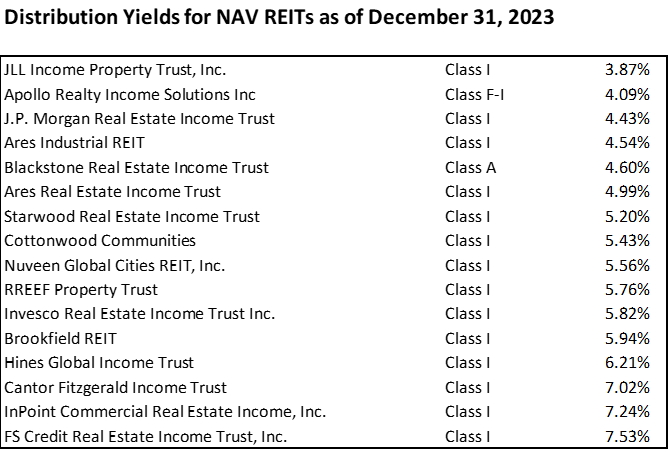

All but one of the 16 continuously offered nontraded REITs were distributing at rates far above the average dividend yield on the S&P 500 listed stock index (1.50% as of December 2023) or the NAREIT All Equity REIT Index for listed REITs (3.92%). The median distribution yield for the 16 NTRs was 5.50% as of December 31, 2023.

Table I

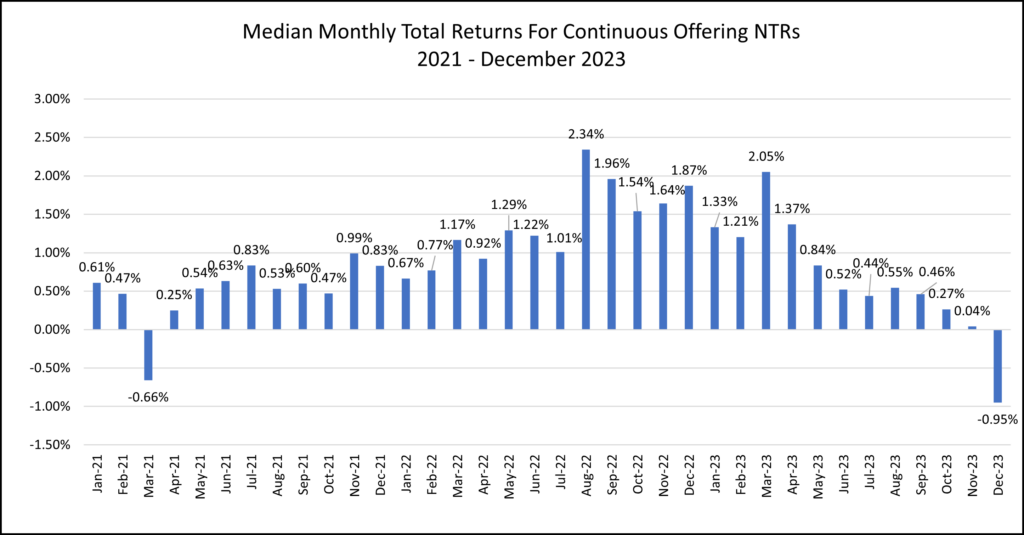

In November 2023, the median monthly total returns for the continuous offering NTRs turned negative for the first time since May 2023 and was negative again in December. Since January 2022, the median total returns for the nontraded REITs were negative eight out of 24 months. The S&P 500 Index had negative total returns for twelve of the 24 months. The listed REIT index had negative total returns in fifteen of the 24 months.

Chart V

Chart VI

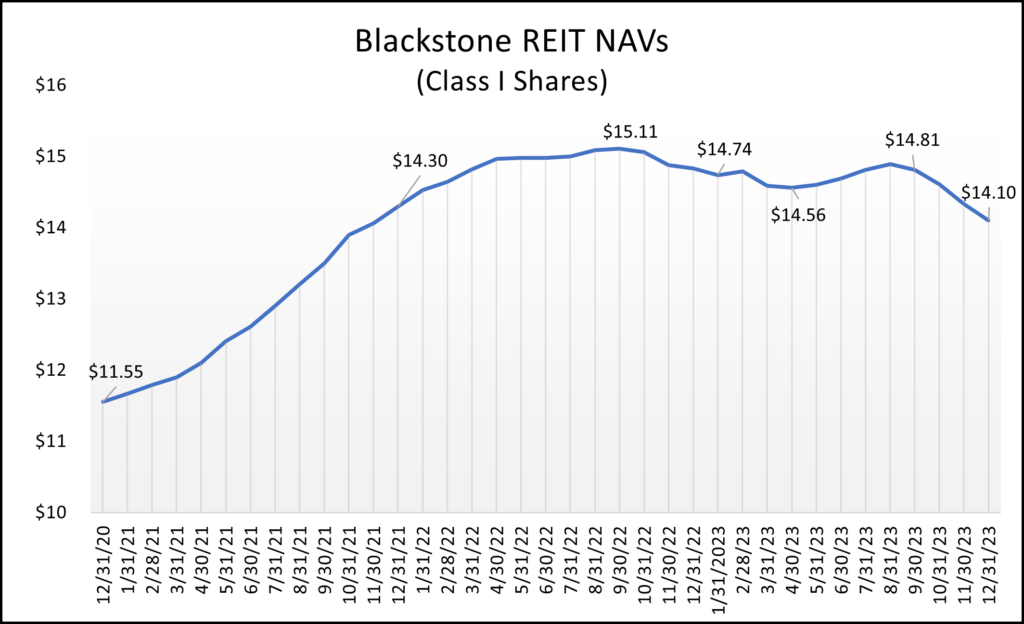

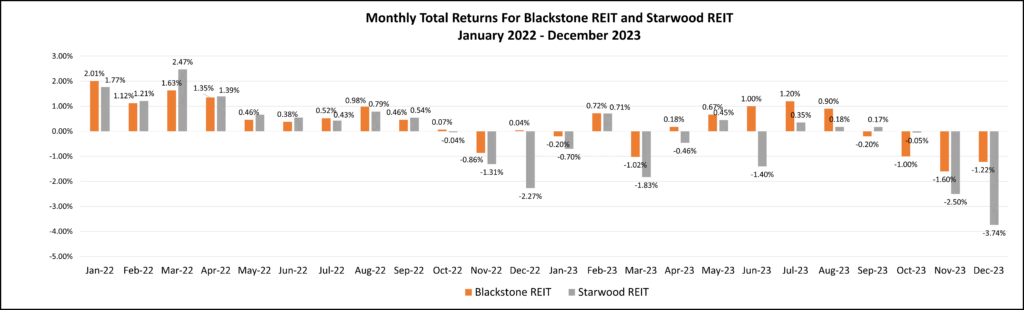

Blackstone REIT posted impressive increases in the net asset values per share from December 2020 until peaking in September 2022. From a high of $15.11 per share for its s Class I shares, the REIT has suffered decreases in its NAV through 2023, reaching a low for the year of $14.10 as of December 31. As the largest nontraded REIT by far, with over $60.7 billion in cumulative net asset value as of December 31, 2023, Blackstone REIT’s valuations are indicative of the trend across the sixteen continuously offered REITs.

Chart VII

Starwood REIT, with over $10.3 billion in cumulative net asset value as of December 31, 2023, has also suffered significant declines in its NAV per share. During the fourth quarter of 2023 the REIT’s NAV per share declined 7.44%, compared to Blackstone’ REIT’s drop during the quarter of 4.79%. The resulting total returns for Starwood REIT and Blackstone REIT, offset by their distributions during the quarter, are shown below.

Chart VIII

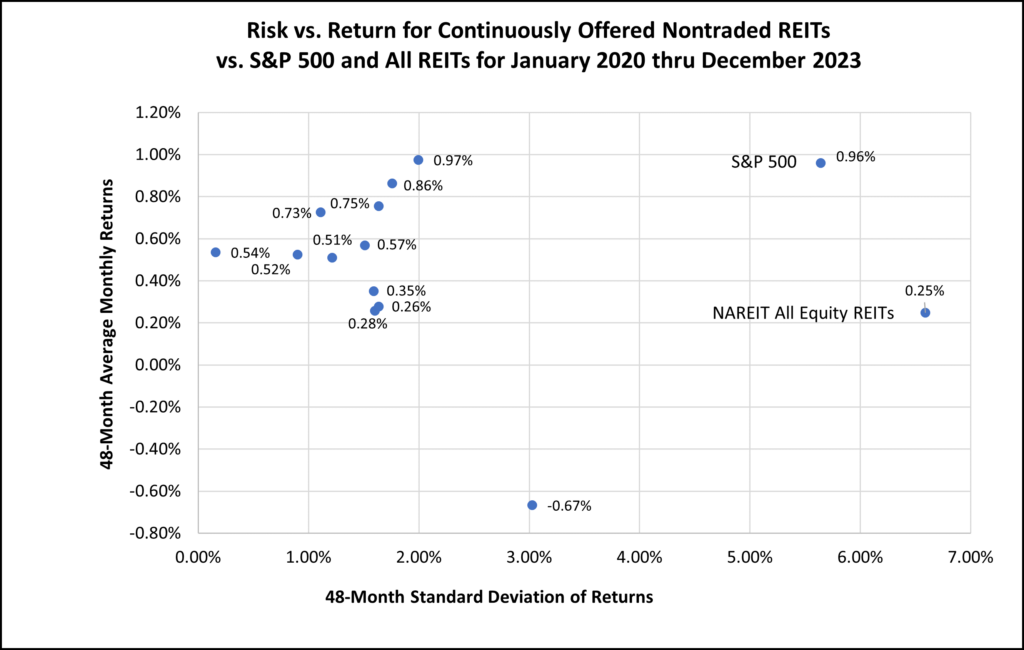

The story of total returns over the past 48-month period earned by investors in continuously offered nontraded REIT shares is not complete without also considering the month-to-month volatility of those returns. The standard deviation of the median monthly returns for investors in these nontraded REIT products was just 0.54%, and the average monthly return was 0.56%. Compared to the standard deviation of the monthly returns to the S&P 500 of 5.64% over the same 48-month period, and the standard deviation of the monthly returns to the All Equity REIT Index for listed REITs of 6.39%, the nontraded REIT returns are much less volatile the both listed stocks and listed REITs, while recording much higher distribution yields.

Chart IX

Sources: Blue Vault, SEC, individual REIT websites, NAREIT and S&P