A $90 Billion Debt Wave Shows Cracks in U.S. Property Boom

January 24, 2017, 10:18 AM EST | by Sarah Mulholland | Bloomberg

A $90 billion wave of maturing commercial mortgages, leftover debt from the 2007 lending boom, is laying bare the weak links in the U.S. real estate market.

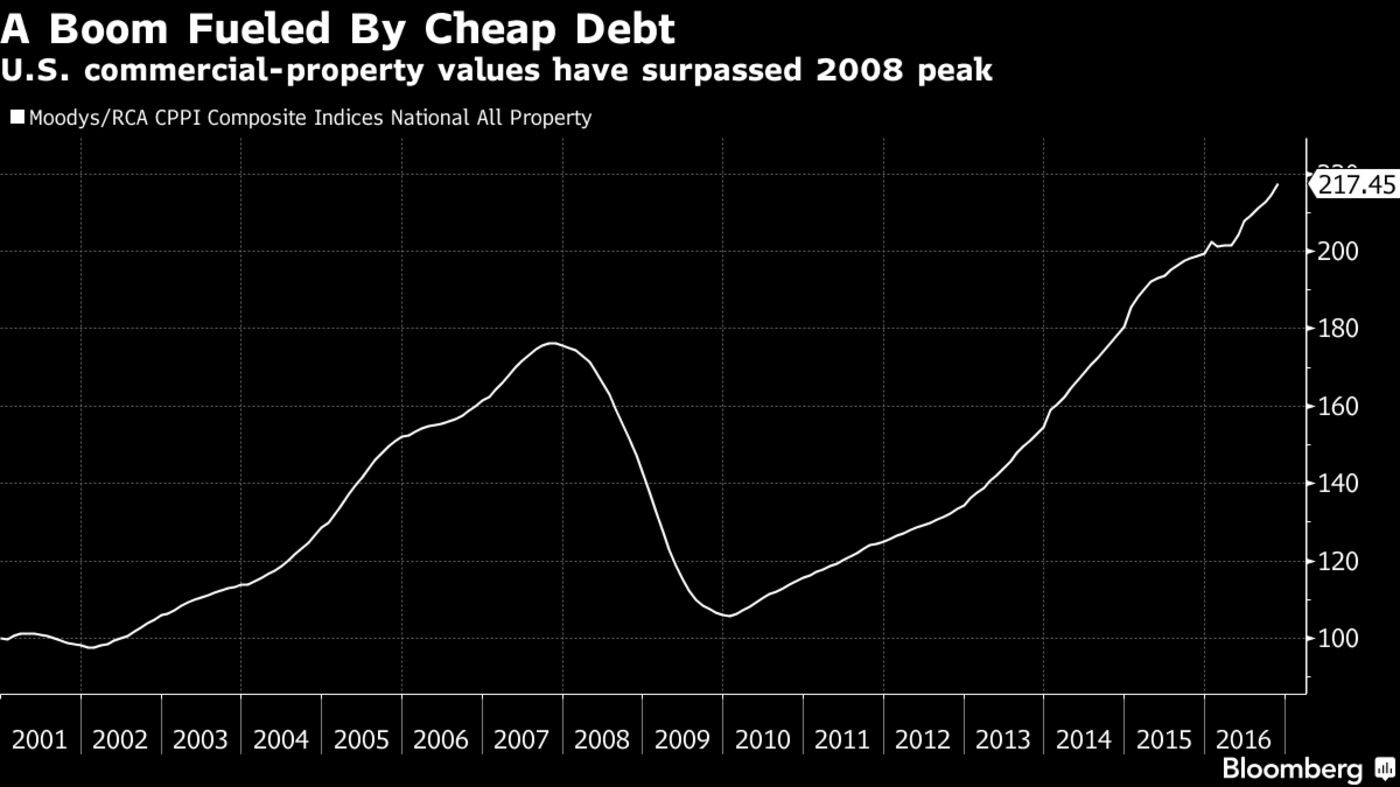

It’s getting harder for landlords who rely on borrowed cash to find new loans to pay off the old ones, leading to forecasts for higher delinquencies. Lenders have gotten choosier about which buildings they’ll fund, concerned about overheated prices for properties from hotels to shopping malls, and record values for office buildings in cities such as New York. Rising interest rates and regulatory constraints for banks also are increasing the odds that borrowers will come up short when it’s time to refinance.

“There are a lot more problem loans out there than people think,” said Ray Potter, founder of R3 Funding, a New York-based firm that arranges financing for landlords and investors. “We’re not going to see a huge crash, but there will be more losses than people are expecting.”