Blue Vault Launches Alts Performance Metrics Engine for Wealth Advisors

Blue Vault and Centersky partner to create a searchable, sortable, filterable database of alternative investment offering performance metrics

April 27, 2021 | Blue Vault

Over the past year, Blue Vault and Centersky have collaborated to create a unique database that includes thousands of data points relating to hundreds of alternative investment offerings. The goal was to take all the performance data Blue Vault has collected over the past 11 years and make it more accessible and flexible for their subscribing advisor clients. With the help of tech experts at Centersky, the Blue Vault Database was created and includes historical data going back to 2009. Gary Davi, Chief Technology Officer of Centersky, says “We gathered and lined up all of Blue Vault’s many data sources into integrated data points inside of Salesforce, which has been permissioned off for internal use as well as external use utilizing Salesforce Community Cloud…essentially getting everyone on the same page as they say…We believe custom portals surrounding a firm’s offerings will become more important for sponsor firms in the future.”

Over the past year, Blue Vault and Centersky have collaborated to create a unique database that includes thousands of data points relating to hundreds of alternative investment offerings. The goal was to take all the performance data Blue Vault has collected over the past 11 years and make it more accessible and flexible for their subscribing advisor clients. With the help of tech experts at Centersky, the Blue Vault Database was created and includes historical data going back to 2009. Gary Davi, Chief Technology Officer of Centersky, says “We gathered and lined up all of Blue Vault’s many data sources into integrated data points inside of Salesforce, which has been permissioned off for internal use as well as external use utilizing Salesforce Community Cloud…essentially getting everyone on the same page as they say…We believe custom portals surrounding a firm’s offerings will become more important for sponsor firms in the future.”

Stacy Chitty, Owner, Blue Vault, commented that “This launch represents the first time a search engine of nontraded REIT performance data has ever been available, and any advisor can access it. If you want to search for certain REITS, filter data, or analyze overall performance, it’s now possible. The amount of data we can add is limitless. It’s an exciting time for the alts industry.”

The Blue Vault Database will be released in phases over the next three months, with the first phase having gone live on April 20. Phase one includes open, closed, and merged nontraded REITs. Phase two will complement phase one by adding data on liquidated REITs. These phases will be followed by Interval Funds, Private Offerings, Nontraded BDCs, Closed-End Funds, and “other” direct participation programs. “What the industry needed was a tool to provide more transparency and more options for comparing fund to fund. Blue Vault had that data, but we weren’t sure how to make it available in a user-friendly way,” said Luke Schmidt, Senior Financial Analyst and Project Team Lead for Blue Vault. “That’s where Centersky came in. They helped bring our idea to life, using their expertise in the alt space; they built and customized atop the salesforce platform to get us where we are today.”

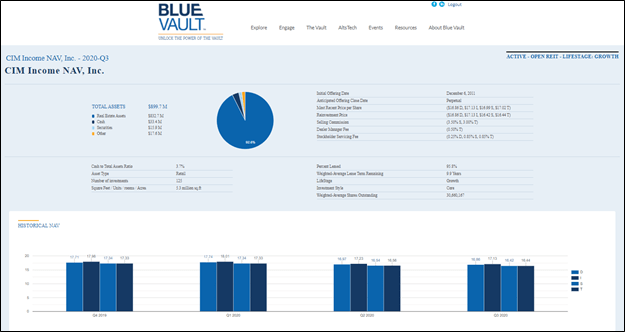

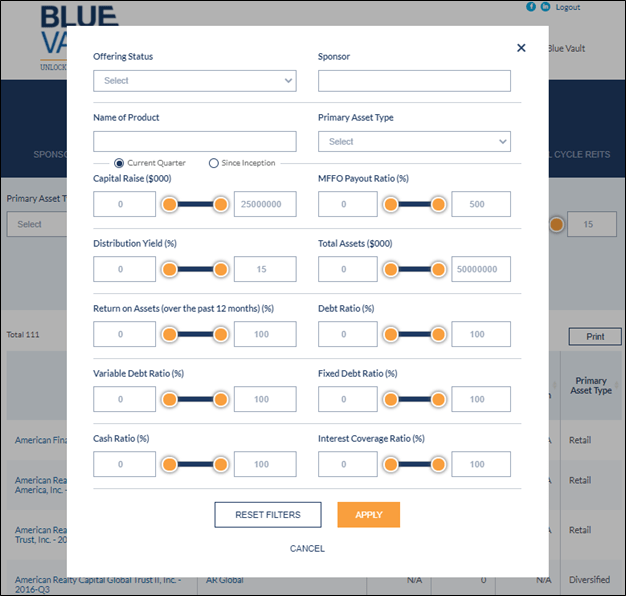

The Blue Vault Database makes all the Blue Vault data searchable, allowing users to filter, compare, and analyze data as needed. Users can filter offerings based on asset types, offering status, capital raised, and distribution rate. The Advanced search feature allows users to search by sponsor, offering status, capital raise, distribution yield, MFFO Payout, and more. Also included in the database are individual product performance pages with easy-to-navigate current and historical data and metrics, for both open and closed offerings. Each Investment Manager also has an individual page covering more information about their firm that links to their products, past webinars, podcasts, news, and more. All the data is real-time as of the most recently filed financial statements for each fund.

Mr. Chitty added, “The database was custom built by Gary and his team, working with our team, and includes thousands of data points that can be customized by the user’s preferences. Our subscribers can now access so much more data on any product or any investment manager. If you like the old way, a one-page pdf or a 100-page pdf report, it’s all still there. But the filterable database is so much more robust.”

The Blue Vault database is available only to Blue Vault subscribers and partners and will be updated continually as additional data is collected.

“Having access to quality, trustworthy data that you can utilize to compare different offerings for your clients surrounding these great Alt products is very exciting to us… as they say, data is the new oil and we have a massively producing oilfield here. It’s very exciting to me,” says Mr. Davi.

About Blue Vault

Founded in 2009, Blue Vault was built on the belief that transparency and education are essential ingredients of research. Blue Vault uncovers valuable performance information that was once stored only deep inside financial statements and filings and often is difficult to obtain. It is our mission to provide the most in-depth and thorough research available on nontraded REITs, nontraded BDCs, Interval Funds, nontraded CEFs, and private offerings, to help educate wealth advisors and help protect investors. Become a subscriber here bluevaultpartners.com/the-store.

About Centersky

By entrusting your business’s CRM platform to Centersky, you bypass the need to hire, train, re-hire, re-train full-time employees who may have less Capital Markets experience, resulting in a lower level of service. The fintech team at Centersky saves you overhead and provides an innovative boost to your business, resulting in more sales and increased market share. Learn more by visiting www.centersky.net.