New York, NY (January 30, 2020) – Bluerock Capital Markets, LLC (“BCM” or “Company”), a distributor of institutional alternative investment products, and the dedicated dealer manager for Bluerock Real Estate (“Bluerock”), announced today a new annual record capital raise of approximately $1.47 billion in 2019. Per Robert A. Stanger & Company, BCM ranked among the top three in total capital raise among all sponsors in the Direct Investments Industry†.

BCM’s record capital raise represents a notable 83% year-over-year increase from 2018. The record was driven by individual annual capital raise records for all three of its current investment program verticals with sales of over $1.075 billion (including distribution reinvestment) in its flagship Bluerock Total Income+ Real Estate Fund up 91%, sales for Bluerock Residential Growth REIT’s Non-Traded Preferred Stock offerings up 94% and sales for Bluerock Value Exchange’s 1031 exchange offerings up 33%, all year-over-year as compared to 2018.

“Bluerock’s leadership among the top industry alternative sponsors is a result of our investment programs delivering on their stated investment objectives and providing quality solutions for advisors and their clients seeking high current income, tax efficiency, appreciation potential, and low pricing volatility”, said Jeffrey Schwaber, CEO of Bluerock Capital Markets.† “We have expanded our selling group significantly and our multi-channel distribution footprint has resulted in substantially increased inflows from our independent broker dealer partners, wealth RIA’s, bank broker dealers and member firms.

2019 Highlights of Bluerock’s Investment Programs Include:

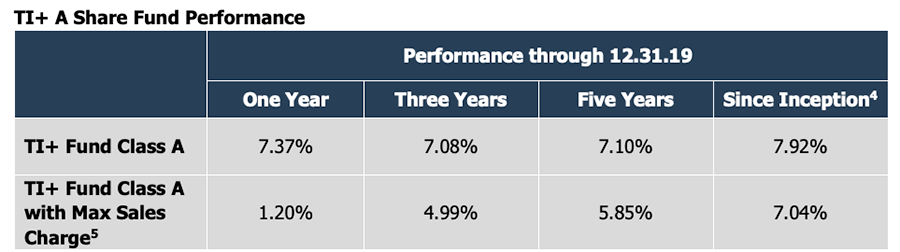

The Bluerock Total Income+ Real Estate Fund closed 2019 with nearly $2.3 billion in AUM making it the 6th largest interval fund among all 66 active interval funds1. The Fund’s A-shares (ticker: TIPRX) delivered a total annualized return of 7.92% in 2019 and has a 10.15% average annual return (including distribution reinvestment) since its inception dating back to October 2012. Further, the Fund has generated the SINGLE HIGHEST RISK-ADJUSTED RETURN (as measured by the Sharpe ratio) OVER FOUR CONSECUTIVE YEARS (2016-2019) among all 1,200+ real estate sector funds in the Morningstar universe of open-end, closed-end and exchange traded funds2,3. The Fund has had 7 consecutive years of positive returns, the lowest generating a positive 6.01% and the highest a positive 13.61%. The Fund has delivered positive total returns to its shareholders in 27 of 28 quarters. Past performance is no guarantee of future results.

Bluerock Residential Growth REIT (BRG) closed its offering of Series B Preferred Stock and Warrants after raising over $530 million in capital. BRG recently paid its 44th consecutive fully covered monthly dividend on its Series B Preferred Stock at a 6% annualized rate and the Series B Preferred Stock has experienced no pricing volatility since its launch in April 2016. There are now 26 tranches of BRG warrants in the money, affording the opportunity for those shareholders to potentially enhance their returns with potential capital appreciation through the exercise of their BRG warrants. In addition, BRG has successfully redeemed 18 tranches of Series B Preferred Stock delivering liquidity at full Stated Value to shareholders within 3.5 years of issuance, plus all accrued dividends paid. In December of 2019, BRG launched an offering of Series T Preferred Stock.

Bluerock Value Exchange successfully full-cycled five sponsored DST programs in 2019 resulting in $122 million in total investment returns, inclusive of distributions, on $70 million of equity resulting in a 17.9% average annual return to Investors, including the full cycling of one of the highest total returns in the history of securitized 1031 exchanges, returning approximately 360% to investors, inclusive of appreciation and distributions.

† Sources: The Stanger Market PulseTM (December 2019)

1 Source: Intervalfundtracker.com (September 30, 2019)

2 Source: Morningstar Direct, annualized Sharpe Ratio, based on daily data from 2016, 2017, 2018 and 2019. Using Morningstar data compiled by Bluerock Fund Advisor, LLC, TIPRX received the highest Sharpe Ratio among 1,189 open-end, closed-end, and exchange traded funds in the global real estate sector equity category for the one year periods ending 12.31.19, 12.31.18, 12.31.17, 12.31.16 TIPRX A Shares; no load. Sharpe Ratio and standard deviation are only two forms of performance measure. The Sharpe Ratio is a measurement of risk-adjusted performance. The annualized Sharpe ratio is calculated by subtracting the annualized risk-free rate – (3-month Treasury Bill) – from the annualized rate of return for a portfolio and dividing the result by the annualized standard deviation of the portfolio returns. The Sharpe Ratio would have been lower if the calculation reflected the load.

3 2019 Total Returns: TI+ Fund, A share no load: 7.37%; Equity: S&P 500: 31.49%; Public Real Estate Index: MSCI U.S. REIT Index: -25.84%; Bond Index: Bloomberg Barclays U.S. Aggregate Bond Index: 8.72%

4 Inception date of the fund is October 22, 2012.

5 The maximum sales charge for the Class A shares is 5.75%. Investors may be eligible for a reduction in sales charges.

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. For performance information current to the most recent month end, please call toll-free 1-844-819-8287. Past performance is no guarantee of future results.

The total annual fund operating expense ratio, gross of any fee waivers or expense reimbursements, is 2.38% for Class A. The Fund’s investment adviser has contractually agreed to reduce its fees and/or absorb expenses of the fund, at least until January 31, 2019, to ensure that the net annual fund operating expenses will not exceed 1.95%, per annum of the Fund’s average daily net assets subject to possible recoupment from the Fund in future years. Please review the Fund’s Prospectus for more detail on the expense waiver. A Fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions. Fund performance and distributions are presented net of fees.

A summary of Bluerock’s three distinct investment programs include:

About Bluerock Total Income+ Real Estate Fund

Bluerock Total Income+ Real Estate Fund offers individual investors access to a portfolio of institutional real estate securities managed by best-in-class fund managers with more than $200 Billion of underlying gross asset value and ~4,000+ properties. The Fund’s primary investment objective is to generate current income while secondarily seeking long-term capital appreciation with low to moderate volatility and low correlation to the broader markets. The Fund utilizes an exclusive partnership with Mercer Investment Management, Inc., the world’s leading advisor to endowments, pension funds, sovereign wealth funds and family offices globally, with over 3,300 clients worldwide, and $15 trillion in assets under advisement.

About Bluerock Residential Growth REIT

Bluerock Residential Growth REIT, Inc. is a real estate investment trust that focuses on developing and acquiring a diversified portfolio of institutional-quality highly amenitized live/work/play apartment communities in demographically attractive knowledge economy growth markets to appeal to the renter by choice. BRG’s objective is to generate value through off-market/relationship-based transactions and, at the asset level, through value-add improvements to properties and operations. BRG reports assets in excess of $2 billion and more than 14,250 apartment units. BRG’s common stock is included in the Russell 2000 and Russell 3000 Indexes. BRG has elected to be taxed as a real estate investment trust (REIT) for U.S. federal income tax purposes.

About Bluerock Value Exchange

Bluerock Value Exchange is a national sponsor of syndicated 1031-exchange offerings with a focus on Premier Exchange Properties™ that seek to deliver stable cash flows and potential for value creation. Bluerock has structured 1031 exchanges on over $1.8 billion in total property value and over 9 million square feet of property. With capacity across nearly all real estate sectors and the ability to customize transactions for individual investors, BVEX is available to create programs to accommodate a wide range of tax requirements.

About Bluerock

Bluerock is a leading institutional alternative asset manager with approximately $8 billion of owned, managed, and sponsored assets and headquartered in Manhattan with regional offices across the U.S. Bluerock principals have a collective 100+ years of investing experience, have been involved with over $13 billion in investments, and have helped launch leading private and public company platforms.

About Bluerock Capital Markets

Bluerock Capital Markets, LLC serves as the managing broker dealer for Bluerock and is a member of FINRA/SIPC. Formed in 2010, BCM distributes a broad range of institutional investment products with potential for growth, income, and tax benefits exclusively through broker dealers and investment professionals including the Bluerock Total Income+ Real Estate Fund, Bluerock Residential Growth REIT, Inc., and programs sponsored by Bluerock Value Exchange, LLC. BCM ranks #3 for capital fundraising in 2019 among all active managing broker-dealers in the Direct Investments Industry†.

Bluerock Residential Growth REIT’s Series B Preferred Stock and Warrants and Bluerock Value Exchange’s programs are offered by Bluerock Capital Markets, LLC. The Bluerock Total Income+ Real Estate Fund is distributed by ALPS Distributors Inc. Bluerock Capital Markets, LLC is not affiliated with Alps Distributors, Inc. or Mercer Investment Management, Inc.

Sharpe Ratio: Measurement of the risk-adjusted performance. The annualized Sharpe ratio is calculated by subtracting the annualized risk-free rate – (3-month Treasury Bill) – from the annualized rate of return for a portfolio and dividing the result by the annualized standard deviation of the portfolio returns. You cannot invest directly in an index. Benchmark performance should not be considered reflective of Fund performance.

Disclosures

Bluerock Total Income+ Real Estate Fund

Bluerock Total Income+ Real Estate Fund’s primary investment objective is to generate current income while secondarily seeking long-term capital appreciation with low to moderate volatility and low correlation to the broader markets. Investing in the Bluerock Total Income+ Real Estate Fund involves risks, including the loss of principal. The Fund intends to make investments in multiple real estate securities that may subject the Fund to additional fees and expenses, including management and performance fees, which could negatively affect returns and could expose the Fund to additional risk, including lack of control, as further described in the prospectus. The Fund’s distribution policy is to make quarterly distributions to shareholders. The level of quarterly distributions (including any return of capital) is not fixed and this distribution policy is subject to change. Shareholders should not assume that the source of a distribution from the Fund is net profit. A portion of the distributions consist of a return of capital based on the character of the distributions received from the underlying holdings, primarily Real Estate Investment Trusts. The final determination of the source and tax characteristics of all distributions will be made after the end of each year. Shareholders should note that return of capital will reduce the tax basis of their shares and potentially increase the taxable gain, if any, upon disposition of their shares. There is no assurance that the Company will continue to declare distributions or that they will continue at these rates. There can be no assurance that any investment will be effective in achieving the Fund’s investment objectives, delivering positive returns or avoiding losses.

Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% of the Fund’s shares outstanding at net asset value. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer. Quarterly repurchases by the Fund of its shares typically will be funded from available cash or sales of portfolio securities. The sale of securities to fund repurchases could reduce the market price of those securities, which in turn would reduce the Fund’s net asset value.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Bluerock Total Income+ Real Estate Fund. This and other important information about the Fund is contained in the prospectus, which can be obtained online at bluerockfunds.com. The Bluerock Total Income+ Real Estate Fund is distributed by ALPS, Inc. The prospectus should be read carefully before investing. Bluerock Fund Advisor, LLC is not affiliated with ALPS, Inc.

Bluerock Residential Growth REIT

The discussion of BRG securities herein relates solely to BRG’s Series T Redeemable Preferred Stock, non-traded securities of BRG which have not been listed on any national exchange. The risks and rewards of investing in the Series T Preferred Stock are separate and distinct from an investment in BRG’s common stock listed on the NYSE American. This is neither an offer to sell nor a solicitation of an offer to buy any securities. An offering is made only by the prospectus. Any prospective investor must be read the prospectus in order to understand fully all of the implications and risks of the Series T Preferred Stock.

BLU000515 / V-20-15

Contact

(Media)

Josh Hoffman (208) 475.2380

jhoffman@bluerockre.com

##