March NTR Sales Surge, Up 48% From February, Nontraded BDC Sales Up 12%

April 10, 2019 | James Sprow | Blue Vault

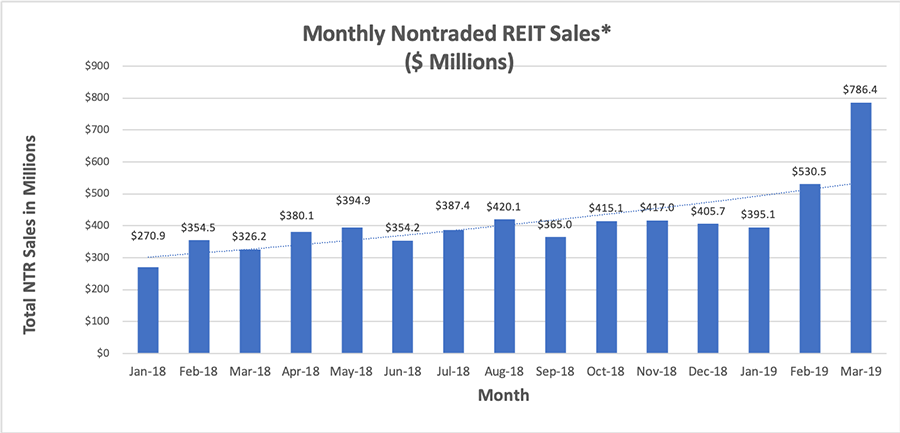

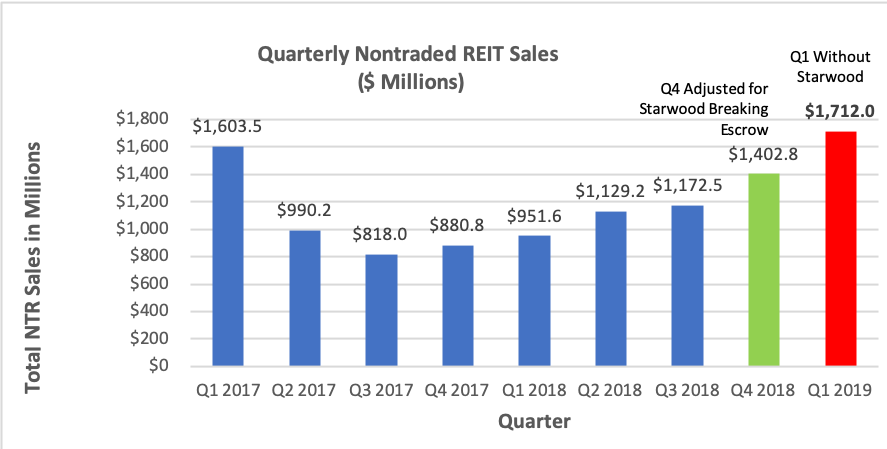

Reporting nontraded REITs booked capital raise of $786.4 million in March, up 48.2% from the $530.5 million total for February and up 38% from the $412.6 million monthly average for the same NTRs in Q4 2018. Blackstone REIT saw capital raise rise in March by 79.8%, and other nontraded REIT offerings reported a combined capital raise increase of just 0.5%, from $211.4 million to $212.4 million, as Blackstone REIT’s share of total NTR sales jumped from 60% in February to 73% in March. Starwood REIT did not respond to requests for sales figures for the quarter ended March 31. Blue Vault estimates that Starwood REIT had sales of $165 million in Q4 2018, which, if continued at that pace, could add significantly to NTR sales totals for Q1 2019. Q1 2019 total sales for reporting REITs, without Starwood, totaled $1.712 billion. The last time NTR quarterly sales exceeded $1.6 billion was in Q1 2017.

Reporting nontraded REITs booked capital raise of $786.4 million in March, up 48.2% from the $530.5 million total for February and up 38% from the $412.6 million monthly average for the same NTRs in Q4 2018. Blackstone REIT saw capital raise rise in March by 79.8%, and other nontraded REIT offerings reported a combined capital raise increase of just 0.5%, from $211.4 million to $212.4 million, as Blackstone REIT’s share of total NTR sales jumped from 60% in February to 73% in March. Starwood REIT did not respond to requests for sales figures for the quarter ended March 31. Blue Vault estimates that Starwood REIT had sales of $165 million in Q4 2018, which, if continued at that pace, could add significantly to NTR sales totals for Q1 2019. Q1 2019 total sales for reporting REITs, without Starwood, totaled $1.712 billion. The last time NTR quarterly sales exceeded $1.6 billion was in Q1 2017.

With the Blackstone REIT March sales of $574.0 million, up 79.8% from sales in February of $319.1 million, the 48.2% increase in total capital raise month-to-month among reporting NTRs was due to that REIT’s success and the pick-up in sales by several other REITs, offsetting the effects of offerings closing. The Hines Global Income Trust total for March was $40.18 million, up from $24.00 million in February. Black Creek Industrial REIT IV was next with sales of $32.42 million, up 19.2% from February. Black Creek’s Diversified Property Fund had March sales of $25.63 million, nearly doubling its February total of $13.40 million. Jones Lang LaSalle’s Income Property Trust raised $21.65 million in March, down 34.7% from $33.14 million in February. Strategic Storage Trust IV raised $19.37 million in March, up 16.4% from $16.64 million February. The March total for NTRs was negatively impacted by the closing of Griffin-American Healthcare REIT IV’s offering, which raised over $52 million in February and only $6.1 million in March.

As we reported last month, a significant addition to nontraded REIT sales in Q4 2018 that was reported as of December 21, 2018, is the breaking of escrow by Starwood Real Estate Income Trust, Inc. The REIT satisfied the minimum offering requirement of subscriptions aggregating at least $150 million on that date, and the escrow agent released gross proceeds of approximately $165 million to the company. As of January 31, 2019, the REIT had issued and sold shares of its Class S, T, D and I shares for estimated total gross proceeds in excess of $191 million. The $165 million raised as of December 21, 2018, when added to the NTR industry’s total for Q4 2018, brings the quarter’s estimated capital raise to over $1.4 billion, up over 19% from Q3 2018. Blue Vault estimates the REIT’s sales at over $27 million per month in Q1 2019. (Third-party reports estimate Starwood’s 2019 NTR sales through February totaled $85.6 million.)

For the reporting sponsors of nontraded REIT offerings in March, Blackstone was first in capital raised with $573.98 million, for 73% of the total NTR sales. Black Creek Group, with two open programs, was next with $58.05 million for a 7.4% share. Hines ranked third with $40.18 million, up 67.4% from its February total of $24.01 million. Jones Lang LaSalle was next with $21.65 million, followed by SmartStop’s two programs with $20.49 million.

Among those REITs with significant increases in capital raised between February and March, the largest percentage increase was achieved by Rodin Income Trust which raised $2.81 million in March after raising just $0.11 million in February, a 24-fold increase. SmartStop’s Strategic Student & Senior Housing Trust raised $1.12 million in March, up 341% from $0.25 million. SmartStop’s Strategic Storage Trust II acquired Strategic Storage Growth Trust in January, for $12.00 per share in cash to the Strategic Storage Growth Trust’s shareholders, the sponsor’s second successful full-cycle event. (see “A Deeper Dive into Strategic Storage Growth Trust’s Full-Cycle Performance”)

*The following NTRs would not provide sales data to Blue Vault: FS Credit Real Estate Income Trust, Phillips Edison Grocery Center REIT III, and Starwood REIT. The following NTRs did not provide sales data to Blue Vault: Nuveen Global Cities REIT and Oaktree REIT.

Due to the lack of capital raise reports from five effective NTRs, most notably Starwood REIT, it is likely that the industry total was significantly greater than $786.4 million for March, easily over $813 million. Year-over-year, March 2019 NTR sales were up over 140% from March 2018, even without the non-reporting REITs. The estimated Q1 2019 total is $1,712.0 without Starwood, and at least $1,793 million with Starwood’s estimated sales added. That would yield an estimated Y-O-Y increase of over 88% for Q1 2019. The estimated Q4 2018 total was $1,402.8 million when Starwood REIT is included, up 19.6% from the Q3 2018 total of $1,172.5 million, and up 59.3% Y-O-Y from the $880.8 million for Q4 2017.

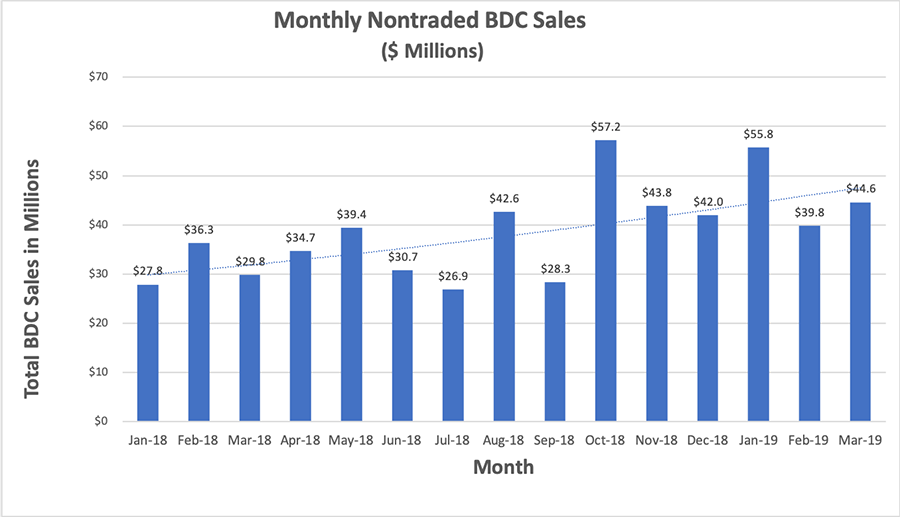

Nontraded BDC Rose 12% in March

Nontraded BDC sales rose 12% from $39.8 million in February to $44.6 million in March, with only two nontraded BDC programs raising funds in March compared to six in April 2018 and seven in February 2018. Owl Rock Capital Advisors again led nontraded BDC sponsors with sales of $42.83 million by its Owl Rock Capital Corporation II program, 96% of nontraded BDC sales in March, up 18% from its $37.95 million sales in February. MacKenzie Realty Capital was the only other BDC program raising capital with $1.77 million in sales for a 4% share in March, down slightly from its February sales of $1.84 million.

Nontraded Preferred Sales by Listed REITs

Blue Vault receives sales reports from three listed REITs that issue nontraded preferred shares. Nontraded preferred sales by these REITs totaled $23.10 million in March 2019, up 5.2% from the $21.96 million total in February. For the first quarter of 2019, sales for the three totaled $70.02 million, down 2.4% from the Q4 2018 total of $71.77 million. Bluerock Residential Growth had sales of $12.58 million for March and $43.99 million for Q1 2019, up 0.7% from Q4 2018’s total of $43.67 million. Gladstone Land Corp. reported nontraded preferred sales of $7.25 million for March and $18.43 million for Q1 2019, up 0.5% for the quarter from the $18.34 million in Q4 2018. CIM Commercial Trust had nontraded preferred sales of $3.27 million in March, up 8.7% from February, and Q1 2019 sales of $7.59 million, down 22% from Q4 2018 sales of $9.75 million.

At least one additional listed REIT issues nontraded preferred stock. Preferred Apartment Communities, Inc. does not report monthly preferred share sales to Blue Vault but SEC filings for Q4 2018 show proceeds of $108.7 million, before offering costs, from sales of units consisting of one share of Series A Redeemable Preferred Stock and one warrant to purchase up to 20 shares of Common. If the pace of preferred sales by this listed REIT continued in Q1 2019, the total for four listed REITs issuing nontraded preferred would exceed $178 million for the quarter.