Price Growth on Commercial Assets Is Showing Signs of Petering Out

March 19, 2017 | by NREI Staff | National Real Estate Investor

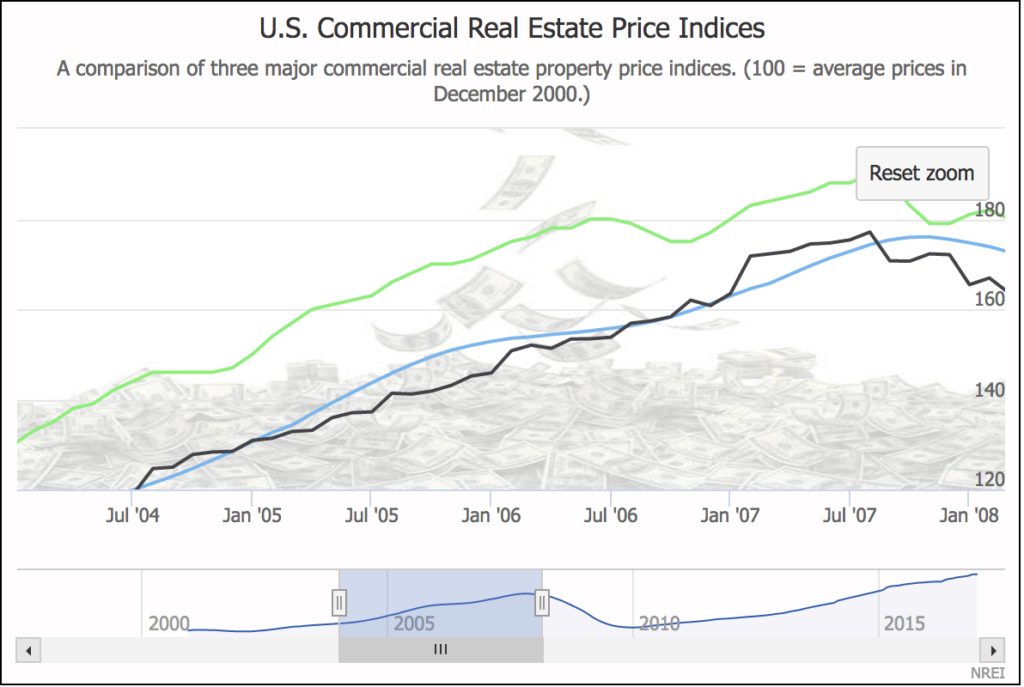

Price increases for U.S. commercial real estate assets have started to moderate in recent months, perhaps as a result of the expectation of rising interest rates. The all-property CPPI put together monthly by ratings agency Moody’s and research firm Real Capital Analytics (RCA) rose by just 0.1 percent in January, the most recent month for which data is available. The apartment sector continued to outperform during the period, posting the biggest upward jump in the index of any property type, at 0.9 percent. Office buildings in Central Business Districts (CBDs) experienced the biggest drop in prices, at 1.9 percent.

The Moody’s/RCA CPPI tracks repeat sales of commercial properties that occur two months prior to the publication of the report.

According to the CPPI put together by research firm CoStar, the value-weighted U.S. Composite Index fell by 0.9 percent in January. The index tracks sales of larger properties in core markets. The equity-weighted U.S. Composite Index, which tracks sales of lower-priced properties in smaller markets, rose by 1.4 percent during the same period.