Priority Income Fund Generated a 20.2% Total Return to Class R Shareholders During the 12 Months ended May 31, 2021

Exceeded Key Loan Index Benchmark by 750 Basis Points

August 3, 2021 | Prospect Capital

Priority Income Fund, Inc. (“Priority” or “Fund” or “PRIS”) is a Closed-End Fund (“CEF”) that produces recurring distribution yields from investing in pools of senior-secured, floating-rate loans to large capitalization companies.

Priority Income Fund, Inc. (“Priority” or “Fund” or “PRIS”) is a Closed-End Fund (“CEF”) that produces recurring distribution yields from investing in pools of senior-secured, floating-rate loans to large capitalization companies.

Priority currently pays a 10.0% common shareholder distribution yield and has a track record of paying 90 consecutive such distributions monthly since inception fully covered by Net Investment Income (“NII”).

Priority’s current shareholder distribution yield of 10.0% compares favorably with yields from similar alternative income investments: Credit Interval Funds (5.8%), CRE Interval Funds (5.5%), Nontraded REITs (5.1%), and Bank Perpetual Preferred Stock (4.6%).

Beyond these alternative income investments, the average yield across a broad range of income-producing asset classes is just 3.6%, including U.S. dividend-paying stocks at 2.8%.

As the operating member of the investment adviser of Priority, Prospect Capital Management L.P. has consistently generated outperforming alpha versus key benchmarks. As of May 31, 2021, Priority R shares generated one-year total returns of 20.2%, outperformance of 750 basis points versus the CS Leveraged Loan Index return of 12.7%.

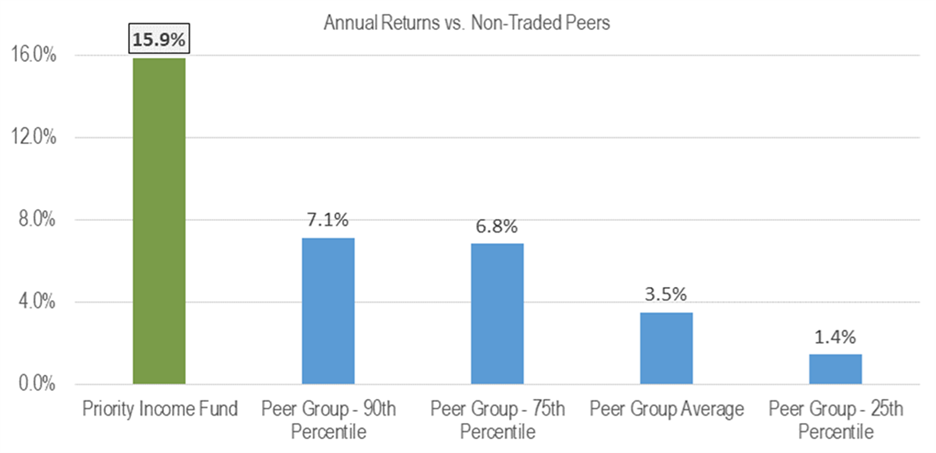

Priority has generated top-decile annualized total returns (shareholder distributions plus change in net asset value (“NAV”)) of 15.9% for the period from December 31, 2014, through March 31, 2021, compared to the non-traded peer group’s 90th percentile return of 7.1% and 50th percentile return of 6.8%.1

Priority’s peer group includes such funds as Bluerock Total Income + Real Estate Fund, Business Development Corporation of American, CION Investment Corporation, Destra Multi-Alternative Fund, FS Energy & Power Fund, Griffin Institutional Access Real Estate Fund, NexPoint Capital, Inc., and Resource Real Estate Diversified Income Fund.

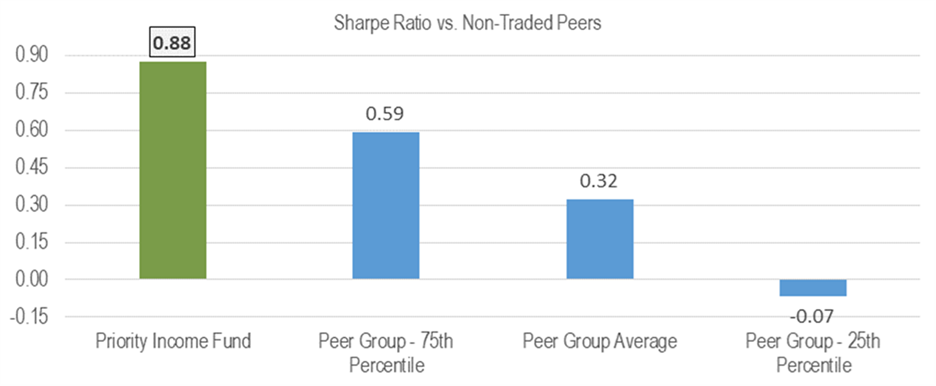

One widely used ratio for analyzing risk-adjusted returns is the Sharpe Ratio, which measures the ratio of excess returns of a fund above the risk-free return represented by U.S. treasuries divided by the standard deviation of those returns.

Priority’s top-quartile Sharpe Ratio during the period December 31, 2014, through March 31, 2021, was 0.88, compared to the peer group’s 75th percentile at 0.59 and 50th percentile at 0.32.1

When measuring volatility produced by only those periods with negative returns, PRIS outperformed the peer group average (meaning Priority had less volatility than its peers) at 4.20% vs. the peer group average of 5.20%.1

Priority’s annualized return of 15.9% was 1050 basis points higher than the 5.4% annualized return of the Eurekahedge credit hedge fund index. Priority’s Sharpe Ratio of 0.88 also significantly exceeded the 0.41 for the credit hedge fund index.

Highlights of Priority Income Fund’s Outperformance

Key features of Priority’s outperformance include:

• Consistent cash income to shareholders: Priority has a 7+ year track record of paying a fully-covered shareholder distribution, with such distribution currently at 10.0% annualized.

• Diversification: Priority’s portfolio is well diversified across over 2,400 senior secured loans to over 1,000 companies through approximately 152 pools of senior secured loans. No single company’s secured loans make up more than 0.78% of the Priority portfolio. The fund is also well diversified by industry sector with its largest segment of 11.1% in healthcare and pharmaceuticals, followed by 9.1% in high tech; 8.8% in banking, finance, insurance & real estate; and 8.6% in business services. The remainder of the portfolio is diversified across 29 various other industries.

• Lack of duration risk: Priority is not significantly impacted by interest rate movements given par protection of floating rate assets coupled with matched book funding of floating rate liabilities.

• Access to best-in-class management teams: Priority has chosen, based on historic performance and other factors, to team up with only 20 of the 130+ management teams who have managed these pools of senior secured loans over the past decade.

Senior Secured Loans: Benefits and Historic Performance

Senior secured loans have experienced only two years of negative returns (including mark-to-market volatility) since 1997. From January 1, 2003, through March 31, 2021, the syndicated loan industry has had an average default rate of just 2.29%. This result has translated into 0.45% in annual credit losses when coupled with an average historical recovery rate of 80% of the par amount of the loan. Even during the financial dislocation in 2008 through 2009, the sector recorded a two-year return of 7.5%. Such dislocations in the market offered our management teams an opportunity to purchase discounted loans, thereby raising the potential for enhanced returns.

Current Opportunity

In the current economic environment of 2021 to date, loan prices have recovered from 2020 pandemic lows. Investors are benefiting from this “pull to par” phenomenon. Priority’s NAV has increased 18.9% since the end of 2020 with the rally in loan prices. After four bonus dividend increases since August 2020, the Priority R share yields 10.0% in comparison with 1.6% for 10-year Treasuries, 2.1% for investment grade bonds, and 4.6% for high yield bonds.

About the Offering

Priority’s common stock and other offerings have raised $747 million since Priority’s inception in May 2013. The current prospectus offers up to 100 million shares of common stock through December 31, 2022. Distributions are made monthly and the minimum investment is $1,000. Its redemptions are capped at DRP proceeds. The Fund also has in its history successfully raised ten series of redeemable preferred stock.

About Prospect Capital Management

Prospect Capital Management L.P. (“Prospect”), established in 1988, is an alternative credit asset manager with a primary focus on private middle-market companies and a secondary focus on multifamily real estate and collateralized loan obligations. Prospect specializes in providing a full range of commercial financing solutions up and down the capital structure.

For over three decades, Prospect has built trusted and valuable relationships with hundreds of management teams, private equity sponsors, entrepreneurs, financial intermediaries and institutions, property managers and collateral managers. As of March 31, 2021, Prospect managed approximately $6.7 billion of capital across a broad set of industries and companies, primarily located in the United States.

Prospect’s mission includes delivering attractive risk-adjusted yields to investors with an emphasis on a broad portfolio, proprietary investment origination and a disciplined, rigorous credit process. Prospect’s proven track record through multiple economic cycles demonstrates a deep commitment to capital preservation, current cash returns and total returns.

Prospect employs approximately 100 professionals and is an SEC-registered investment advisor.

Prospect is the investment adviser for Prospect Capital Corporation (NASDAQ: PSEC), one of the largest listed business development companies in the industry with an investment grade corporate credit rating from 5 rating agencies.

PSEC recently announced a $1.0 billion convertible preferred stock offering with a dividend of 5.50%.

Prospect also manages Prospect Flexible Income Fund, Inc. (a non-traded BDC).

Preferred Capital Securities is the dealer manager for the PSEC convertible preferred offering and Priority Income Fund offering.

Footnotes

(1) Returns were calculated based on the following assumptions: (i) entry price is equal to NAV as of 12/31/2014, (ii) all dividends for the period are reinvested and (iii) exit price is equal to NAV as of 3/31/2021. All NAV and distribution data for comparable funds was sourced from Blue Vault Partners.

Disclosures Regarding Risks

An investment in shares of Priority Income Fund, Inc. (the “Fund”) involves substantial risk and may result in the loss of principal invested. This Fund may not be suitable for all investors. You should carefully read the information found in the Fund’s prospectus, including the “Risk Factors” section, before deciding to invest in the Fund’s shares. These risks include but are not limited to:

• The Fund seeks to achieve its objective by investing at least 80% of its total assets in senior secured loans made to companies whose debt is rated below investment grade. Senior Secured Debt involves a greater risk of default and higher price volatility than investment grade debt.

• The fund will invest in equity and junior tranches of collateralized loan obligations (“CLOs”), which may be riskier than a direct investment in the underlying companies.

• CLOs will typically have no significant assets other than their underlying Senior Secured Loans.

• Our shares are not currently listed on any securities exchange, and we do not expect a public market for them to develop in the foreseeable future, if ever. Therefore, stockholders should not expect to be able to sell their shares promptly or at a desired price. No stockholder will have the right to require us to repurchase his or her shares or any portion thereof. Because no public market will exist for our shares, and none is expected to develop, stockholders will not be able to liquidate their investment prior to our liquidation or other liquidity event, other than through our share repurchase program, or, likely in limited circumstances, as a result of transfers of shares to other eligible investors.

• The Fund’s investment strategy involves investments in securities issued by foreign entities, which will expose investors to risks not typically associated with investing in U.S. securities.

• The Fund may invest a substantial percentage of its portfolio in securities that are considered illiquid, which may prevent the advisor from readily disposing of securities at favorable prices.

• Investors should carefully consider the investment objectives and risk factors of the Priority Income Fund. This and other important information about the Fund is contained in the prospectus which should be read carefully before investing.

Source: Prospect Capital