The True Value of Inflection Points What will be the big disruptor in 2022? Advisor Group CEO Jamie Price tells advisors to view its inevitable arrival as an opportunity. May …

Read more

The True Value of Inflection Points

What will be the big disruptor in 2022? Advisor Group CEO Jamie Price tells advisors to view its inevitable arrival as an opportunity.

May 11, 2017 | by Jamie Price | WealthManagement.com

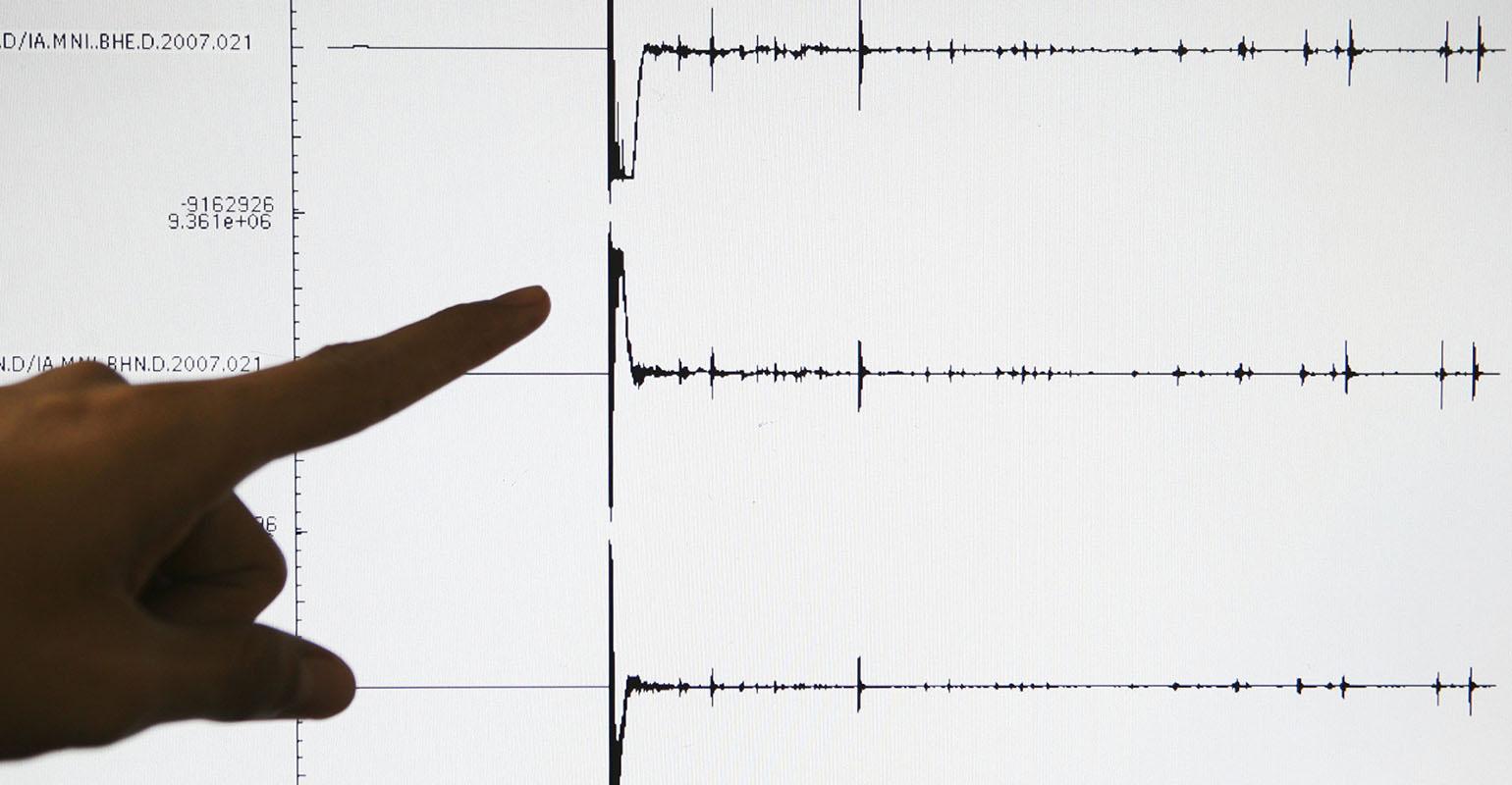

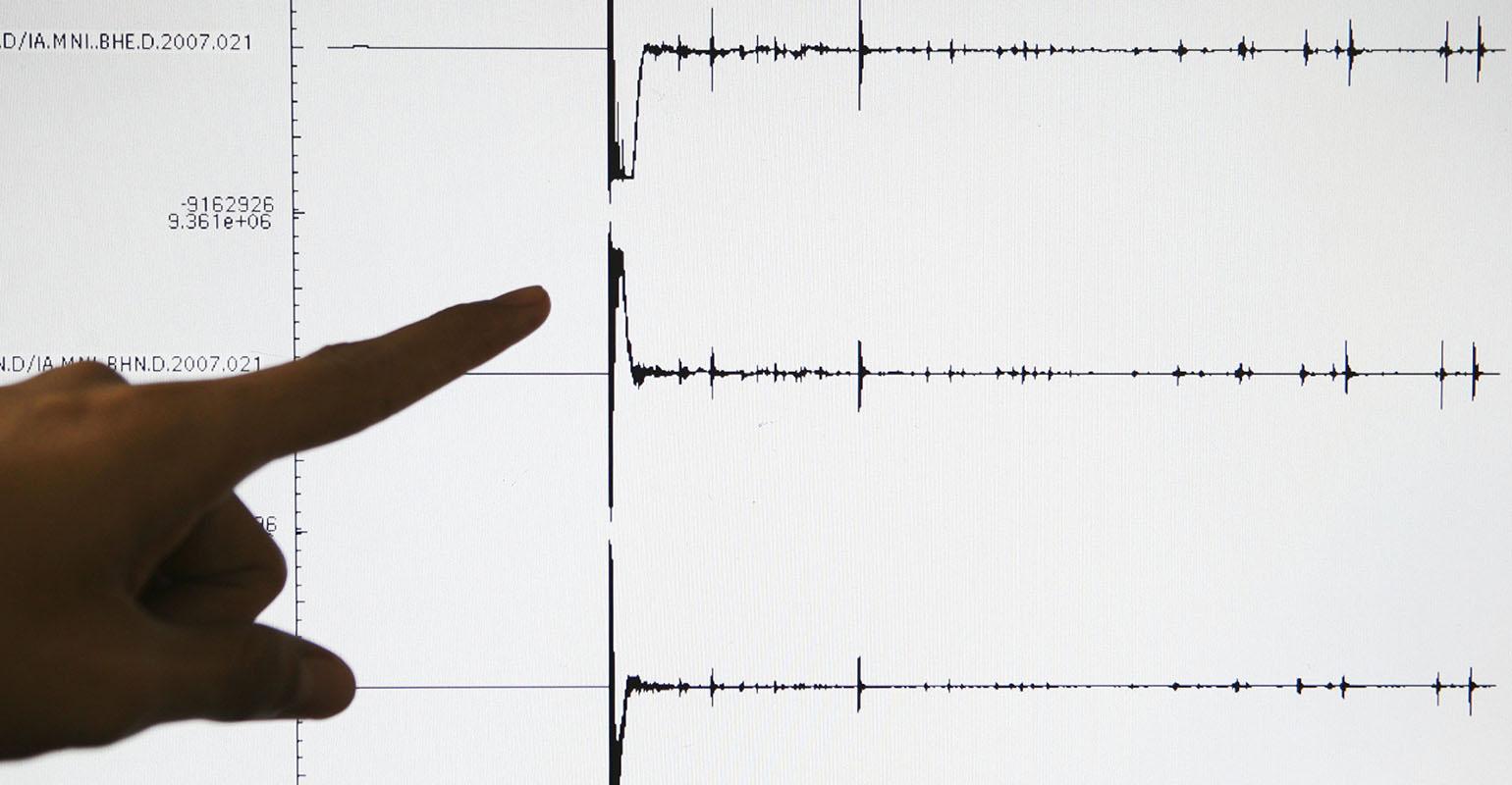

I have been reading about the demise of our industry for over 30 years. On May Day in 1975, the world was about to stop spinning on its axis because the government abolished fixed-rate commissions. The outlook was bleak — there would be no survival, and yet here we are. Since then, there have been a variety of these “seismic” events, all of varying measure on the Richter scale. While each disrupts things, the financial industry adapts and soldiers on. Every inflection point brings big change, but the good news is that we most certainly will survive; some will even thrive, but in order to do so, you need the right mindset.

Consider that Charles Schwab launched its discount brokerage in May 1975. Prior to this, it had been known primarily as a company that put out a very good, informative newsletter. It seized the moment, taking advantage of the deregulation of commissions and launched its business. The rest is history. Schwab was certainly one of the leaders of the day, spearheading a charge to innovation that others quickly joined. In 1982, I was with E.F. Hutton, which offered a wrap-fee account for investors and brought an institutional product mix to retail investors. All of the sudden, the industry was crackling. The RIA model, as well as the broker/dealer model, were spawned and are now mainstays. External forces created an inflection point and those with a prevailing sense of calm and purpose harnessed the opportunity to affect change. We are all better off for it.