Nontraded REITs Share Online Auctions

Shareholders in nontraded REITs have limited options when attempting to liquidate some or all of their common stock holdings. While most nontraded REITs have share redemption programs, these programs may have been suspended due to liquidity issues, or restricted to redemption requests filed due to death, disability, or other hardships. Funding for share redemptions is usually tied to distribution reinvestment programs (DRIP), and in numerous cases the redemption or repurchase of shares has been suspended indefinitely by the boards of directors. Blue Vault reports on the redemptions of nontraded REIT shares by each REIT on a quarterly basis, but a more complete picture of the redemption issue would require a comparison of redemptions granted to redemptions requested. REITs may place limits on the percentage of outstanding shares that can be redeemed in a given period, and many REITs do not redeem all of the shares that stockholders have requested, in which case only a percentage of each request may be repurchased.

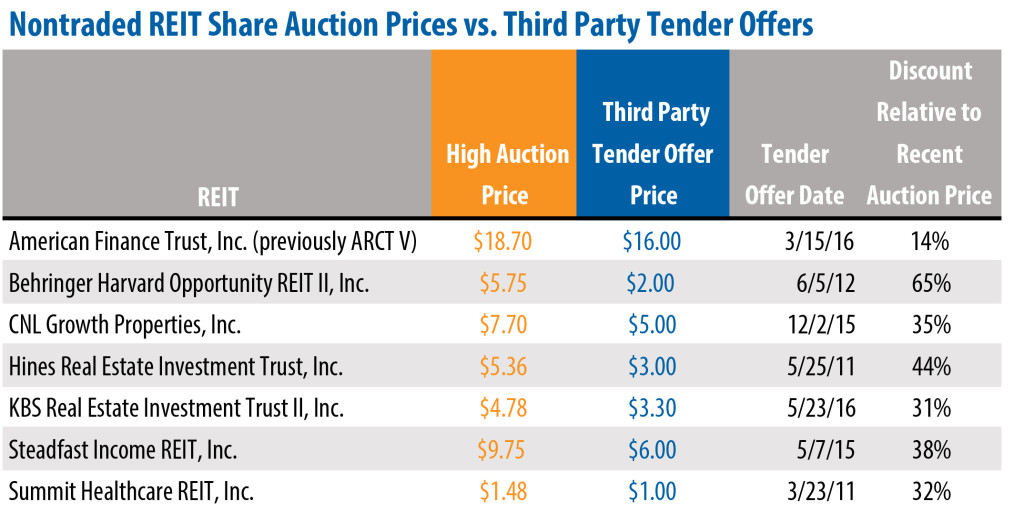

Another avenue for shareholders seeking liquidity prior to a full-cycle event is via third-party tender offers filed by companies that appear to specialize in making significantly lower share price offers to nontraded REIT shareholders. Each year several companies file third party tender offers with the SEC for the common shares of nontraded REITs, often at very steep discounts to both the stated per share NAVs of the REITs and significantly below the eventual full liquidity values realized when the REITs have a liquidity event. While the boards of the REITs usually file letters to shareholders advising against accepting such offers, the tender offering firms persist. Even if a small number of shareholders tender their shares at such low prices, the companies that buy the shares can cover their expenses and either hold the shares with a view toward full liquidation or turn them around quickly in the secondary markets that do exist for a profit.

A better alternative for shareholders seeking to liquidate shares in nontraded REITs prior to a full-cycle event is to offer shares for sale on an auction site. There are at least two such sites that carry out regular auctions of nontraded REIT shares.

Central Trade and Transfer (CTT) – www.CTTAuctions.com

CTT began auction activities in early 2011 and is a branch office of Orchard Securities, LLC, located in Lehi, Utah. A listing agreement allows sellers to set a reserve price and an auction listing lasts for three business days. A history of past auctions of shares for a particular REIT is available upon request, and CTT can recommend  a reserve price based upon past transaction history. After the high bidder is determined, the sale is cleared through the designated transfer agent for the REIT. When an auction is complete, the buyer transfers funds that are placed in escrow until the title to shares is transferred. Typical times from the auction ending to transfer date have been two to four weeks. In early 2015, CTT acquired American Partnership Board (APB). At the time of the acquisition CTT and APB accounted for more than 65 percent of all secondary market trades by dollar volume, and that market share has reportedly increased.

a reserve price based upon past transaction history. After the high bidder is determined, the sale is cleared through the designated transfer agent for the REIT. When an auction is complete, the buyer transfers funds that are placed in escrow until the title to shares is transferred. Typical times from the auction ending to transfer date have been two to four weeks. In early 2015, CTT acquired American Partnership Board (APB). At the time of the acquisition CTT and APB accounted for more than 65 percent of all secondary market trades by dollar volume, and that market share has reportedly increased.

REITbid – www.reitbid.com

The REITbid online auction platform was founded by Ray Wirta and Bill Lange. Wirta is the former Chief Executive Officer and current Director of CBRE, the world’s largest commercial real estate brokerage firm. Lange is chairman of the LFC Group of Companies and one of the early pioneers of Internet-based real estate auction marketing. The decision to create REITbid was based on demand from non-traded REIT sponsors, broker-dealers and investors who needed an efficient secondary market that could provide liquidity for existing non-traded public REIT shares. REITbid and FRE.com partnered in 2011 to create an auction site just for nontraded REIT shares.

An investor wishing to sell nontraded REIT shares fills out a form online with the REIT name, number of shares, a copy of the last statement and anticipated reserve price. Once ownership of the shares is confirmed, transfer documents are prepared and the auction is displayed on the REITbid.com website and is open for bidding. Buyers who have expressed an interest in the REIT shares are notified of the auction start date. At the end of the auction, the highest bidder meeting the reserve price becomes the buyer and transfer documents are executed by buyer and seller, with purchase monies sent to the clearing firm. Completed transfer documents are processed by the REIT, the seller receives confirmation and funds are distributed to the seller.

It is important to note that investors who wish to purchase shares on these auction sites must be vetted by the dealers who manage these platforms and meet the same qualifications required of investors who purchase nontraded REIT shares in public offerings.

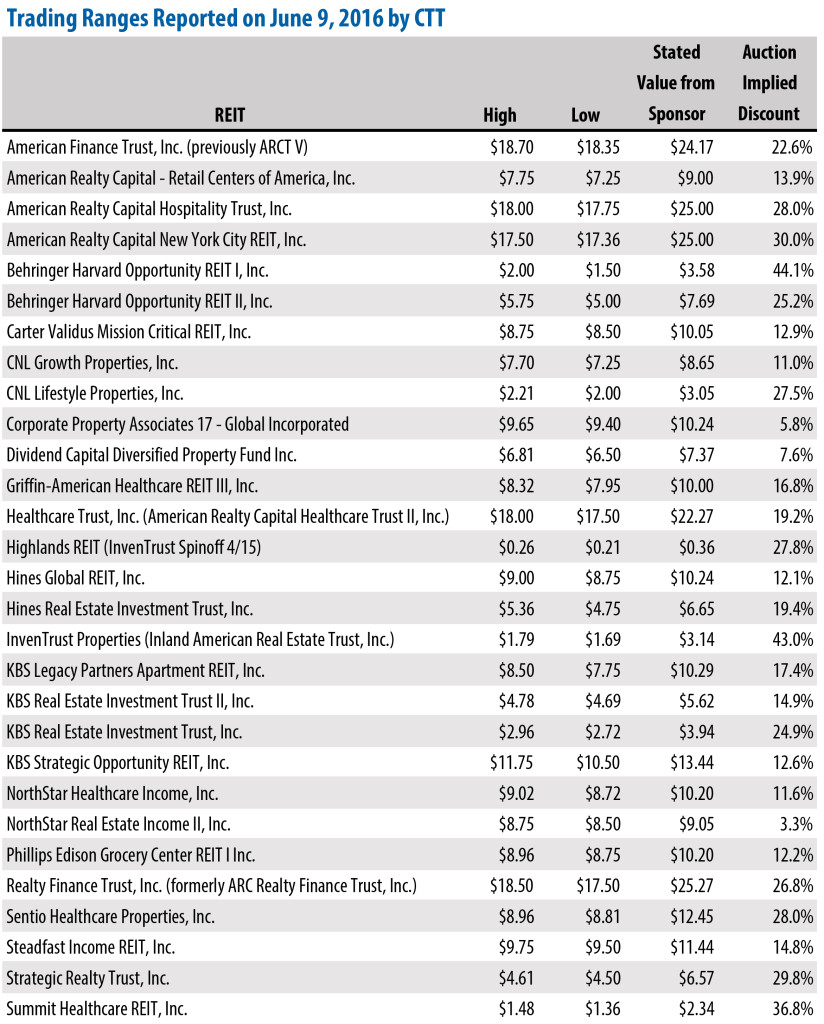

Nontraded REITs whose shares have been auctioned on the CTT site within the last 12 months and a final price are shown below.

The data for online auction transactions reveal a significant discount from the REIT’s stated values (NAVs), averaging around 20% before fees.

The two alternatives to utilizing online auctions for shareholders wishing to liquidate their nontraded REIT shares are the redemption programs of the REITs themselves, or in some cases, tendering shares to third parties. Redemption prices are often at the REIT’s most recently stated NAV, and when available, redemptions by the REITs offer the best prices to shareholders. However, if the REIT is not offering redemptions, or if the redemption programs are not fulfilling all redemption requests, or if the shareholder does not qualify for redemptions (e.g. death or disability requirements), then a last resort is the occasional third-party tender offers. Our data reveal that third-party tender offers are typically “low-ball” offers at significant discounts to NAVs and to available online auction prices.