Jim Sprow | Blue Vault |

A July 31, 2023, article in the Wall Street Journal focused on the plunging values of shopping malls. The article quoted real estate research firm Green Street. “Older, low-end malls are worth at least 50% and in some cases more than 70% less than they were when mall valuations peaked in late 2016, said Vince Tibone, head of U.S. retail and industrial research for real-estate research firm Green Street.”

Using Blue Vault’s exclusive database, we looked at the properties held by nontraded REITs as of March 31, 2023, to see if those assets could be categorized as “older, low-end malls” and if, so how holding those types of properties could impact a REIT’s valuations.

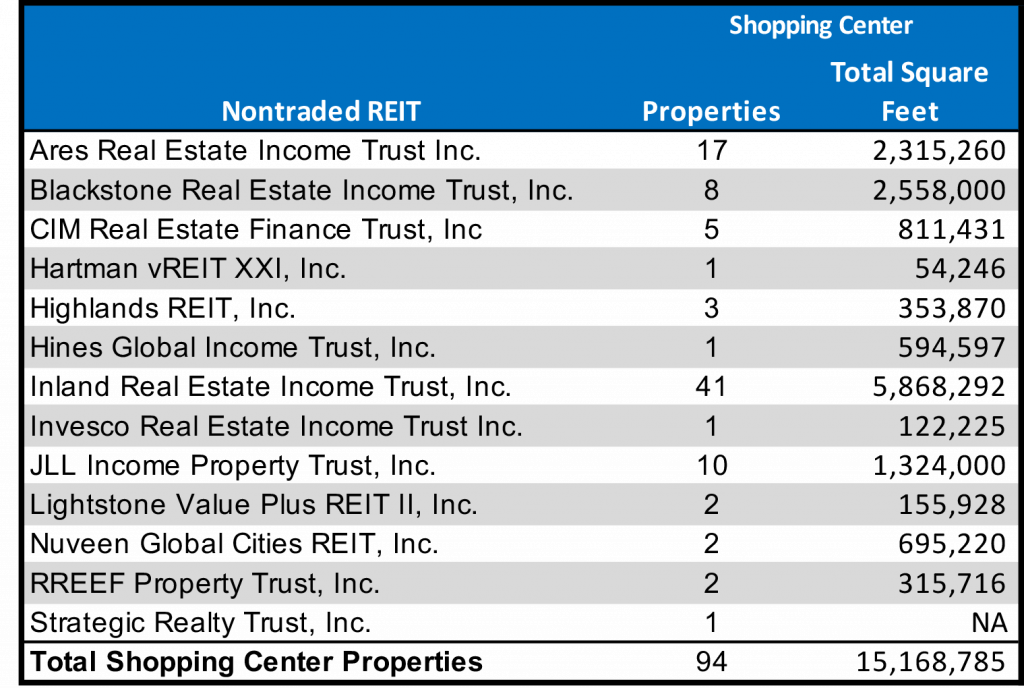

Our data classifies nontraded REIT assets by type and there were just 94 properties (out of over 2900 properties in the database) at the end of Q1 2023 classified as “Shopping Center.” We looked at the 46 of those properties with the greatest square feet of leasable space to see if they were enclosed shopping malls or open shopping centers with stores surrounding a parking lot or facing a parking lot with no common space within a central structure. Of the 46 properties owned by nine different nontraded REITs, 43 were open shopping centers with free-standing stores, or strip-malls with no central structure connecting them. Two could possibly be typified as enclosed shopping centers and one was a portfolio of retail properties with 1.2 million total square feet owned by Blackstone REIT.

We conclude that active nontraded REITs are not holding traditional enclosed shopping mall assets and are not likely to be greatly impacted by the falling values of those assets. For those 74 properties with data for the year built, the median age was 16 years. Compared to the enclosed malls which were the subject of the WSJ article, these retail assets are more likely to be newer and very unlike the troubled assets held by listed REITs such as Simon Properties, Macerich and CBL Properties.

The WSJ article uses the example of Crystal Mall, an enclosed mall built in the 1980s in Waterford, Connecticut. “Valued by an appraiser at $153 million as recently as 2012, Crystal Mall sold in June for just over $9.5 million in a foreclosure auction.” Crystal Mall’s former owner, Simon Property Group, stopped making payments on $81 million in outstanding CMBS debt during the pandemic and last year handed back the keys to the property it had owned since 1999.

According to the article, “Widespread department-store closures beginning in 2018 hastened malls’ decline. Large mall anchors like Macy’s, Bon-Ton, JCPenney and Sears closed about 875 department stores between 2018 and the end of 2020, according to Green Street, compared with a combined 175 in 2016 and 2017.” We looked at the tenants in the nontraded REIT-owned shopping centers and are impressed with the quality of the tenants in the free-standing and attached buildings located there. The tenants include such relatively recession-proof retailers as Lowe’s, Home Depot, Walmart, Hobby Lobby, Walgreens, and various grocery stores such as Osco, Giant, Sprouts, and Ralph’s. None of the “anchor” tenants in these properties appear to be in trouble, with the one exception of Bed, Bath & Beyond.

The table below summarizes the shopping center properties owned by nontraded REITs. In terms of number and square feet of leasable space, Inland Real Estate Income Trust had the largest portfolio of shopping center properties.

Property-level data is made available to Blue Vault subscribers every quarter for all nontraded REITs.

Sources: Blue Vault Database; Google and Microsoft Bing for tenants at shopping center properties