Nontraded REITs Have Downward Trend in Quarterly FFO Y-O-Y for Q1 2020

June 24, 2020 | James Sprow | Blue Vault

In a look at changes in funds from operations (“FFO”) for 46 nontraded REITs, comparing the year-over-year quarterly totals for Q1 2019 FFO and Q1 2020 FFO, there were 25 REITs with lower FFO totals in Q1 2020 and 21 REITs with increases in FFO year-over-year. The total decrease in FFO for all 46 REITs combined was $1.12 billion, but interestingly, the total decrease was primarily due to unrealized decreases in the value of assets for Blackstone Real Estate Income Trust (“BREIT”) in Q1 2020 totaling $1.104 billion. That adjustment to the net loss attributable to BREIT shareholders caused FFO to swing from a positive number to a large negative number of $(877.15) million for the quarter. Due to the size of BREIT’s portfolio relative to all other nontraded REITs, the significant adjustment for unrealized losses from the change in the fair value of the REIT’s financial instruments contributed over 78% of the drop in quarterly FFO Y-O-Y for all 46 REITs.

In a look at changes in funds from operations (“FFO”) for 46 nontraded REITs, comparing the year-over-year quarterly totals for Q1 2019 FFO and Q1 2020 FFO, there were 25 REITs with lower FFO totals in Q1 2020 and 21 REITs with increases in FFO year-over-year. The total decrease in FFO for all 46 REITs combined was $1.12 billion, but interestingly, the total decrease was primarily due to unrealized decreases in the value of assets for Blackstone Real Estate Income Trust (“BREIT”) in Q1 2020 totaling $1.104 billion. That adjustment to the net loss attributable to BREIT shareholders caused FFO to swing from a positive number to a large negative number of $(877.15) million for the quarter. Due to the size of BREIT’s portfolio relative to all other nontraded REITs, the significant adjustment for unrealized losses from the change in the fair value of the REIT’s financial instruments contributed over 78% of the drop in quarterly FFO Y-O-Y for all 46 REITs.

The value of reporting funds from operations for nontraded REITs is found in the adjustments to net income (loss) from the non-cash accounting for such items as real estate depreciation and amortization and gains (losses) on dispositions of real estate to arrive at a total that better represents the ongoing or “normal” cash flows available to stockholders. Further adjustments for non-cash accounting totals then are made to FFO to arrive at modified funds from operations (“MFFO”) or adjusted funds from operations (“AFFO”) which better reflect the on-going cash-generating ability of the REIT.

From the quarterly financial report by BREIT:

“FFO, as defined by NAREIT and presented below, is calculated as net income or loss (computed in accordance with accounting principles generally accepted in the United States of America (“GAAP”)), excluding (i) gains or losses from sales of depreciable real property, (ii) impairment write-downs on depreciable real property, plus (iii) real estate-related depreciation and amortization, and (iv) similar adjustments for non-controlling interests and unconsolidated entities.”

“We also believe that adjusted FFO (“AFFO”) is a meaningful non-GAAP supplemental disclosure of our operating results. AFFO further adjusts FFO in order for our operating results to reflect the specific characteristics of our business by adjusting for items we believe are not related to our core operations. Our adjustments to FFO to arrive at AFFO include removing the impact of (i) straight-line rental income and expense, (ii) amortization of above- and below-market lease intangibles, (iii) amortization of mortgage premium/discount, (iv) unrealized (gains) losses from changes in the fair value of investments in real estate debt, (v) forfeited investment deposits (vi) amortization of restricted stock awards, (vii) non-cash performance participation allocation or other non-cash incentive compensation even if repurchased by us, (viii) gain or loss on involuntary conversion, (ix) realized (gains) losses on extinguishment of debt, and (x) similar adjustments for non-controlling interests and unconsolidated entities.”

Not all nontraded REITs report MFFO or AFFO. In the Q1 2020 Nontraded REIT Industry Review available on the Blue Vault website, we report MFFO for those REITs that report it and we estimate MFFO using the NAREIT methodology for all REITs that don’t report MFFO in their quarterly financials.

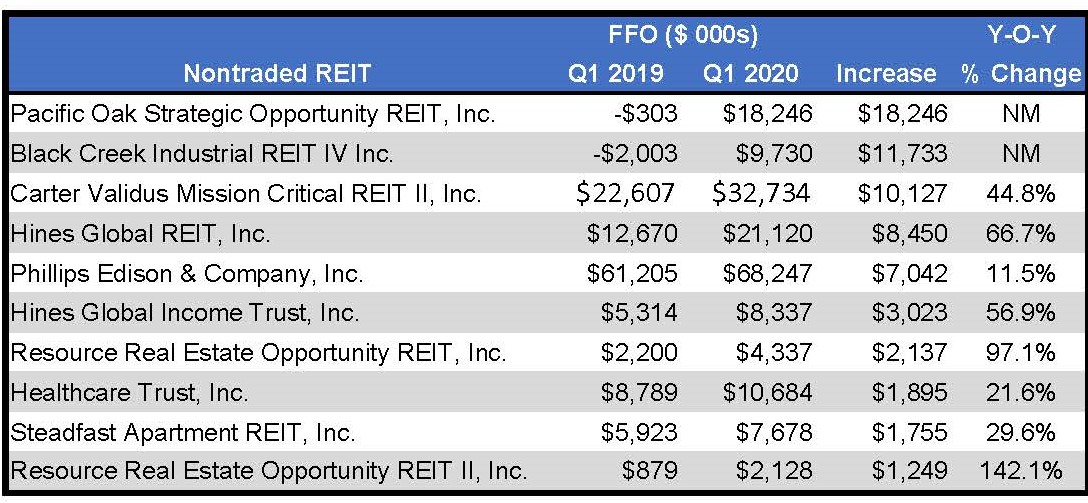

Shown below are the ten nontraded REITs that reported the largest dollar value of increases in FFO from Q1 2019 to Q1 2020.

Sources: SEC, Blue Vault