The Macro Environment for Office Properties

The news in the financial press about weakness in the office sector of commercial real estate has been largely negative. Vacancies in office properties have remained historically high and company attempts to have employees return to offices following the pandemic have met with mixed success. Lease renewal activity has been challenging to landlords as demand for square feet of office properties has fallen and many significant corporate tenants have recently given up their space or sought to sublet it.

In a Spring 2023 survey by CBRE, over half of respondents, led by large companies, anticipate further reductions of their office footprints to trim unoccupied space, with most executing this upon lease expirations.

Vacancies in the largest office markets are rising. New York City had a vacancy rate of 16.1% while San Francisco’s rate was 26.4% per JLL’s Q1 2023 report. Sublease space nationally grew by another 12.4 million square feet in Q1, reaching a record high of 189 million square feet in Q1, according to CBRE. Sublease space made up 19% of total available space at the end of the first quarter, up from 13% in Q1 2020.

Leasing activity declined 25% on a quarterly basis, according to CBRE Group Inc.’s Q1 office market report. Cushman & Wakefield PLC had a similar assessment, finding activity dropped 23% from Q4 2020, reaching levels observed during the depths of the Covid-19 pandemic.

On June 6, Blackstone REIT was reportedly looking to sell an 815K sf office building in Atlanta that it acquired for $210.1 in its purchase of Preferred Apartment Communities last year. The property is expected to sell for roughly $175 million. The nontraded REIT’s parent, Blackstone, has reduced its U.S. office space to 2% of its portfolio, down from over 60% in 2007.

Office Properties in Nontraded REIT Portfolios

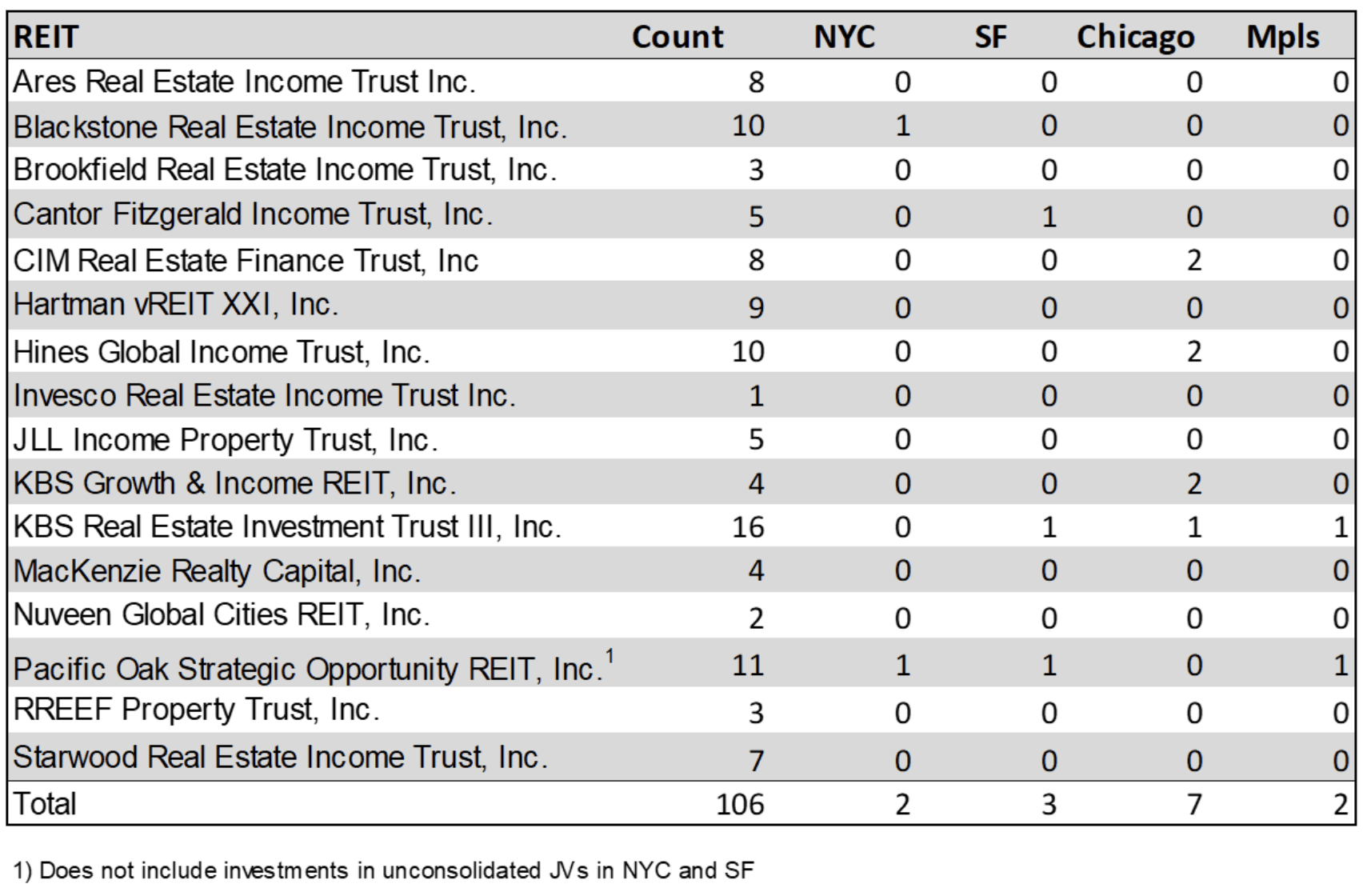

As of March 31, 2023, there were 106 office properties in the portfolios of 16 nontraded REITs. Less than half of the active nontraded REITs with real estate property assets owned any office properties. In a listing of all properties held by all nontraded REITs in the Blue Vault Database, there were a total of 2,923 properties, including portfolios of properties, of which eight were identified as “Office” portfolios without a specific property count. Thus, only 3.6% of all nontraded REIT properties were in the category of “Office.”

The table below shows which REITs owned office properties and how many of those properties were located in four major cities that have seen significant challenges in recent years.

Office Properties in Nontraded REIT Portfolios and Locations

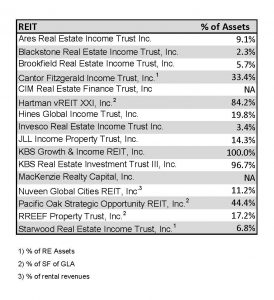

Some smaller nontraded REITs have higher portions of their portfolios in office properties. The two largest NTRs, Blackstone REIT and Starwood REIT, have just 2.3% and 6.8% of their portfolios in office properties, respectively. Blackstone REIT had just one of its 10 office properties in New York City, and Starwood REIT had none of its seven properties there.

Some smaller nontraded REITs have higher portions of their portfolios in office properties. The two largest NTRs, Blackstone REIT and Starwood REIT, have just 2.3% and 6.8% of their portfolios in office properties, respectively. Blackstone REIT had just one of its 10 office properties in New York City, and Starwood REIT had none of its seven properties there.

Office Properties in Nontraded REIT Portfolios by % of Portfolio

By comparison, NAREIT reports that the office sector consisting of 19 listed office REITs had a market capitalization of $54.7 billion as of April 30, 2023. That represented just 5.4% of the total market capitalization of the FTSE Nareit Equity REITs, all the listed REITs. Not included in that total were the 11 listed REITs classified as “Diversified” which may also own some office properties and made up an additional 2.6% of the total market capitalization. By comparison, Industrial REITs made up 16.4% of the total market capitalization, and Residential REITs made up 18.3% of the total.

Specific NTRs with Office Property Challenges

KBS Growth & Income REIT was in default on a loan on the Commonwealth Mortgage Building in Portland, Oregon, as of February 1, 2023. “Given the depressed office rental rates and continued social unrest and increased crime in downtown Portland where the property is located, we do not anticipate any near-term recovery in value.” The Portland property was on the REIT’s books at $37.3 million, or roughly 38% of its portfolio value. The REIT also had two of its four office properties in Chicago, Illinois. The REIT has experienced a decline in occupancy from 90.4% as of December 31, 2020, to 71.6% as of March 31, 2023.

KBS Real Estate Investment Trust III has 96.7% of its properties in the office category by count. The REIT’s Q1 2023 10-Q states “Both upcoming and recent tenant lease expirations amidst … headwinds coupled with slower than expected return-to-office, most notably in the San Francisco Bay Area where we own several assets, have had direct and material impacts on our ability to access certain credit facilities.” While the REIT did take an impairment charge of $27.0 million against its San Francisco property, and four of its 16 properties are in the greater San Francisco Bay area, most of its portfolio appear to be in healthier office markets, like Texas (4), for example.

Hartman vREIT XXI, Inc., owns office properties in Houston (8), San Antonio (1), and Dallas (1), along with two non-office properties. The REIT has yet to file a 10-Q for Q1 2023, but as of September 30, 2022, its total portfolio occupancy was 80%. In a February 1, 2022, letter to shareholders, the REIT stated “Historically, the Company has delivered a 6% return to our investors. However, with rapid upward pressure on interest rates over the past twelve months, our weighted average interest rate now equals approximately 7.3%, more than double from January 2022 (sic), and our total monthly debt service obligation has more than tripled. As a result, the Company is not able to support a distribution. While our revenue has increased, we do not anticipate a meaningful decline in interest rates for the 2023 calendar year. Because of that, it is not anticipated that XXI will be able to pay a distribution for the foreseeable future as we navigate these market conditions.”

Conclusion

Nontraded REITs hold just 3.6% of their real estate assets in office properties. Three nontraded REITs had portfolios with over 80% in the office category and five had over 30% in the office category. Despite the market’s heavily discounting of the office sector, it doesn’t appear to present a major challenge to the large majority of nontraded REITs. However, at least three NTRs are feeling the impact of troubled properties, and the resulting impact that has on their valuations.

June 12, 2023 | James Sprow | Blue Vault Partners

Sources: S&P Global Market Intelligence, BISNOW.com, CBR, JLL, The Business Journals