November 2022 Reported Nontraded REIT Sales Down 2.3% From October

December 19, 2022 | James Sprow | Blue Vault

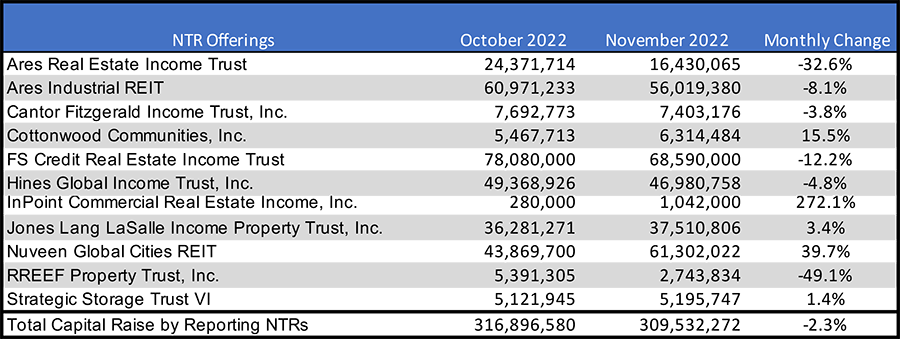

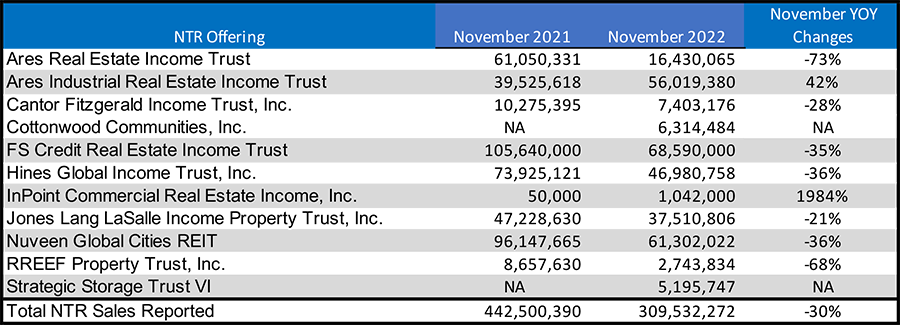

Blue Vault received November 2022 sales totals for eleven nontraded REIT program offerings as of December 16, 2022. Sales reported by those eleven NTRs totaled $309.5 million, down 2.3% from $316.9 million in October, and down 30% Y-O-Y from the $442.5 million in sales in November 2021. Among reporting nontraded REITs, FS Credit Real Estate Income Trust led with $68.6 million in sales, down 12.2% from $78.1 million in October. Nuveen Global Cities REIT had sales of $61.3 million, up 39.7% from October’s sales of $43.9 million. Ares Industrial REIT was next among reporting REITs with $56.0 million in November, down 8.1% from $61.0 million in October. Hines Global Income Trust reported $47.0 million in sales, down 4.8% from $49.4 million in October. Five reporting NTRs reported increases in monthly sales, with InPoint Commercial RE Income posting $1.0 million, up 272% from just $0.3 million in October and Strategic Storage Trust VI, with $5.2 million in sales, up 1.4% from $5.1 million in October.

Table I

All capital raise figures for these nontraded REITs include DRIP proceeds.

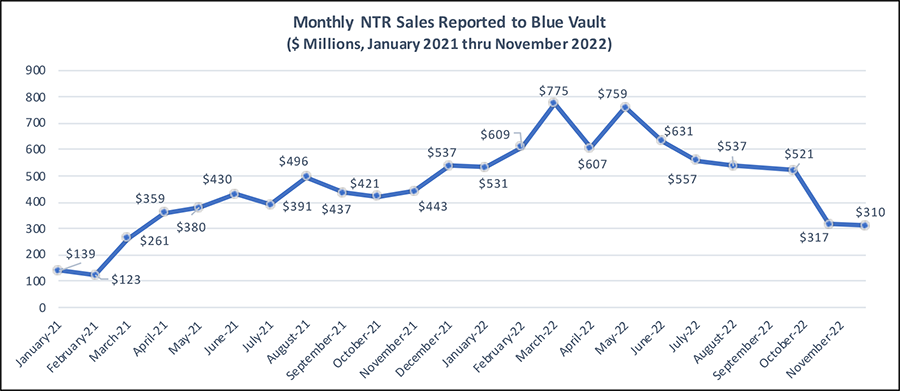

Chart I NTR Sales

Sales in the chart do not include capital raised by Blackstone REIT, Starwood REIT, Brookfield REIT, and Invesco REIT. Those four REITs raised an estimated $5.071 billion in Q3 2022 and raised capital with equity sales in November 2022 but did not report to Blue Vault. Blackstone REIT raised $4.17 billion (including DRIP) in Q3 2022, followed by Starwood REIT with $1.80 billion, Brookfield REIT with $208 million and Invesco REIT with $21.5 million.

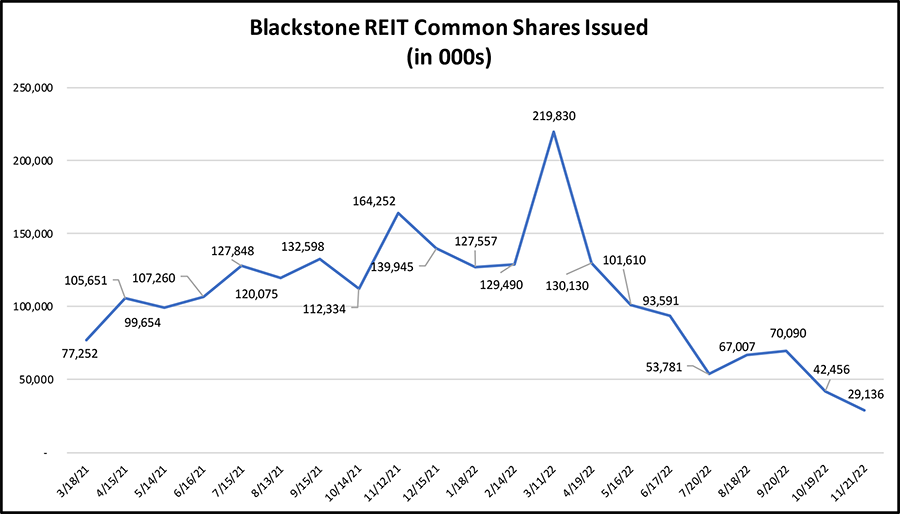

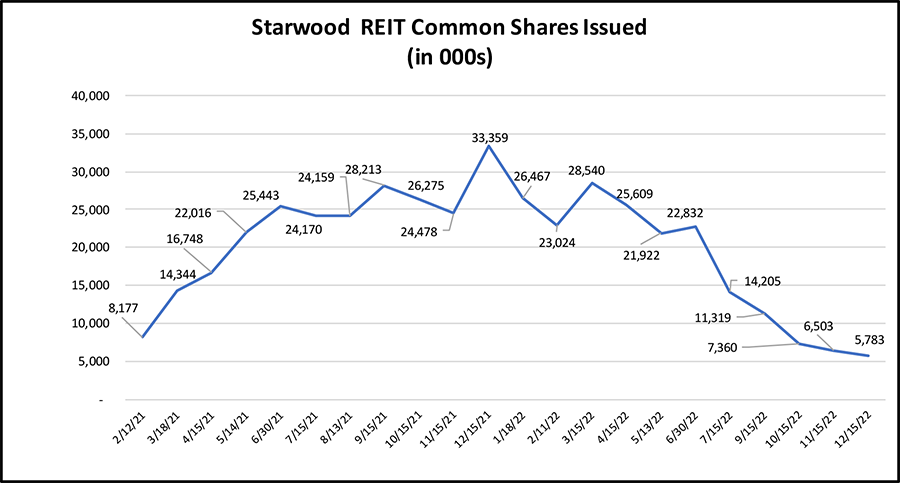

Estimated Common Stock Issuances by Blackstone REIT and Starwood REIT

Using the monthly 424b3 filings by Blackstone REIT and Starwood REIT, we can plot the estimated number of common shares issued by the two nontraded REITs. The data bridge two offerings for each REIT, so some discontinuity in the monthly totals may show up in the series. Blackstone REIT appears to have issued the most shares over the time period in March 2022, while Starwood REIT issued its highest total in December 2021. Both REITs reported significant drops in common share issuances over the last eight to eleven months. Both REITs have also been subject to a large volume of redemptions requests, reaching their monthly limits of 2% of total NAV in November 2022 and pro-rating the number of share redemptions fulfilled that month. Shareholders who wish to redeem shares in December will have to re-submit their redemption requests each month as the pro-rated fulfillments reach their monthly limits.

While the news of capped monthly common share redemptions by BREIT and Starwood REIT was a subject of many articles in November, no other REITs among the continuously offered NAV REITs reported reaching their redemption limits during the fourth quarter of 2022. For more information on redemption requests among the NAV nontraded REITs, see the Blue Vault articles “NAV REITs See Surge in Share Repurchases in Q3 2022,” and “Digging Deeper into Blackstone REIT Repurchases” published on the Blue Vault website over the past two weeks.

Y-O-Y NTR Capital Raise Comparisons

Year-over-year comparisons show capital raised by reporting nontraded REITs was down 30%.

Table II

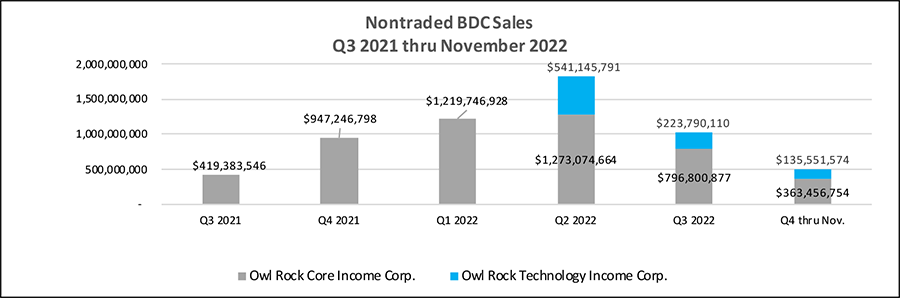

Nontraded BDC Capital Raise thru November 2022

Only two nontraded BDCs were raising funds and reported to Blue Vault for November 2022. Blue Owl Capital Inc. (formerly Owl Rock Capital Advisors) had $227.2 million in equity capital raised by two BDCs in November 2022, down 16.4% from the October total of $271.8 million. Blackstone’s nontraded BDC was also raising capital but did not report its sales to Blue Vault. Quarterly capital raise for the three reporting nontraded BDCs since Q3 2021 are shown below thru Q3 2022 totals and November 2022.

Chart II

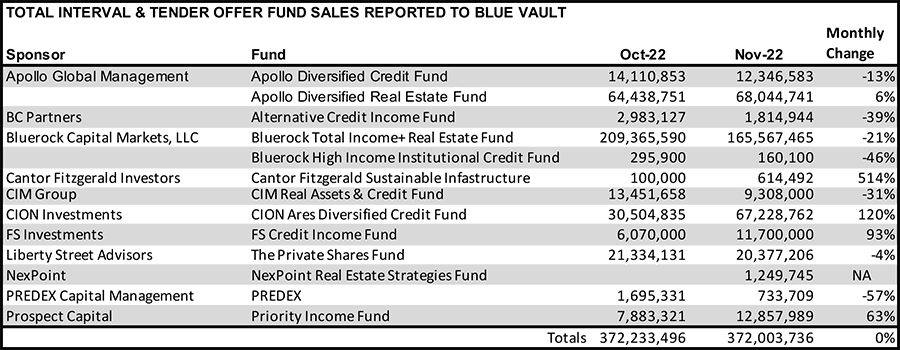

Interval and Tender Offer Fund Sales Reported to Blue Vault for November

Thirteen funds reported their capital raise for November 2022 to Blue Vault. Bluerock Total Income+ Real Estate Fund raised $165.6 million, down 21% from the $209.4 total for October. Apollo Diversified Real Estate Fund raised $68.0 million, up 6% from the October total of $64.4 million. The 13 funds that reported had total capital raise of $372.0 million, virtually unchanged from the $372.2 million raised by twelve funds in October 2022.

Table III

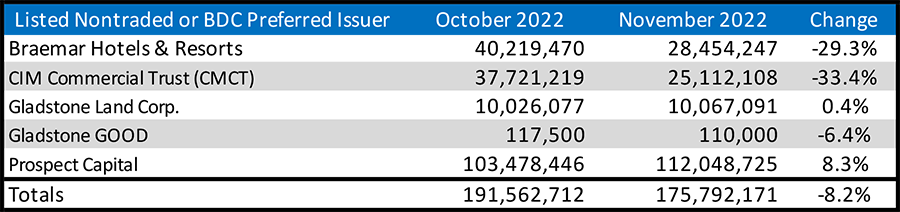

Listed REITs and BDCs with Nontraded Preferred Stock Issuances

Blue Vault has received sales reports from four listed REITs and a listed BDC that issued nontraded preferred stock in November. Leading the group was listed BDC Prospect Capital with $112.0 million in preferred stock issuances, up 8.3% from the $103.5 million October total. Braemar Hotels & Resorts issued $28.5 million, down 29.3% from $40.2 million in October. Gladstone Land issued $10.1 million in nontraded preferred stock, up 0.4%% from the October total. For all five listed funds that issued nontraded preferred and reported to Blue Vault, the total was $175.8 million, down 8.2% from the October total of $191.6 million reported by the same funds.

Table IV

Sources: SEC, Blue Vault