November Nontraded REIT Capital Raise

December 11, 2019 | James Sprow | Blue Vault

Blue Vault received November sales totals for 15 effective nontraded REIT program offerings as of December 10. Sales reported by those 15 NTRs totaled $160.7 million for November compared to the October total for a larger 17 REIT sample of $167.2 million. Based upon a comparison of the same reporting 15 REITs for both months, the 15 REITs raised $167.1 million in October and the same-sample decrease was 3.8% month-to-month. Among the nontraded REIT offerings that had increases in capital raise between October and November, Black Creek Industrial REIT IV’s raise increased from $13.7 million in October to over $29.5 million in November, a 115% increase, following a 103% increase from September to October. CIM Income NAV saw sales increase by over 79% month-to-month, from $3.7 million in October to $6.7 million in November. Procaccianti Hotel REIT increased monthly sales by over 47%, from $0.98 million in October to $1.45 million in November. Inland’s InPoint Commercial Real Estate Income increased sales by over 32%, from $3.06 million in October to $4.05 million in November. Cottonwood Residential increased sales from $5.3 million in October to $6.7 million in November, an increase of 27% month-to-month. Of the 15 public offerings by nontraded REITs that have reported sales for November, eight programs had increases in sales and seven programs had decreases month-to-month. The eight NTRs with increases are shown in Table I.

Table I

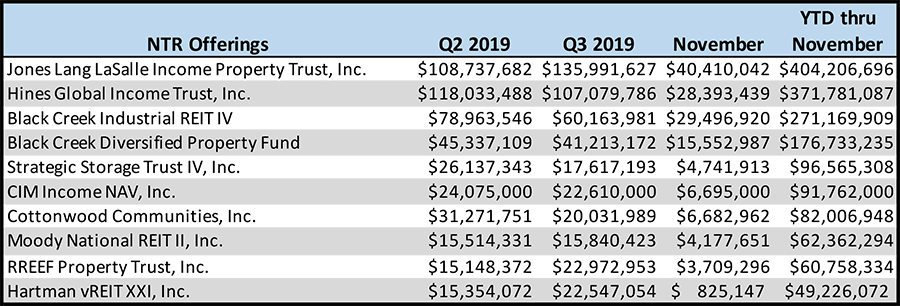

For the year-to-date through November 2019, of the 15 programs reporting sales as of December 10, the offering by Jones Lang LaSalle Income Property Trust had the largest total for the 11 months at $404.2 million. Next on the list were Black Creek Industrial REIT IV at $271.2 million and Black Creek Diversified Property Fund at $176.7 million. The top 10 among the REITs reporting as of December 10 are shown in Table II.

Table II

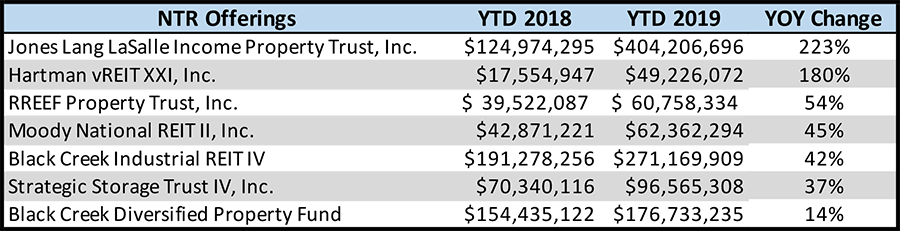

For the NTRs that were raising funds for 11 months in both 2018 and 2019 and reported sales for November 2019, Jones Lang LaSalle Income Property Trust had the largest percentage increase in sales for the 11-month year-to-date periods from 2018 to 2019, increasing over 223% from the 2018 period. Again, Jones Lang LaSalle Income Property Trust had the largest absolute increase in capital raise between the 11-month YTD periods in 2018 and 2019, increasing total sales by $279.2 million. Black Creek Industrial REIT IV had an absolute increase in sales for the two 11-month periods of $79.9 million. The seven reporting NTRs that increased their public offering proceeds for the same 11-months between 2018 and 2019 are shown in Table III.

Table III

Other NTR programs raising funds in November 2019 that have yet to report their sales to Blue Vault as of December 10 include Blackstone REIT, Cantor Fitzgerald’s Rodin Global Property Trust and Rodin Income Trust, FS Credit Real Estate Income Trust, Oaktree REIT, and Starwood REIT. Blackstone and Starwood raise most of their funds through wirehouses.

Nontraded BDC Sales

Just two nontraded BDCs were raising funds in November 2019 and reported those sales to Blue Vault. Owl Rock Capital Corporation raised $47.3 million and MacKenzie Realty Capital raised $0.88 million. Triton Pacific/Prospect’s TP Flexible Income Fund did not report capital raise for November. The total capital raise for those two BDCs in November was $48.1 million, down 18.5% from the October total of $59.1 million. The decrease by Owl Rock Capital Corporation II of $9.45 million was responsible for all but $1.47 million of the decrease for the nontraded BDCs. For the 11 months YTD in 2019, Owl Rock has raised over $456 million and MacKenzie has raised $21.2 million.

Nontraded Preferred Sales by Listed REITs

Bluerock’s Bluerock Residential Growth REIT (NYSE: BRG) is a listed REIT that issues nontraded preferred stock. The REIT raised $24.38 million in November through those issuances, down from the $27.27 million in issuances in October 2019. For the 11-month year-to-date, the REIT has reported a total of $208.4 million through the issuance of nontraded preferred stock, an average of $18.9 million per month. Gladstone LAND Corp. raised $6.08 million in October, up from $5.98 million in September, but has yet to report preferred equity sales for November, having raised $62.95 million YTD through October. CIM Commercial Trust (CMCT) raised $3.15 million in November though preferred stock issuances, down from $3.80 million in October. For 2019 YTD, the listed REIT has raised a total of $38.1 million via the nontraded preferred issuances.