NTR Sponsors Benefitting as Industry Sales Surge to $1.4 Billion in August

September 18, 2019 | James Sprow | Blue Vault

According to Robert A. Stanger & Company (“Stanger”), nontraded REITs booked capital raise of nearly $1.4 billion in August, up 228% from the $418 million total for August 2018. Blue Vault looks at the NTR capital raise by programs with a significant share coming via independent broker dealers to see which REITs are benefitting from the increased industry sales. Among the continuous offerings by REITs other than Blackstone and Starwood, whose sales come primarily through wirehouses, there are some notable success stories in August.

According to Robert A. Stanger & Company (“Stanger”), nontraded REITs booked capital raise of nearly $1.4 billion in August, up 228% from the $418 million total for August 2018. Blue Vault looks at the NTR capital raise by programs with a significant share coming via independent broker dealers to see which REITs are benefitting from the increased industry sales. Among the continuous offerings by REITs other than Blackstone and Starwood, whose sales come primarily through wirehouses, there are some notable success stories in August.

Jones Lang LaSalle Income Property Trust had August sales of $45.2 million, up over 500% compared to August 2018’s total of just $6.7 million. Hines Global Income Trust booked sales of $30.5 million, up over 350% from August 2018. Black Creek Industrial REIT IV’s sales were $29.9 million in August, increasing 27% from July’s $23.5 million and up 61% from August 2018. Several newer nontraded REITs boosted sales in August. Cottonwood Communities led the newcomers with sales of $7.6 million, up from $6.0 million in July. Strategic Student & Senior Housing raised $5.8 million in August, up from just $50,000 in July. Procaccianti Hotel REIT raised $1.4 million in August and Rodin Income Trust raised $857,000.

Year-to-date as of August 31, Hines Global Income Trust has raised $277.8 million. Jones Lang Lasalle Income Property Trust is second at $274.4 million, and Black Creek Industrial REIT IV is third at $221.3 million thru August 2019.

Nontraded REIT capital raise through August this year has topped $1.5 billion by asset managers raising capital through the traditional independent broker dealer channel only. While Blackstone’s sales are indeed impressive, and have more than doubled that raise, it’s comparing apples to oranges to compute the figures in the same bucket. Blackstone has relationships with the wirehouses. It probably should come as no surprise that they’ve been able to raise the significant capital they’ve raised.

Managing Partner, Stacy H. Chitty, noted about Blackstone’s capital raise that, “it’s interesting. In hindsight, I don’t know if Blackstone ever had intentions of raising their capital for their nontraded REIT through the independent channel. It appears they either had a different strategy for doing so, or they didn’t really care to. It appears the same may be true for Starwood.”

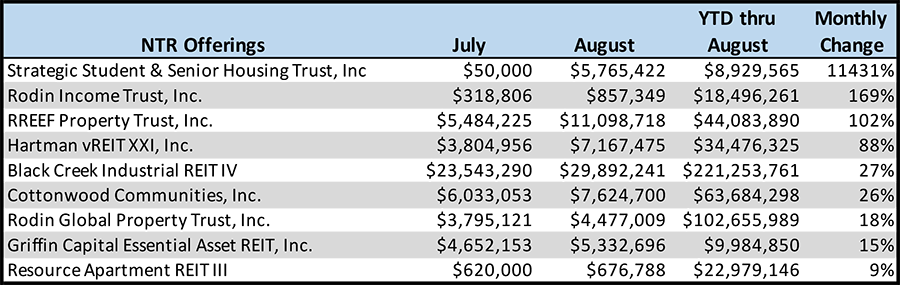

Table I shows the nontraded REITs with the largest month-to-month increases in sales for those offerings that are not predominately offered through wirehouses.

Table I

Table II shows those NTR offerings that have large increases for August 2019 compared to August 2018, again excluding NTRs Blackstone and Starwood that raise capital almost exclusively via the wirehouses.

Table II

In Blue Vault’s July NTR Sales Report, we estimated that quarterly sales for all NTRs in July were approximately $950 million. With Stanger’s estimated sector sales of $1.4 billion in August, the increase month-to-month would be approximately 47%.

Nontraded BDC Sales Down 11% in August

Nontraded BDC sales fell 11% from $42.1 million in July to $37.5 million in August, with only two nontraded BDC programs raising funds in August 2019 compared to six in April 2018 and seven in February 2018. Owl Rock Capital Advisors again led nontraded BDC sponsors with sales of $34.1 million by its Owl Rock Capital Corporation II program, 96% of nontraded BDC sales in August, down 11% from its $40.3 million sales in July. MacKenzie Realty Capital was one of two other BDC programs raising capital with $3.4 million in sales for a 4% share in August, up 28% from its July sales of $1.75 million.

Nontraded Preferred Sales by Listed REITs

Blue Vault receives sales reports from three listed REITs that issue nontraded preferred shares. Nontraded preferred sales by these REITs totaled $30.8 million in August 2019, down from the $33.1 million total in July. Bluerock Residential Growth had sales of $19.63 million for August, decreasing 12% from the $22.31 total for July. Gladstone Land Corp. reported nontraded preferred sales of $8.82 million for August, up from the $5.08 million in July. CIM Commercial Trust had nontraded preferred sales of $2.36 million in August, down 59%% from July sales of $5.73.

Sources: Reporting NTRs and BDCs, SEC, Robert A. Stanger, and Blue Vault