Pacific Oak Strategic Opportunity REIT II Announces Increased NAV at $10.25

December 17, 2019

On December 17, 2019, the board of directors of the Pacific Oak Strategic Opportunity REIT II, Inc. (“the Company”) approved an estimated net asset value (“NAV”) per share of the Company’s common stock of $10.25 based on the estimated value of the Company’s assets less the estimated value of the Company’s liabilities, or NAV, divided by the number of shares outstanding, all as of September 30, 2019, with the exception of the following adjustments: (i) the Company’s consolidated investments in real estate properties were valued as of October 31, 2019; (ii) an adjustment to reduce cash for the amount of capital expenditures incurred in October 2019; (iii) an adjustment for disposition costs and fees incurred in connection with the disposition of 2200 Paseo Verde (collectively the “Adjustments”). Other than the Adjustments, there have been no material changes between September 30, 2019 and the date of this filing that would impact the overall estimated NAV per share. The Company is providing this estimated NAV per share to assist broker-dealers that participated in the Company’s initial public offering in meeting their customer account statement reporting obligations under National Association of Securities Dealers Conduct Rule 2340 as required by the Financial Industry Regulatory Authority (“FINRA”). This valuation was performed in accordance with the provisions of and also to comply with Practice Guideline 2013–01, Valuations of Publicly Registered, Non-Listed REITs, issued by the Institute for Portfolio Alternatives (formerly known as the Investment Program Association) (“IPA”) in April 2013 (the “IPA Valuation Guidelines”).

On December 17, 2019, the board of directors of the Pacific Oak Strategic Opportunity REIT II, Inc. (“the Company”) approved an estimated net asset value (“NAV”) per share of the Company’s common stock of $10.25 based on the estimated value of the Company’s assets less the estimated value of the Company’s liabilities, or NAV, divided by the number of shares outstanding, all as of September 30, 2019, with the exception of the following adjustments: (i) the Company’s consolidated investments in real estate properties were valued as of October 31, 2019; (ii) an adjustment to reduce cash for the amount of capital expenditures incurred in October 2019; (iii) an adjustment for disposition costs and fees incurred in connection with the disposition of 2200 Paseo Verde (collectively the “Adjustments”). Other than the Adjustments, there have been no material changes between September 30, 2019 and the date of this filing that would impact the overall estimated NAV per share. The Company is providing this estimated NAV per share to assist broker-dealers that participated in the Company’s initial public offering in meeting their customer account statement reporting obligations under National Association of Securities Dealers Conduct Rule 2340 as required by the Financial Industry Regulatory Authority (“FINRA”). This valuation was performed in accordance with the provisions of and also to comply with Practice Guideline 2013–01, Valuations of Publicly Registered, Non-Listed REITs, issued by the Institute for Portfolio Alternatives (formerly known as the Investment Program Association) (“IPA”) in April 2013 (the “IPA Valuation Guidelines”).

The estimated NAV per share was based upon the recommendation and valuation prepared by Pacific Oak Capital Advisors, LLC (the “Advisor”), the Company’s external advisor. The Advisor’s valuation of the Company’s consolidated investments in real estate properties was based on (i) appraisals of all but one property (“Appraised Properties”) performed by the independent third-party real estate valuation firm Duff & Phelps, LLC (“Duff & Phelps”) and (ii) the contractual sale price less estimated selling credits for an office property located in Henderson, Nevada (2200 Paseo Verde) which was sold on December 4, 2019. Duff & Phelps prepared appraisal reports, summarizing key inputs and assumptions for each of the Appraised Properties. The Advisor performed valuations of the Company’s cash, restricted cash, investment in real estate equity securities, investment in an unconsolidated entity, other assets, mortgage debt and other liabilities. The methodologies and assumptions used to determine the estimated value of the Company’s assets and the estimated value of the Company’s liabilities are described further below.

The Advisor used the appraised values of the Appraised Properties and in the case of 2200 Paseo Verde, the contractual sales price less estimated selling credits, together with its estimated value of each of the Company’s other assets and liabilities to calculate and recommend an estimated NAV per share of the Company’s common stock. Based on (i) the conflicts committee’s receipt and review of the Advisor’s valuation report, including the Advisor’s summary of the appraisal reports prepared by Duff & Phelps and the Advisor’s estimated value of each of the Company’s other assets and the Company’s liabilities, (ii) the conflicts committee’s review of the reasonableness of the Company’s estimated NAV per share resulting from the Advisor’s valuation process, and (iii) other factors considered by the conflicts committee and the conflicts committee’s own extensive knowledge of the Company’s assets and liabilities, the conflicts committee concluded that the estimated NAV per share proposed by the Advisor was reasonable and recommended to the Company’s board of directors that it adopt $10.25 as the estimated NAV per share of the Company’s common stock. The board of directors unanimously agreed to accept the recommendation of the conflicts committee and approved $10.25 as the estimated NAV per share of the Company’s common stock, which determination is ultimately and solely the responsibility of the board of directors.

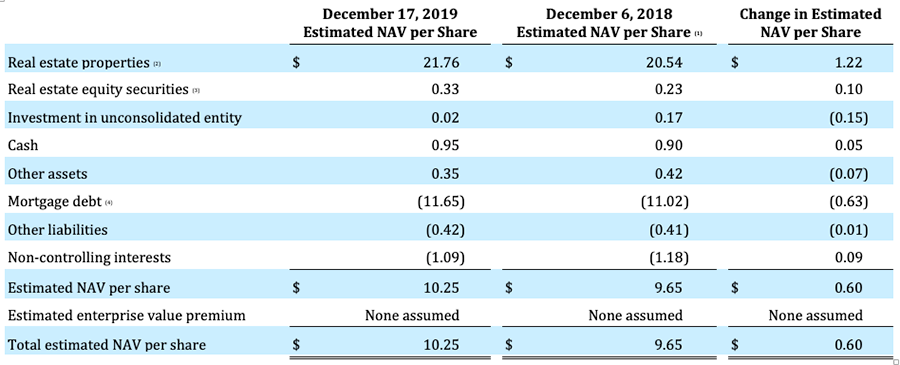

The table below sets forth the calculation of the Company’s estimated NAV per share as of December 17, 2019, as well as the calculation of the Company’s estimated NAV per share as of December 6, 2018. Duff & Phelps is not responsible for the determination of the estimated NAV per share as of December 17, 2019, or December 6, 2018.

(1) The December 6, 2018, estimated value per share was based upon the recommendation and valuation of the Company’s former external advisor, KBS Capital Advisors LLC (“KBS Capital Advisors”). The Company engaged Duff & Phelps to provide appraisals of the Company’s consolidated investments in real properties and KBS Capital Advisors performed valuations of the Company’s cash, restricted cash, investment in an unconsolidated entity, other assets, mortgage debt, and other liabilities. For more information relating to the December 6, 2018, estimated NAV per share and the assumptions and methodologies used by Duff & Phelps and KBS Capital Advisors, see the Company’s Current Report on Form 8-K filed with the SEC on December 11, 2018.

(2) The increase in the estimated value of real estate properties was due to increases in fair values of the Company’s real estate properties.

(3) The increase in the estimated value of real estate equity securities was due to acquisitions of real estate equity securities as well as unrealized gains on the securities.

(4) The increase in mortgage debt was primarily due to borrowings for future capital needs and to fund capital expenditures on real estate.

Source: SEC