Peakstone Webcast Fails to Buoy Stock Price

April 26, 2023 | James Sprow | Blue Vault

On Thursday, April 20, after markets closed for its newly listed common stock (NYSE: PKST), the REIT’s CEO Michael Escalante, explained in a webcast that the listing that the Company completed on Thursday, April 13, provided shareholders of Griffin Realty Trust, the nontraded REIT’s previous name, with the first opportunity to liquidate their holdings.

“The listing, among other things, provides investors access to liquidity and positions the company for long-term growth,” said Escalante. “The listing is not an IPO. The company did not issue new shares. Escalante also stated that management has not sold any shares since the effectiveness of the listing and “has no current plans to sell its shares.”

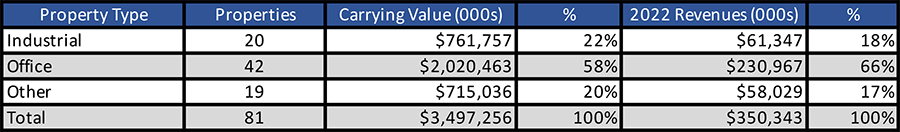

Peakstone Realty Trust was founded in 2009 as a nontraded REIT externally managed by Griffin Capital. As of December 31, 2022, it owned 81 properties in 24 states, approximately 95.5% leased based on square footage. The portfolio mix was:

Peakstone’s most recently reported estimated net asset value per share was $66.87, following the nine-for-one reverse stock split executed by the company on March 8, 2023. That net asset value was last estimated as of June 30, 2022, at $7.51 for Class I shares, before the nine-for-one reverse stock split. At the time of the listing, that “most recent” estimated NAV per share was over eight months out of date.

At the close of trading shares on the first day of trading, PKST finished at $11.65, up 45.62% after starting the trading day at $8.00. Shares traded at $36.80 at the close of the trading day on Thursday, April 20. That price movement is, to say the least, remarkable and difficult to rationalize. Interestingly, after the webcast at 4:30 PM on Thursday, the PKST shares opened at $35.22 Friday morning, down 4.3%. By 4:00 PM on Friday, less than 24 hours after the webcast by the REIT’s management, the shares were trading at $28.60, down 22% from Thursday’s close.

To say that the Peakstone webcast failed to buoy the REIT’s common stock would be a gross understatement. Objectively, the REIT’s investment in office properties, a sector that has had a particularly rough year, weighed heavily on its valuation by the market. According to NAREIT, the office sector of 19 listed REITs had a total return in 2022 of negative 37.6%. The 12 Industrial REITs had a total return of negative 28.6%. YTD through March 2023 the office REITs were down another 0.64% while industrial REITs had a YTD total return of +8.63%.

The performance of listed REITs could explain some of the drop in PKST’s common stock price from its outdated net asset value per share, but the total drop in value and the market’s apparently negative reaction to the webcast on Thursday are difficult to explain.

Log in to the Blue Vault database to observe more useful trends. Not a subscriber? Subscribe here.