Pension Funds Increase Allocations to REITs

April 29, 2022 | James Sprow | Blue Vault

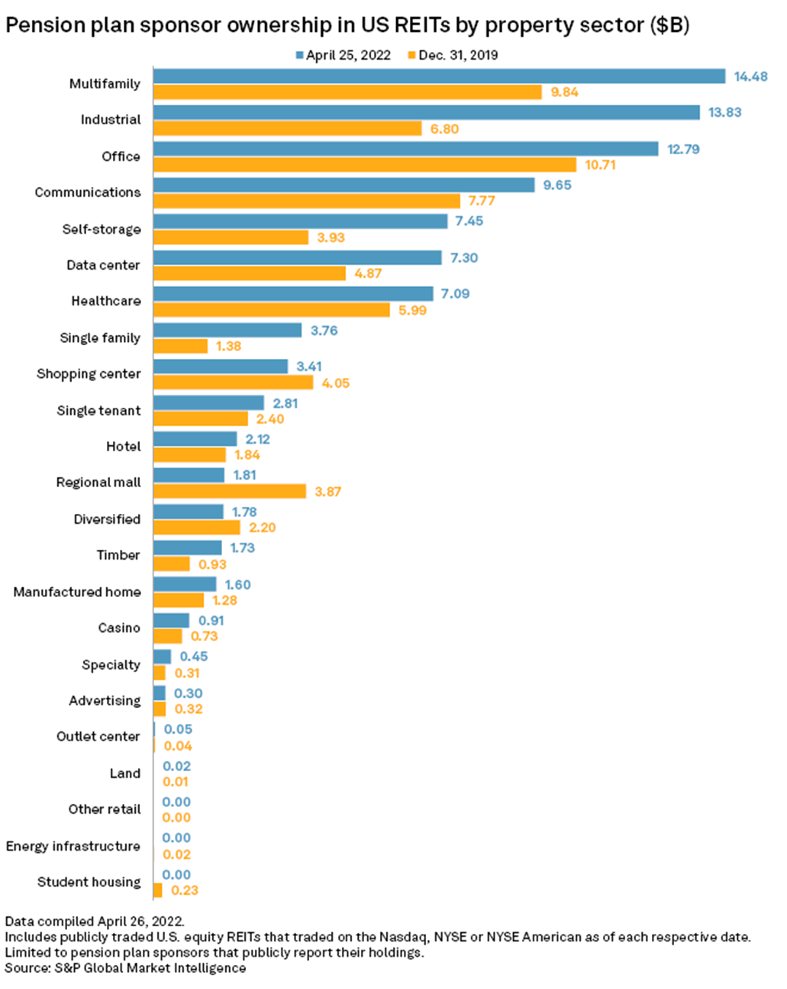

According to S&P Global Market Intelligence data, pension fund sponsors have significantly increased their investments in U.S. REITs, especially in those that specialize in multifamily, office and industrial properties, since the end of 2019.

According to a recent report, multifamily investments were $14.5 billion as of April 25, up by 47.2% from the end of 2019. Industrial investments were $13.8 billion, up by 103.4%, while office investments increased to $12.8 billion, up by 19.4% during the same period.

In terms of percentage increases, the single family home sector saw an increase of 172% in pension fund holdings. While NAREIT lists only two single family home-focused listed REITs with an implied market value of just $40.3 billion, about 2.9% of the market value of the listed REITs in the NAREIT data, the allocation by pension funds to that asset sector increased by $2.38 billion to a total of $3.76 billion.

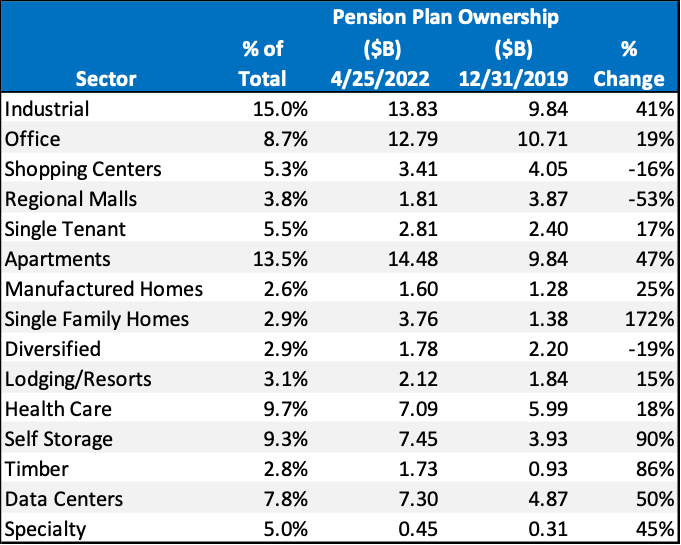

In terms of market value, 13 industrial-focused REITs make up 15.0% of the total for the listed REITs in the NAREIT data. Apartment REITs made up 13.5% of the market value. Retail REITs represented 14.6% of the listed REIT market value, made up of shopping centers (5.3%), regional malls (3.8%), and free-standing retail (5.5%).

Other asset types that saw significant increases in pension fund allocations were self-storage (+90%), timber (+86%) data centers (+50%), apartments (+47%) and specialty REITs (+45%).

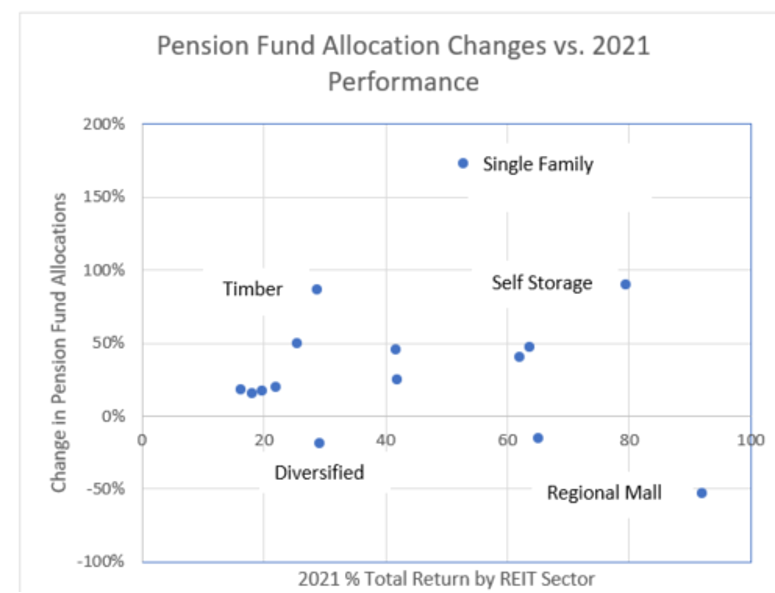

There is no indication that the total return performance by REITs in 2021 influenced the changes in allocations by pension funds between the end of 2019 and March 25, 2022. In other words, there is no evidence that last year’s performance motivated pension funds to invest more in strong performers and less in poor performers, or that market performance explained the changes in the value of holdings. One interesting outlier was the strong total return performance by two regional mall REITs in 2021 (+92%) and the reduced allocation by pension funds in that asset type (-53%).

Sources: Nareit at REIT.com; S&P Capital IQ