Pimco Says ‘Storm Is Brewing’ in U.S. Commercial Real Estate

by John Gittelsohn, Sarah Mulholland | June 20, 2016 — 10:00 AM EDT | Bloomberg

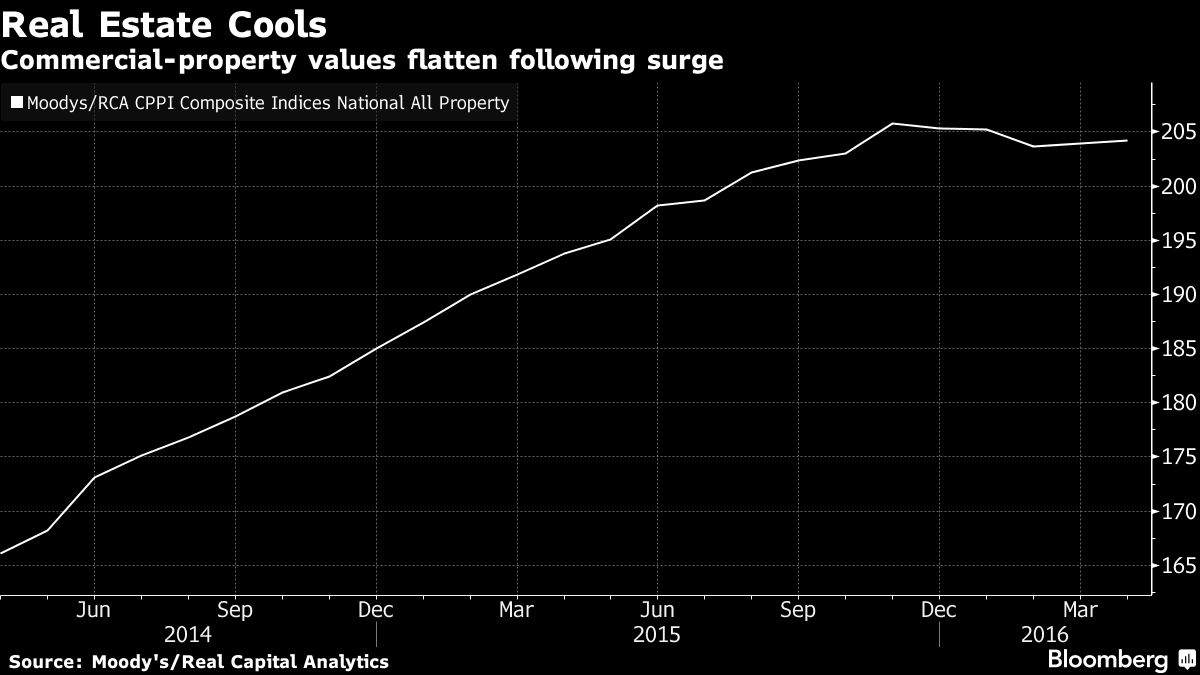

- Firm warns prices may fall as much as 5% in next 12 months

- Buying, refinancing opportunities to emerge for some investors

U.S. commercial real estate prices may fall as much as 5 percent in the next 12 months amid tightened regulations, a wall of debt maturities and property sales by publicly traded landlords, Pacific Investment Management Co. said in a report Monday.

A global surge in demand for U.S. property investments that pushed real estate values to records may wane as slowing growth in China, lower oil prices and dislocated debt markets threaten to halt six years of price growth, Pimco portfolio managers John Murray and Anthony Clarke said in their report, titled “U.S. Real Estate: A Storm Is Brewing.”

“Storms form when moisture, unstable air and updrafts interact,” they said. A similar confluence of factors “is creating a blast of volatility for U.S. commercial real estate.”