Johnathan Rickman | Blue Vault

Preferred stock refers to securities that companies issue to raise capital while providing different pathways for investing in a particular investment strategy. This story picks up where part one of the series, covering the basics, benefits, and risks of preferred stock, left off.

To further our understanding of “preferreds,” we will use the NexPoint Diversified Real Estate Trust, a listed REIT (NYSE: NXDT) that has both a listed (NXDT-PA) and a nontraded preferred stock option, as a case study, with expert commentary from the NexPoint team.

Three Investment Pathways

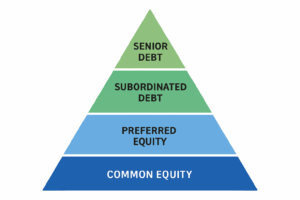

NXDT has three share classes, including common shares, that offer investors different avenues for investing in the REIT. By issuing preferreds, NXDT is able to raise capital and invest in its real estate strategy subordinate to its senior debt, Scott Simon, NexPoint Director of Product Strategy, explains.

Let’s explore the different investment pathways that NXDT provides.

NXDT Common Shares

The bottom line: Portfolio diversification and growth.

Buying common stock in a listed REIT allows investors to achieve upside potential, as the shares trade just like that of a typical stock. These investors also benefit from being the actual owner of NXDT, noted Simon. “When there’s growth, you’re getting all of that.”

However, common stock investors are in a “first-loss position,” meaning they experience any risk downsides before any other share class investors, said Micah Jordan, NexPoint Senior Director of National Accounts.

NXDT Series A Shares

The bottom line: Less volatility with a quarterly dividend.

NXDT-PA, the REIT’s 5.50% Series A cumulative preferred shares, were issued in connection with the company’s previous tender offer several years ago to diversify the capital stack. This listed preferred trades like a stock, though with typically less volatility than the common stock, allowing investors to capture some upside potential if the preferred trades higher, Simon said. However, he noted that Series A investors are still open to market risk.

NXDT Series B Shares

The bottom line: Steady income via a monthly dividend.

The REIT’s 9% Series B cumulative redeemable preferred shares are nontraded and thus only available through broker-dealer and advisory channels.

“This preferred checks all the boxes on why alternative investments exist,” said Jordan. “It diversifies away from some of the primary risks related to the equity and fixed income markets, reduces portfolio volatility, and delivers consistent income that does not fluctuate with overall market movements.”

If common shares of NXDT rise, Series B investors won’t capture all that growth. On the other hand, if NXDT stock falls, Series B investors won’t feel that shockwave. However, unlike many other nontraded preferred stock offerings, NXDT Series B offers a unique conversion feature that permits investors to convert to common shares at a discount that grows the longer an investor holds the stock. This feature allows investors the opportunity to capture additional upside, provided certain conditions are met.

Both NXDT Series A and B investors have the advantage of the preferred being issued by a NYSE-listed, publicly traded company that’s required to meet regulatory and filing requirements and other forms of transparency, Simon noted.

Retail and Real Estate

Across all of its products, NexPoint has raised about $7 billion in equity across the retail channel over the last decade, including about $1.7 billion in the Reg D/DST/1031 channel, Jordan said. Capital raised by the firm is a mix of non-accredited and accredited investors.

“Year to date, NexPoint has received equity investments from over 400 unique wealth management firms,” Jordan added. “Currently, there are over 600 firms that hold assets with NexPoint, with most of those being broker-dealers and investment advisors.”

He also notes that NexPoint has dedicated in-house teams operating in several different sectors, which allows them the unique ability to pivot where they see opportunity advancing. While acknowledging current market challenges, Jordan says NexPoint continues to have “high conviction” in certain real estate sectors that have long-term economic tailwinds. He cites life-sciences, self-storage, residential (NexPoint’s bread and butter) and small-bay industrial real estate as sectors with enduring trends that will continue to reward committed investors for the foreseeable future.

“We think real estate should be a core holding of most people’s retirement and individual investment accounts and NexPoint is dedicated to providing timely investment strategies that further the adoption and access of alternative investments,” he says.

Learn more about NexPoint, NXDT, and NXDT Series B.

Blue Vault tracks nontraded preferred stock offerings as part of our research into private markets for credit, real estate, and equity. Learn about Blue Vault membership and how our performance data can help build your advisory practice. Are you an asset manager, broker-dealer, or other entity? Contact us today to see how we can help you.