Quarterly Changes in FFO for Nontraded REITs

September 26, 2018 | James Sprow | Blue Vault

Blue Vault has compared the changes in Funds From Operation (FFO) for nontraded REITs from Q1 2018 to Q2 2018 and also year-over-year from Q2 2017 to Q2 2018. We have made comparisons for those nontraded REITs that have reported FFO for those periods, which eliminates those nontraded REITs that have had liquidating events during the periods in the comparisons and newer nontraded REITs that did not report FFO for Q2 2017. The overall results for all nontraded REITs show that 28 reported increases in reported FFO from Q1 2018 to Q2 2018. There were 31 that reported decreases in FFO for those quarters. When comparing changes in FFO for the year-over-year periods Q2 2017 to Q2 2018, 30 nontraded REITs reported increases in quarterly FFO and 28 reported decreases in FFO, year-over-year.

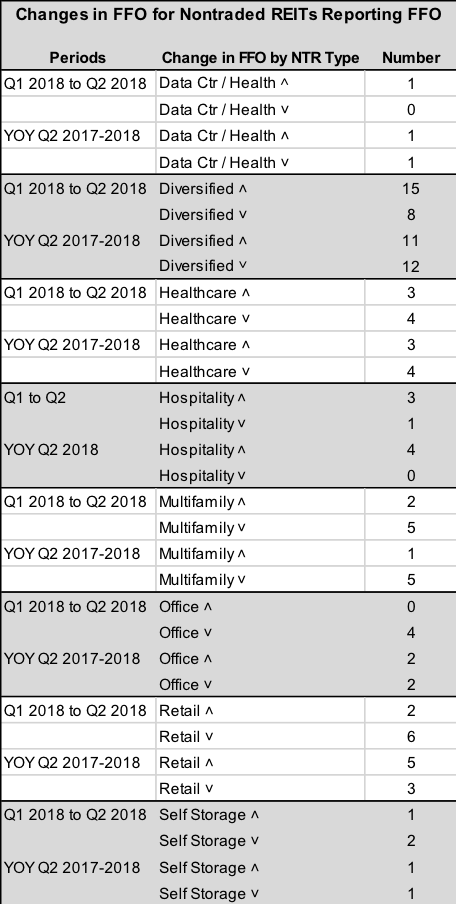

Looking at the results for different investment types of this sample of nontraded REITs reveals the following results (˄ = increase in FFO, ˅ = decrease in FFO):

These results are subject to many qualifications. First, the quarterly and year-over-year comparisons will be greatly influenced by the size and composition of the REIT portfolios. REITs that liquidated a portion of their portfolios over the periods reported above (e.g. Carter Validus Mission Critical REIT) would be expected to report lower FFO, other things equal. REITs that grew their portfolios significantly over the periods above would be expected to report higher FFO, other things equal (e.g. Blackstone REIT). REITs that are categorized as “Diversified” in their investment strategies may have high concentrations in one specific asset type.