Recent Nontraded REIT Rent Collections vs. Listed REIT Experience

August 11, 2020 | James Sprow | Blue Vault

In a recent article, we looked at the rent collections by nontraded REITs in April, May and June of 2020. NAREIT recently published the results of a rent collections survey for listed REITs and it is interesting to compare the success of some nontraded REITs in collecting property rents to their peers among the listed REITs. Notably, those nontraded REITs that broke out their rent collections experience by asset type did quite well compared to the listed REITs.

In a recent article, we looked at the rent collections by nontraded REITs in April, May and June of 2020. NAREIT recently published the results of a rent collections survey for listed REITs and it is interesting to compare the success of some nontraded REITs in collecting property rents to their peers among the listed REITs. Notably, those nontraded REITs that broke out their rent collections experience by asset type did quite well compared to the listed REITs.

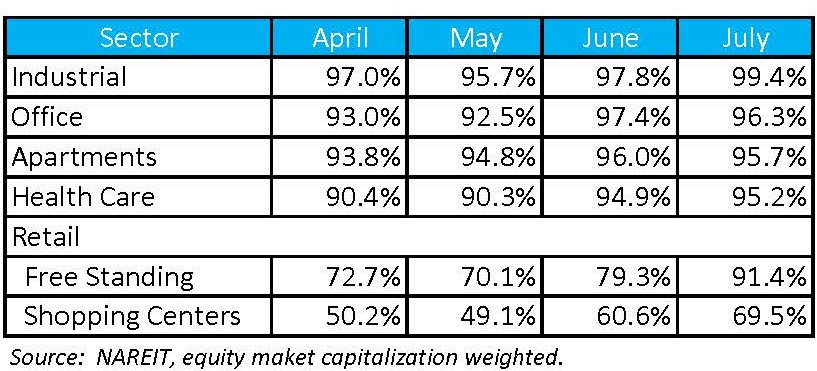

NAREIT surveyed a sample of listed REITs and presented the rent collections data weighted by the equity capitalization values of the survey respondents. The results of the survey which was conducted July 20, 2020, are shown in Table I. The collections history for retail properties, in particular, show a healthy rebound in July.

Table I

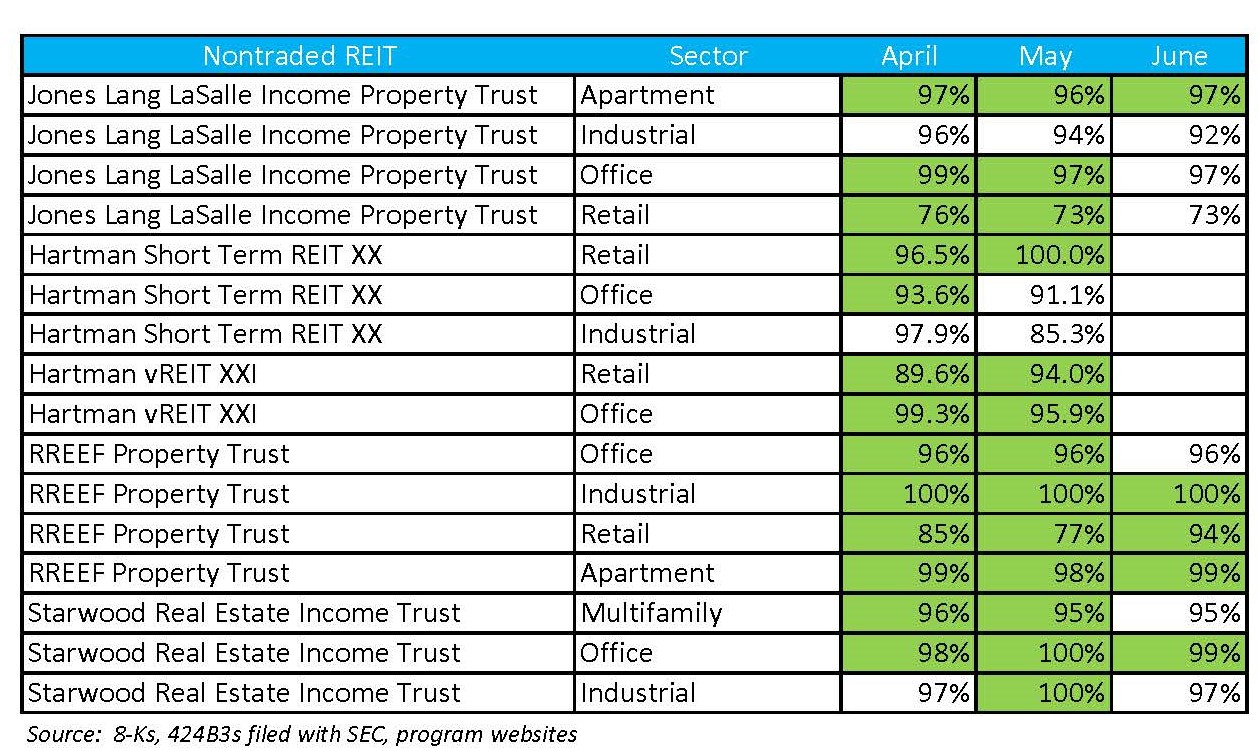

The published rent collection history for nontraded REITs is shown in Table II. As of July 31, very few of the nontraded REITS had reported their July rent collections. Wherever the property sector results for a nontraded REIT exceeded the collections percentages for the listed REITs in NAREIT’s survey, the percentages are highlighted in green. The results show that, at least for those nontraded REITs that reported their rent collection history, rent collections were impressive when compared to their listed REIT peers.

Table II

As usual, whenever we report statistics for small samples, whether in the NAREIT survey or in the published reports of the nontraded REITs in our sample, there is most likely to be self-selection bias. That is, REITs with relatively favorable rent collections history, for example, are more likely to report their results, other things equal. Still, these nontraded REITs have good reason to publish their results.

Sources: NAREIT, SEC filings