REITs Own 535,000 Properties in the U.S.

October 13, 2022 | Nicole Funari | Nareit

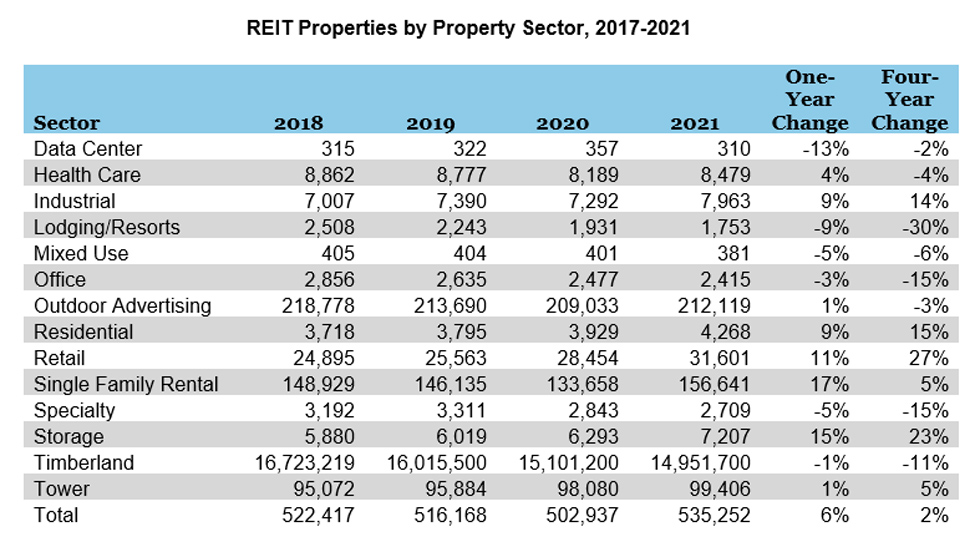

Nareit’s annual update of REIT property counts and estimated gross asset values by state and property sector is now available on the REITs Across America website. At the end of 2021, U.S. public REITs owned an estimated 535,000 properties—up 6% from the previous year—and 15 million acres of timberland across the U.S.

Nareit has tracked the changes in the REIT industry’s property holdings since 2018, including changes in REITs’ portfolios and the composition of the REIT industry as companies enter and exit. Nareit’s T-Tracker showed strong net acquisitions in 2021, translating to a 6% total increase in REIT properties at year-end 2021 compared to the previous year.

• Retail has continued to make gains every year and had the largest percentage increase in properties since 2018 at 27%.

• Single family rental had the largest one-year percentage increase in properties, up 17%. This is largely due to the entry of a new public non-listed REIT.

• Storage is one of the top growing sectors with a 15% increase in properties year-over-year in 2021 and a 23% increase from 2018, the second highest overall.

• Industrial and residential were both up 9% from the previous year and up 14% and 15% since 2018, respectively.

• Cell towers saw a modest annual increase of 1% in 2021 and are up 5% since 2018.

• Health care and outdoor advertising were both down since 2018 but up 4% and 1% from the previous year, respectively.

• Data centers and specialty have experienced mergers, acquisitions, and corporate restructuring at the company level leading to some fluctuations in property counts. Overall, both property sectors were down—2% for data centers over the four years and 15% for specialty.

• Office, mixed use, and lodging/resorts have all been trending downward over the four years. Lodging/resorts has had the most significant decline, down 30% from 2018.