Self-Storage Assets as a Recession Resistant CRE Sector

April 27, 2023 | James Sprow | Blue Vault

Self-storage is a commercial real estate sector that has attractive qualities for investors. Self-storage facilities have very low expenses compared to other asset classes. When tenants move out, the managers sweep out the unit and determine an attractive rental rate for the next tenant. When vacancies rise, rates can be adjusted on a monthly basis. The sector still has a large “mom & pop” ownership share and professional management of newly acquired properties can improve the bottom line. Technology is now making it possible to sign up new tenants online, get a credit card number, provide lease and insurance agreements, provide a unit number, and allow access via smartphone. Compared to other asset classes, self-storage is very low maintenance, requires little in the way of ongoing capital improvements, and does relatively well in a challenging economic environment.

According to Ron Havner, Chair at Public Storage (PSA), a leading listed self-storage company, “I don’t think self-storage is recession-proof, I think it’s recession resistant.” He told Globe Street, “During the GFC, we saw reduction in demand of 2% to 3%. Look at the operator yields for the Great Recession and you’ll see that it had a di minimus impact on their profit.”

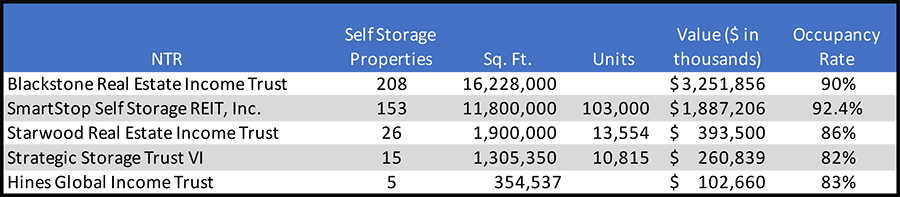

Nontraded REITs have been increasing their investments in self-storage properties. Blackstone REIT had 208 self-storage properties as of December 31, 2022. The REIT acquired 34 more in 2022 at a cost of $542 million. (Should the year be 2023? If not, maybe the previous 2 sentences could be re-written as “Blackstone REIT had 208 self-storage properties as on December 31, 2022, including 34 acquired in 2022 at a cost of $542 million”) SmartStop Self Storage REIT had 153 self-storage properties as of December 31, 2022, acquiring 14 in 2022. Starwood REIT had just 26 self-storage properties. Strategic Storage Trust VI and Hines Global Income Trust held 15 and 5 self-storage assets, respectively.

The demand for self-storage tends to increase when recessions lead to downsizing of households. If tighter budgets lead to downsizing, such as moving into smaller apartments, people need to put more stuff in storage units. A recession in 2023 could cause some tenants to give up their units, while many others may need a place to store their personal items.

Because of the sector’s strong past performance and defensive characteristics, capital is flowing in to both acquire assets and develop new properties. One concern affecting the sector is the potential for the new units being developed to increase supply and create downward pressure on pricing.

Five self-storage focused listed REITs had total returns through March 2023 of +13.22%. In March 2023 they returned +1.96% compared to the FTSE Nareit All Equity REIT Index return of -1.74%. For all of 2022, listed self-storage REITs had a total return of -26.73%, compared to -24.95% for the FTSE Nareit All Equity REIT index of -24.95%. While hardly evidence of protection in a down market, it’s also important to note that in 2022 Office REITs averaged a total return of -37.62%, Industrial REITs had a return of -28.58%, and Residential REITs had returns of -31.34%. Thus, two sectors most favored over the last three years, Industrial and Residential, both did worse than Self Storage.

One developer that has thrived in this competitive environment is Leitbox Storage Partners. Founder and CEO Bill Leitner, with his background in retail development, has found a strategy to develop self-storage facilities in prime locations by utilizing mixed use, with retail on the ground floor and storage units above. The firm introduces what they call high-urban-street-front retail, using a small percentage of the total building, but overcoming resistance to self-storage developments in preferred locations.

Leitner utilizes a proprietary algorithm to find the best sites, searching for areas with population growth, above average per capita income and household income, concentrations of apartment dwellers, attractive rental rates, and few competitors in close proximity. The firm uses programmatic development, repeating the use of their self-storage prototype. Their “Fifth Generation Self Storage” secures zoning approval by integrating mixed use and attractive urban design, then reduces their break-even occupancy via generating retail rental income, and enables quick turnaround by selling the properties either at certificate of occupancy, at approximately 50% occupancy, or at stabilization.

Sources: Blue Vault, REIT.com, leitbox.com