September 2022 Reported Nontraded REIT Sales Down 3.0% From August

October 19, 2022 | James Sprow | Blue Vault

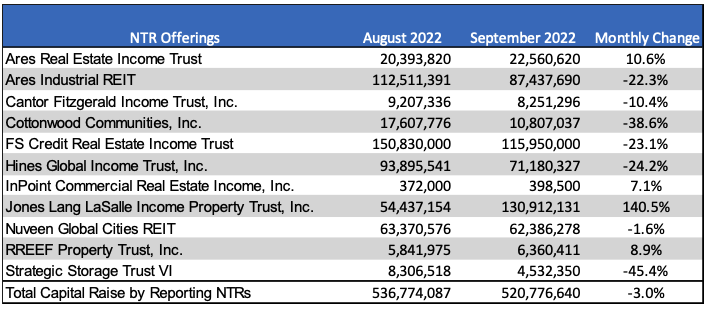

Blue Vault received September 2022 sales totals for eleven nontraded REIT program offerings as of October 18, 2022. Sales reported by those eleven NTRs totaled $520.8 million, down 3.0% from $536.8 million in August, and up 19% Y-O-Y from the $437.0 million in sales in September 2021. Among reporting nontraded REITs, Jones Lang LaSalle Income Property Trust led the reporting NTRs with $130.9 million in sales, up 140.5% from $54.4 million in August. FS Credit Real Estate Income Trust followed with $116.0 million in sales, down 23.1% from the sales by the REIT in August. Ares Industrial REIT had sales of $87.4 million, down 22.3% from $112.5 million in August. Hines Global Income Trust reported $71.2 million in sales, down 24.2% from $93.9 million in August. Nuveen Global Cities REIT had sales of $62.4 million, down 1.6% from August’s sales of $63.4 million.

All capital raise figures for these nontraded REITs include DRIP proceeds.

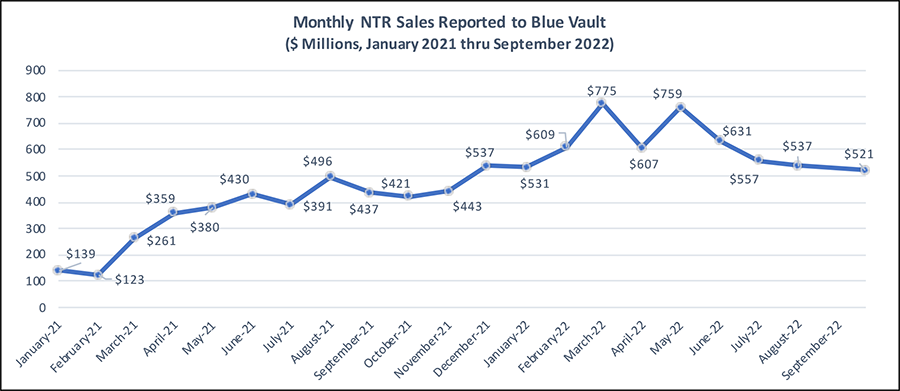

Sales in the chart do not include capital raised by Blackstone REIT, Starwood REIT, Brookfield REIT, and Invesco REIT. Those four REITs raised an estimated $8.57 billion in Q2 2022 and raised capital with equity sales in August 2022 but did not report to Blue Vault. Blackstone REIT raised $6.67 billion (including DRIP) in Q2 2022, followed by Starwood REIT with $1.80 billion, Brookfield REIT with $91.7 million and Invesco REIT with $13.4 million.

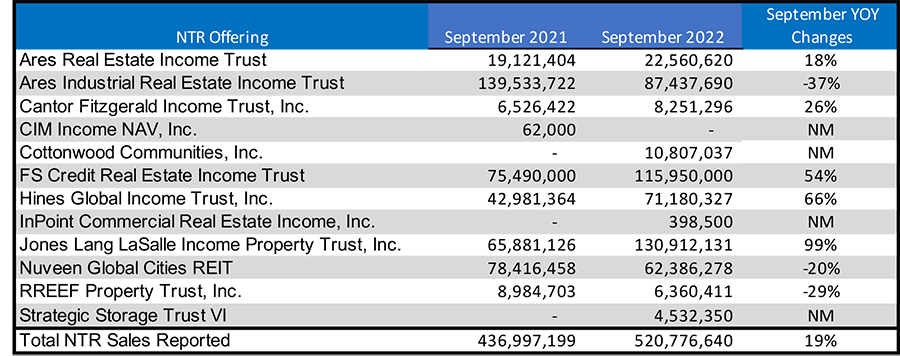

Y-O-Y NTR Capital Raise Comparisons

Year-over-year comparisons show capital raised by reporting nontraded REITs was up 19%.

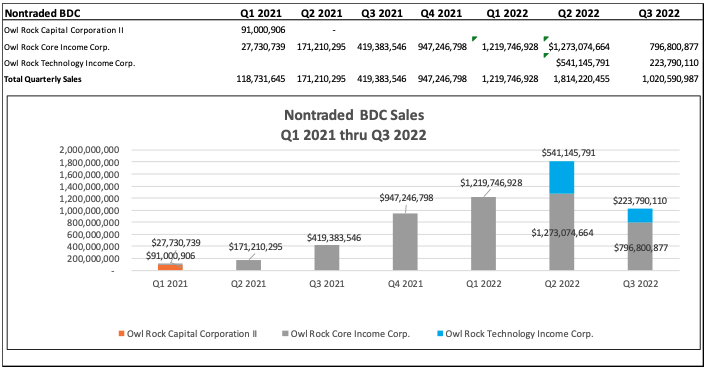

Nontraded BDC Capital Raise thru September 2022

Only two nontraded BDCs were raising funds and reported to Blue Vault for September 2022. Blue Owl Capital Inc. (formerly Owl Rock Capital Advisors) had $369.0 million in equity capital raised by two BDCs in September 2022, up 32.8% from the August total of $277.9 million. Blackstone’s nontraded BDC was also raising capital but did not report its sales to Blue Vault. Quarterly capital raise for the three reporting nontraded BDCs since Q1 2021 are shown below along with Q3 2022 totals thru September.

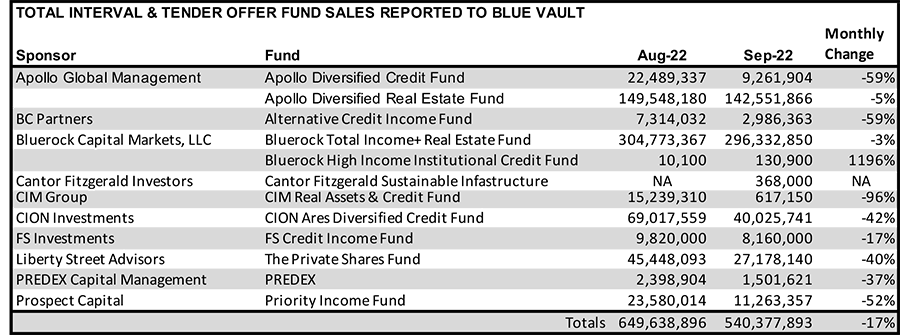

Interval and Tender Offer Fund Sales Reported to Blue Vault for September

Twelve funds reported their capital raise for September 2022 to Blue Vault. Bluerock Total Income+ Real Estate Fund raised $296.3 million, down 3% from the $304.8 total for August. Apollo Diversified Real Estate Fund raised $142.6 million, down 5% from the August total of $149.5 million. The twelve funds that reported had total capital raise of $540.4 million, down 17% from the $649.6 million raised by eleven funds in August 2022.

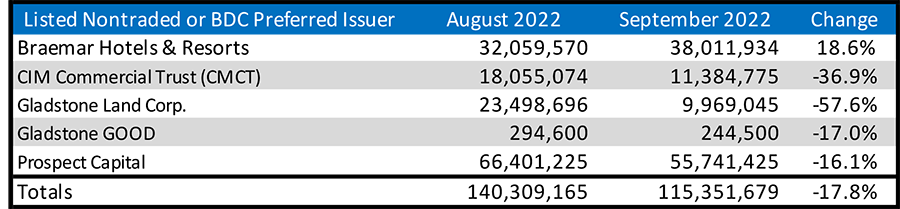

Listed REITs and BDCs with Nontraded Preferred Stock Issuances

Blue Vault has received sales reports from five listed REITs and a listed BDC that issued nontraded preferred stock in September. Leading the group was listed BDC Prospect Capital with $55.7 million in preferred stock issuances, down 16.1% from the $66.4 million August total. Braemar Hotels & Resorts issued $38.0 million, up 18.6% from $32.1 million in August. Gladstone Land issued $9.97 million in nontraded preferred stock, down 57.6% from the August total. For all five listed funds that issued nontraded preferred and reported to Blue Vault, the total was $115.4 million, down 17.8% from the August total of $140.3 million reported by the same funds.

Sources: SEC, Blue Vault