Starwood Real Estate Income Trust Reports July Distributions and June Rent Collections

August 3, 2020

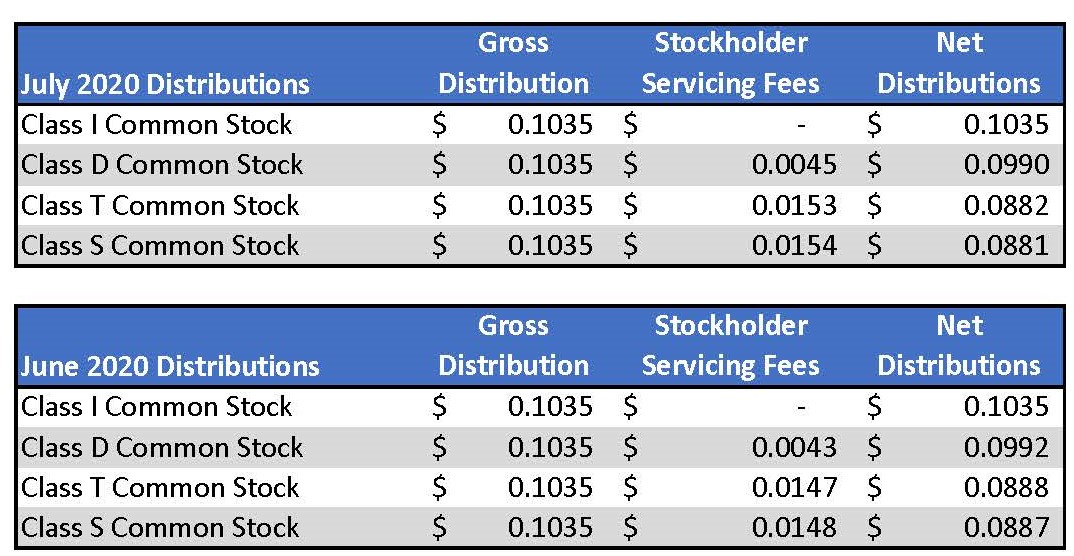

Starwood REIT declared distributions for July 2020. The distribution rates per share for each share class, before stockholder servicing fees, remained at $0.1035, equivalent to $1.242 annualized. Based upon an estimated NAV per share of $21.29 for Class I common shares as of June 30, 2020, the distribution yield for Class I shares would be 5.83% annualized.

From the Company’s July 31, 2020, 8-K filing:

June 2020 Rent Collections Update

As of June 29, 2020, Starwood Real Estate Income Trust, Inc. (the “Company”) has collected 97% of rent across all asset classes which is consistent with the full month collections for February 2020, March 2020, April 2020 and May 2020 – demonstrating that there has been no significant impact on the Company’s collections during the COVID-19 pandemic to date. Here is the breakdown by asset class:

• Multifamily (44% of the portfolio) is 95% collected and consistent with last month at the same time

• Office (35% of the portfolio) is 99% collected and 1% lower than last month at the same time

• Industrial (9% of the portfolio) is 97% collected and consistent with last month at the same time

• Medical Office (6% of the portfolio) is 90% collected and 3% lower than last month at the same time

Finally, hotel (6% of the portfolio) performance continues to recover. Month-over-month hotel occupancies have increased by 12% from an average occupancy of 26% in May to 38% in June. Even more encouraging, hotel occupancy on June 29, 2020 was 45%, so the positive trend continues. We are seeing “drive-to” leisure demand leading the hospitality recovery followed by transient business demand (outside of the major gateway cities which continue to struggle). This is benefiting our Florida select-service hotels which make up the majority of our hotel investments.

Source: SEC