Starwood Real Estate Income Trust’s $18 Billion Follow-On Offering

February 15, 2022 | James Sprow | Blue Vault

Starwood Real Estate Income Trust, Inc. filed a preliminary prospectus on February 8, 2021, to offer on a continuous basis up to $18 billion in shares of common stock, consisting of up to $16 billion in shares in its primary offering and up to $2 billion in shares pursuant to its distribution reinvestment program.

Starwood Real Estate Income Trust, Inc. invests primarily in stabilized, income-oriented commercial real estate. The REIT is externally managed by its advisor, Starwood REIT Advisors, L.L.C. The Advisor is an affiliate of the REIT’s sponsor, Starwood Capital Group Holdings, L.P., a leading global investment manager. The REIT’s objective is to bring Starwood Capital’s leading institutional-quality real estate investment platform to income-focused investors. Starwood Real Estate Income Trust is a nontraded REIT.

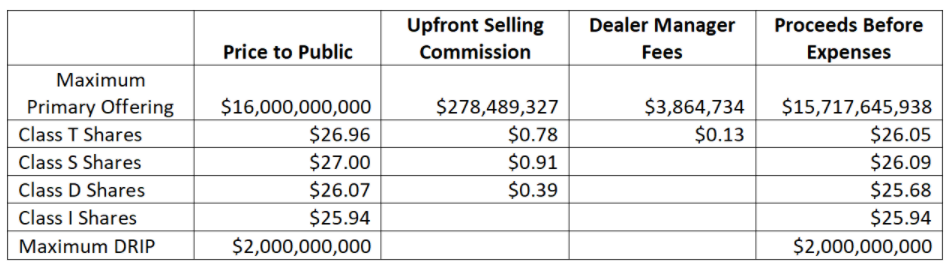

The REIT is offering to sell any combination of four classes of shares of common stock, Class T common stock, Class S common stock, Class D common stock and Class I common stock, with a dollar value up to the maximum offering amount. The share classes have different upfront selling commissions and dealer manager fees, and different ongoing stockholder servicing fees. The purchase price per share for each class of common stock will vary and generally will equal the prior month’s net asset value (“NAV”) per share, as determined monthly, plus applicable upfront selling commissions and dealer manager fees.

Starwood REIT launched its initial $5 billion offering in December 2017 and raised approximately $3.9 billion from investors before closing in June 2021. The follow-on offering, comprised of $10 billion in shares, launched immediately afterward and raised approximately $5.8 billion as of December 31, 2021.

The REIT’s investment strategy will continue to focus on stabilized, income-oriented commercial real estate properties located primarily in the United States, and to a lesser extent, Europe. The REIT may also invest in real estate debt. Starwood Capital LLC will continue to act as the dealer manager for the offering.

Since December 31, 2020, Starwood REIT’s Class I shares have increased in NAV per share from $21.66 to $25.94 as of December 31, 2021, an increase YOY of 19.76%. The shares had a total return of 26.33% for the year, highest among 11 continuously offered REITs tracked by Blue Vault for 2021.

Since there is no public trading market for shares of its common stock, repurchase of shares by the REIT will likely be the only way to dispose of shares. The REIT’s share repurchase plan provides stockholders with the opportunity to request that the REIT repurchase their shares on a monthly basis, but it is not obligated to repurchase any shares and may choose to repurchase only some, or even none, of the shares that have been requested to be repurchased in any particular month at its discretion. In addition, repurchases are subject to available liquidity and other significant restrictions. Further, the board of directors may modify or suspend the share repurchase plan if it deems such action to be in the REIT’s best interest and the best interest of its stockholders. As a result, the shares should be considered as having only limited liquidity and at times may be illiquid.

According to the Prospectus, the pricing of the REIT’s common shares will be as follows:

The price per share shown for each of the classes of shares is equal to the transaction price as of February 1, 2022, which is equal to such class’s NAV per share as of December 31, 2021, plus applicable selling commissions and dealer manager fees.

Source: SEC Form S-11 filed 2-8-22