Strategic Storage Trust VI Registers $1 Billion Public Offering

June 10, 2021 | James Sprow | Blue Vault

Strategic Storage Trust VI Inc., a private real estate investment trust sponsored by an affiliate of SmartStop Self Storage REIT Inc., has registered a $1 billion public offering. Pacific Oak Capital Markets, LLC is the dealer manager of this offering and will offer the shares on a best efforts basis. The minimum permitted purchase is generally $5,000.

Strategic Storage Trust VI Inc., a private real estate investment trust sponsored by an affiliate of SmartStop Self Storage REIT Inc., has registered a $1 billion public offering. Pacific Oak Capital Markets, LLC is the dealer manager of this offering and will offer the shares on a best efforts basis. The minimum permitted purchase is generally $5,000.

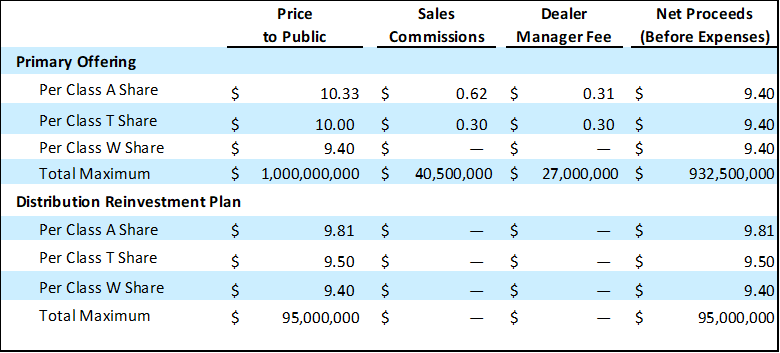

The offer is for up to $1.0 billion in shares of common stock in the primary offering, consisting of three classes of shares: Class A shares for $10.33 per share (up to $450 million in shares), Class T shares for $10.00 per share (up to $450.0 million in shares), and Class W shares for $9.40 per share (up to $100.0 million in shares). The share classes are designed for and available for different categories of investors. All investors can choose to purchase Class A shares or Class T shares in the offering, while Class W shares are only available to investors purchasing through certain fee-based programs or registered investment advisers. The share classes have differing sales commissions, including an ongoing stockholder servicing fee with respect to Class T shares and an ongoing dealer manager servicing fee with respect to Class W shares.

Property Portfolio

On March 11, 2021, the REIT, through an indirect, wholly-owned subsidiary of its operating partnership, acquired a self storage facility located in Phoenix, Arizona, from an unaffiliated third party. The Phoenix Property contains approximately 810 storage units and consists of approximately 84,200 square feet of rental space. The Phoenix Property’s physical occupancy is approximately 72% as of May 21, 2021. The purchase price for the Phoenix Property was approximately $16.0 million, plus closing and acquisition costs.

On April 19, 2021, the REIT, through its subsidiaries, and SmartCentres Real Estate Investment Trust, an unaffiliated third party, through its subsidiaries, acquired a tract of land located in Toronto, Ontario. The purchase price for the Toronto land was approximately $8.5 million CAD, plus closing and acquisition costs. The Toronto land is owned by a limited partnership in which the REIT, through its subsidiaries, and SmartCentres, through its subsidiaries, each own 50% of the limited partner interests and 50% of the general partner interests.

Source: SEC