James Sprow | Blue Vault

Blue Vault data reveals five industrial and warehouse/distribution centers within the Baltimore RCA Property Data Market area. Four of those properties are listed as owned by Ares Industrial REIT and one is owned by Starwood Real Estate Income Trust. The Wall Street Journal reports that all vessel traffic in and out of the Port of Baltimore is indefinitely suspended. Ports in Norfolk, Virginia, and the New York/New Jersey area are expected to pick up most of the diverted ship traffic.

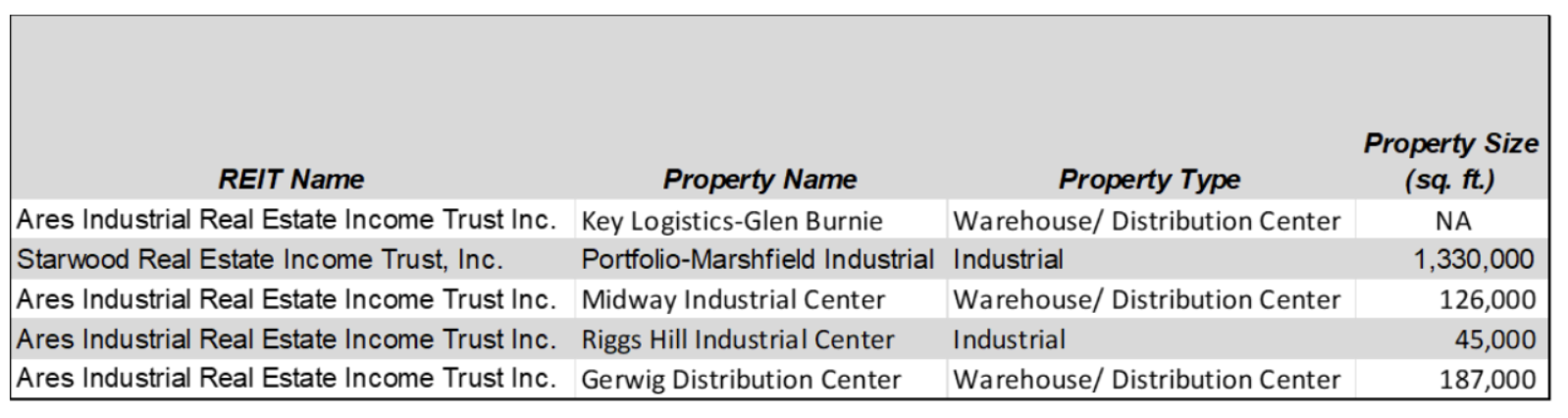

The Kelso Drive property owned by Starwood REIT, a 1.33 million sf warehouse in their Marshfield Industrial portfolio is approximately 7.7 miles as the crow flies from the Key Bridge. The property is on highway 695, which is the highway across the Key Bridge. Of the five industrial or warehouse/distribution properties in NTR portfolios, this appears to be one with tenants that could be affected by the bridge loss. However, much of the cargo entering and leaving the Port of Baltimore appears to be of a type that wouldn’t use typical warehouse/distribution assets. According to news reports, the Port of Baltimore is a busy entry point along the East Coast for new vehicles made in Germany, Mexico, Japan and the United Kingdom, along with coal and farm equipment.

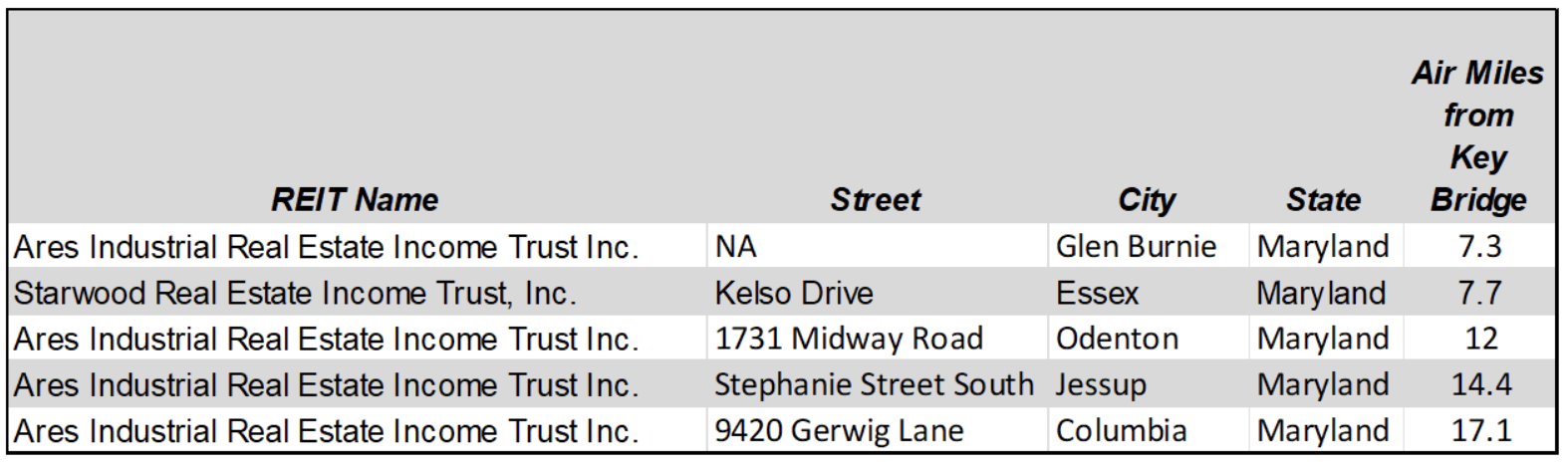

Baltimore Area Properties in Nontraded REIT Portfolios

Location Relative to Bridge

Location Relative to Bridge

Property Information

Property Information

As the plans for replacing the Key Bridge progress, property owners most directly affected by its closure, likely for years, will adjust their routes and adapt to the changing circumstances. As unfortunate the disaster is, the US has numerous alternatives for outbound and inbound ocean freight. The role of warehousing and distribution centers in the Baltimore area may be affected, but it appears that the tenants and the typical contents of such properties will be served by alternative transportation modes. Trucking will likely have to re-route, but goods should arrive and depart with relatively minor adjustments.

Sources: BV Database, Starwood REIT Webpage, Google Earth, WSJ