The Wall or the Cliff? ExchangeRight’s Macro Perspective

June 16, 2022 | ExchangeRight

A Macroeconomic Update from ExchangeRight’s Joshua Ungerecht

In light of the current economic volatility, a number of investors, representatives, and advisors with whom we work have asked about ExchangeRight’s current macroeconomic perspective. While I can only speak for myself, as I look at the world right now, I believe that we are in the early stages of what could become an extremely severe recession. At the same time, it appears that costs will remain stubbornly high for those things people need most, setting us up for the worst of both worlds: a stagflationary environment where the costs of necessities remain elevated at the same time that growth is rapidly slowing. All of this is exacerbated by massive financial bubbles that may be on the verge of deflating simultaneously. The deeper I have dug into the data, the more concerned I have become and the more compelled I have felt to share my conclusions, all the while hoping that I am wrong. Grab a stiff drink and remove all sharp objects as I attempt to unpack the situation below.

Before I dig into the details, let me first give a disclaimer. I was raised and shaped by my grandparents who grew up during the Great Depression. I started my career in real estate analysis right before the Great Recession and lived through the decimation of our industry during that time. I am deeply conservative by nature, analyzing probabilities first from a bad-case scenario, then working forward from there. This is fitting since ExchangeRight serves investors who are predominantly retired and who don’t have the time or ability to remake what took them and their family decades or even generations of hard work to accumulate. The investors who entrust us with their wealth look to us to protect their capital and provide stable income regardless of economic conditions. I take our calling as stewards of their wealth very seriously, so that materially shapes how I see the world.

Everything we do at ExchangeRight starts with a macroeconomic framework. We try to understand what drives markets and valuations before we make specific investment decisions. If we understand what the macroeconomic tailwinds and headwinds are, we can pick the right asset classes based on where we are in the market cycle. From there, we can then select the right industries, tenants, locations, and properties within those asset classes. If we don’t get an accurate view of the forest (understanding the macroeconomic context) before we focus on the trees (evaluating specific investments), we could find ourselves in a section of the forest that’s burning down, where it really doesn’t matter if one tree is relatively “better” than another.

Getting a solid grasp of the macroeconomic picture starts with the understanding that markets are fundamentally cyclical. What goes up also eventually goes down, recessions inevitably follow periods of growth, and valuations always revert to the mean in the long run. This cyclicality is ultimately driven by human nature, which tends to swing back and forth from extremes of greed and fear, over and over again. Since humans tend to operate with a herd mentality, that back-and-forth is what drives broader market cycles, leading to expansions and contractions of the economy, corporate earnings, and valuations of stocks, bonds, real estate, and basically everything else.

This market cyclicality has been driven to extremes by excessive fiscal and monetary intervention that attempts to delay or avoid periods of slowing growth and/or recession. Each successive Federal Reserve chairperson since the tech crash of the early 2000s has enacted increasingly aggressive policies that seem to boil down to a combination of “go big or go home” and “hold my beer.”[1] However, these policies have only exacerbated the fundamental problems that lead to slower growth and deeper recessions, while creating massive financial bubbles in the process. The larger these bubbles get, the more unsustainable they become and the more deficit spending, leverage, investor euphoria, and bail outs that eventually follow must increase to delay the inevitable popping of those bubbles. And when those bubbles eventually pop, as they always do, the resulting damage is far worse for the markets and the economy than the recession originally feared.

Greed always eventually shifts back to fear, and valuations that were driven to extreme highs by euphoria will eventually revert to extreme lows driven by despair. The good news is that if you understand this about human nature and the cyclicality of markets, you can gain significant insight into where we are in the macroeconomic cycle and you can prepare yourself accordingly to make better investment decisions. With all of this in mind, let’s look at how late we are in the current market cycle, how we got here, and why we may be in for a much more difficult time ahead than many realize.

First, we are clearly very late in the current market cycle. We have essentially gone without a major long-term correction for approximately 13 years, primarily due to successive rounds of increasingly unprecedented intervention by the US government and Federal Reserve. Following the Great Recession of 2008, instead of reducing the massive leverage that thrust us into the crisis in the first place, the US government doubled down on deficit spending, which the Federal Reserve enabled to the tune of more than $4.5 trillion dollars through 2018. The Federal Reserve also pinned interest rates to the floor to spur increased leverage and risk-taking with the hope that this would drive economic growth.

However, instead of driving economic growth, the Federal Reserve’s actions led to the inflation of massive bubbles not just in housing, but also in corporate bonds, commercial real estate, the stock market, the tech industry, and even more speculative markets in private equity and cryptocurrencies. To put things in perspective, by early 2020, valuations in many of these investment categories eclipsed the extremes experienced prior to the Great Recession in 2008, the Dot-Com bust of the early 2000s, and the Great Depression in 1929! I guess the good news is that we will get a spot in the history books.

What goes up must come down. What started as a growth slowdown in late 2019 was well on its way towards a recession by early 2020, notably before the COVID crisis was underway. More than a decade of excessive intervention by both the US government and the Federal Reserve failed not only to prevent a recession, but also exchanged one speculative bubble in valuation (that threatened the global banking system) for at least five or six asset bubbles that exceeded the size of the former by a multiple. Go big or go home! But that was peanuts compared to what was coming next….

Shortly after the economy was already slowing and heading into recession in 2020, the COVID crisis and government-imposed economic shutdowns were upon us. Markets were melting down, and the economy was grinding to a halt. In response, the federal government, supported by the Federal Reserve’s willingness to underwrite the extraordinary expansion of the deficit, flooded the economy with over $5 trillion dollars in cash (aka money literally created out of thin air).[2] The government injected nearly double the economic stimulus on a per capita basis in one year than was added per capita during the entire decade of the New Deal following the Great Depression![3] This intervention was three times larger than what was injected into the system during the Great Financial Crisis to bail out the entire global banking system.

The COVID stimulus payments were the realization of Modern Monetary Theory:[4] a “helicopter drop”[5] of cash directly to the public that exceeded former Fed Chairman Ben Bernanke’s wildest dreams. In true “hold my beer” fashion, the Fed expanded its balance sheet more in one year than all of the prior 108 years of its existence combined. And boy, did this stimulus “work”—unleashing investor greed and wild speculation, which drove almost all investment assets to new highs despite the economic destruction caused by the COVID crisis. The following table highlights how that speculative excess manifested itself in various investment categories following the extreme highs of early 2020s. Note that these figures represent the increases over levels that had already eclipsed every other valuation extreme we have experienced in US history as of early 2020.

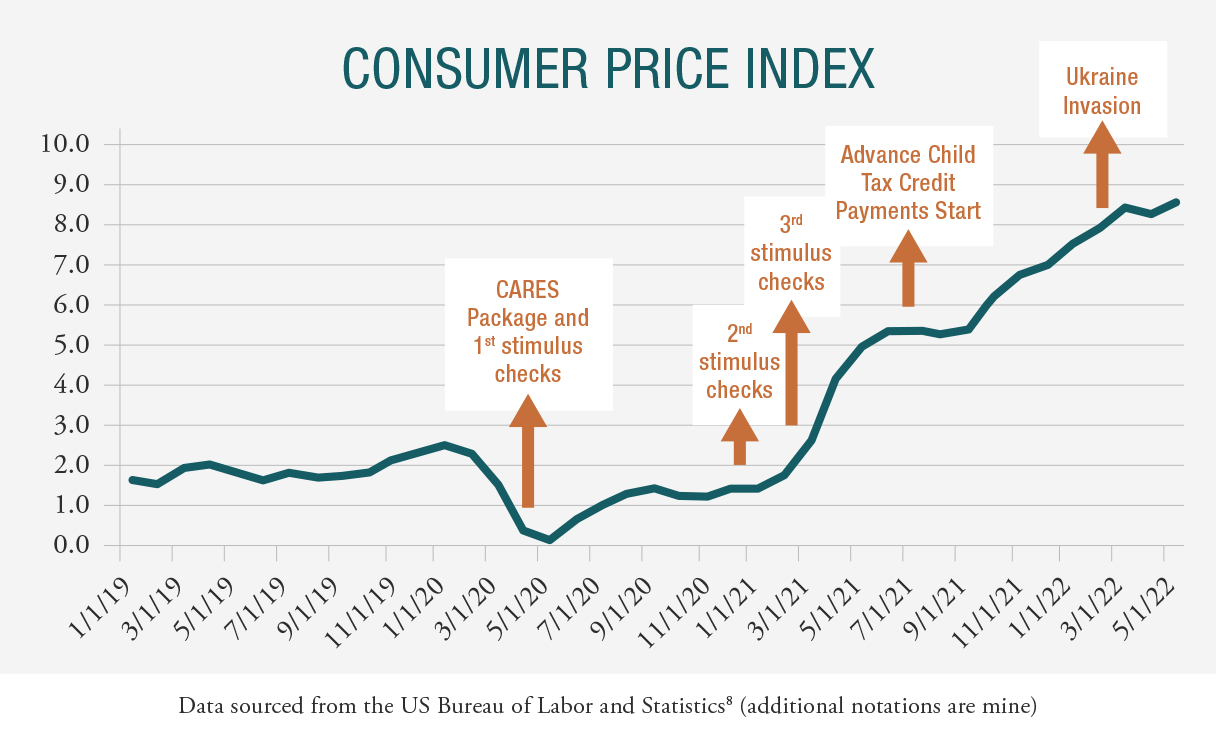

Of course, this record stimulus did not stay contained within already overvalued investment markets. With each successive round of stimulus, inflation in just about everything else took off. Who would have thought that adding cash infusions to the economy representing more than 25% of GDP within one year might just cause a bit of inflation? This was further exacerbated by the massive supply chain disruptions caused by government-imposed COVID lockdowns across the globe. The chart below shows the Consumer Price Index that tracks (and infamously understates) the inflation rate for the vast majority of the US population.

The combination of record-breaking stimulus payments and supply chain disruptions resulted in rapidly escalating inflation pressure not seen in over 40 years. Matters were made much worse with Russia’s invasion of Ukraine in late February of this year. And all of this is on top of the mounting tensions between China and the US over the past several years that have been unwinding a massive trade relationship that has been one of the biggest drivers of lower-cost production for US imports over the past few decades. The tailwinds of globalization that kept costs lower due to increasingly efficient supply chains for the past 30+ years were replaced by strong headwinds of de-globalization as geopolitical tensions increased and as companies and nations around the world reassessed the counterparty risks that impacted the means of production, economic interests, and even national security interests.

When you combine broken and rapidly decoupling supply chains, the movement from globalism to a multi-polar and increasingly contentious geopolitical framework, and trillions of dollars of new cash flooding the system, it’s not exactly shocking to get high inflation. But the inflation we’re experiencing now is not primarily demand-driven in the traditional sense.

Our situation isn’t like the inflation of the 1970s, where there was rapid growth in the workforce and in wages, which ultimately resulted in growth in demand via aggregate growth in income. Instead, what we see is a short-term sugar high of cash: one year of cash infusions that massively increased speculation and debt without increasing ongoing income. Because wage growth is not keeping up with cost inflation, the average person is effectively getting pay decreases every single month as the real costs of living spiral out of control. Notice the chasm between the growth in real living costs (food, gas, utilities, etc.) and wages (the yellow line) in the chart below.

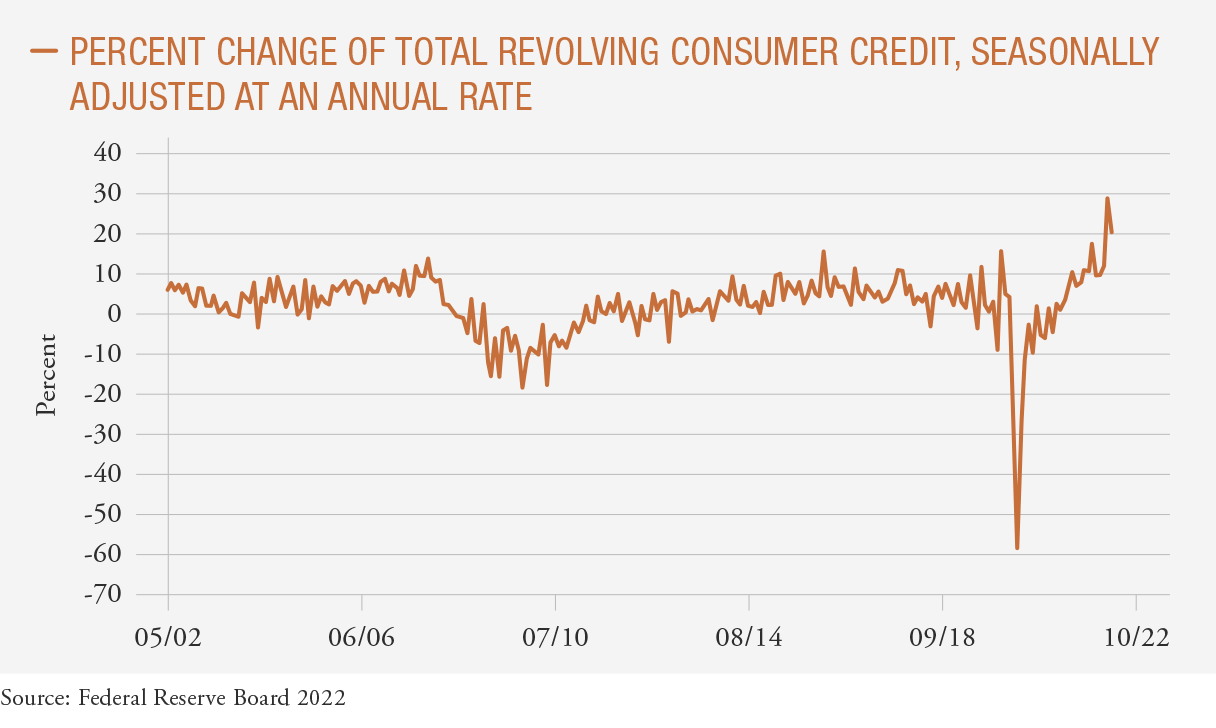

The bigger the gap between the real cost of living and wages, the less spending power people have to buy what they need, let alone engage in discretionary spending. The costs of necessities like food and energy have increased so much that consumers have been forced to borrow at record levels just to make ends meet. Target and Walmart both highlighted the plight of the consumer on their recent earnings calls, highlighting that spending on necessities remained elevated while spending on discretionary items plummeted. As depicted on the chart below, the line represents the percentage change in total consumer credit card debt month over month, which has just experienced higher increases than at any other time in history two months in a row.

We’re already seeing additional headwinds develop. Housing is already slowing because mortgage rates have dramatically increased. The companies that have been the biggest engines of growth throughout the last decade are introducing hiring freezes and natural attrition layoffs, a quiet way of reducing expenses without sounding alarms. I think they will get louder as these companies start to see their earnings decline, and a lot of the things people took for granted are going to reverse over time because those companies were driven more by artificially repressed interest rates – cheap money – and that has already risen to an unsustainable level.

Since consumption drives approximately 70% of our economy, it is no wonder that we are seeing the economy in rapid decline as the consumer gets crushed. This is why first-quarter GDP growth was negative. And it won’t shock me if the second quarter is negative as well, which would technically mean we are already in a recession. But whether we are already in a recession or not, it is worth noting that we are only in the early stages of a decline that appears to have much more downside potential ahead.

This brings us to where we are right now. What happens next will depend largely on which aspect of the Federal Reserve’s dual mandate it plans to sacrifice. The Federal Reserve is mandated with maintaining 1) price stability and 2) optimal employment. With runaway inflation, it is clearly behind the curve on #1 and is under immense political pressure, and even existential pressure, to get that back under control.

The only way for the Fed to resolve mandate #1 will be for it to sacrifice mandate #2 since it can’t do anything to solve the supply chain issues that are simultaneously reducing goods and making things more expensive. All it can do to attempt to reduce inflation is increase interest rates and remove liquidity from the system to try to reduce aggregate demand. Putting that more bluntly, to have any chance of breaking the back of inflation the Fed will need to break the back of the consumer, raising rates until the economy hits a wall, resulting in a deep recession and mass layoffs.

If the Fed has any hope of getting inflation back under control, it will be forced to keep raising interest rates and/or removing liquidity while growth is already in decline and in the face of significant economic pain. If it blinks, if it relents too soon and attempts to pivot to stem the tide of unemployment before inflation has resolved lower, then inflation may very well become far more unhinged than it already is, resulting in a stagflationary currency crisis and much deeper economic collapse. The choice the Fed must make is tantamount to the decision of whether to intentionally accelerate into a wall to avoid going off a cliff. We better hope they make the right choice (as painful as that may be).

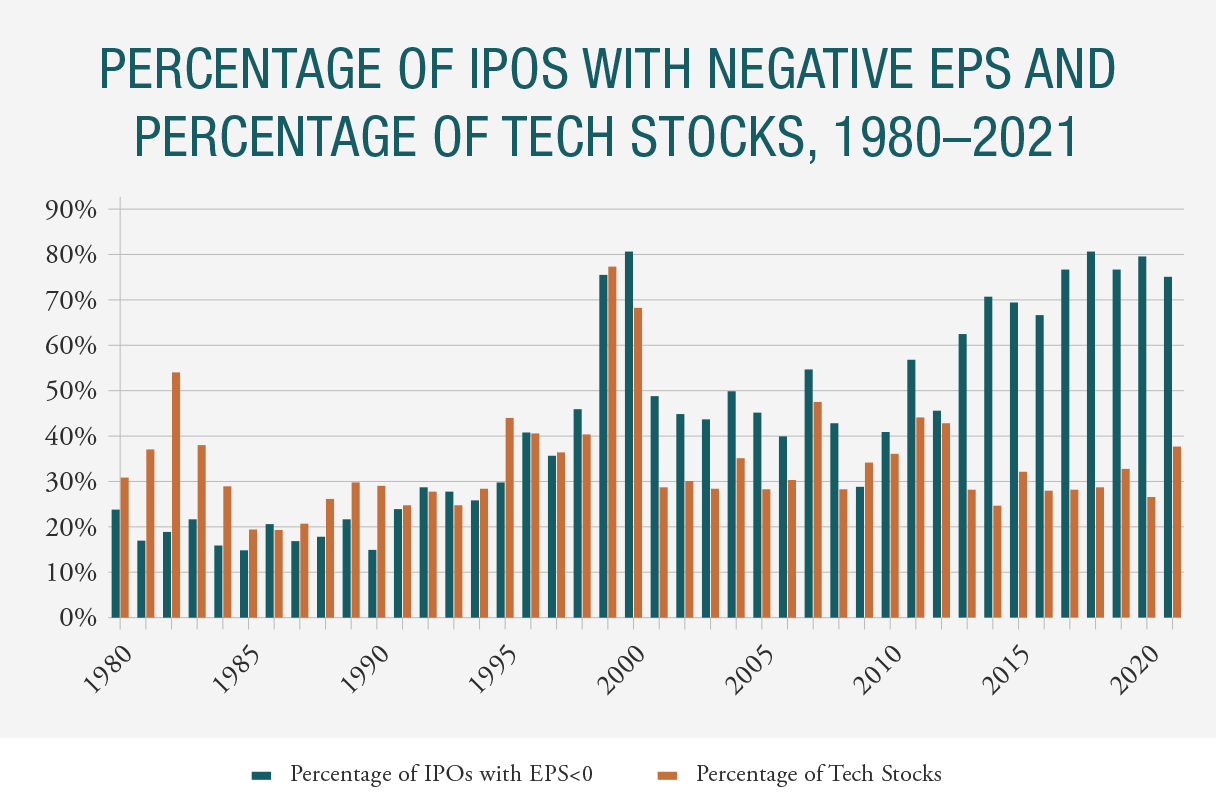

So what happens to markets that have been at record valuations exceeding every other valuation peak in US history? In the hysteria of the Dot-Com bust, a lot of companies valued in the hundreds of millions became laughingstocks. Who buys pets.com for 200 million? Now we see the same kind of concept at work, but at an order of magnitude larger. It’s in the billions. You have an increasing number of zombie companies that may have been “great ideas” but were poorly executed or not financially viable (or only viable in an interest rate regime where money was free and there were no consequences). On the following chart of unprofitable IPOs and Tech stocks[9], you can see how the environment of free money and low interest rates we have been in has caused these kinds of companies to proliferate.

What happens now that interest rates are spiking and if they continue to stay elevated? We now have at least five distinct bubbles that could pop if the economy hits the wall. Remember how painful it was when just the tech bubble popped in the early 2000s, or when the housing bubble popped in 2008? What happens when multiple bubbles pop at the same time? I guess you could say, “This time is different.”—but not in the way that most people who say that mean it. By the way, a similar reality is unfolding at the same time in many other countries across Europe and Asia, so there’s a decent chance we’re heading into a global recession.

That’s the macroeconomic setup right now. That’s why ExchangeRight is predominantly positioned in long-term net-leased properties backed by investment-grade credit. The increasingly overvalued climate leading up to where we are today is also what compelled us to sell off all of our multifamily over the past few years, walking away from millions in syndication and management profits for us in order to protect investors. Given investors’ needs for reliable cash flow, we have been avoiding more economically sensitive investments that are prone to see their net operating incomes eviscerated by rising costs, declining growth, and crushed spending power.

If the economy ends up in a severe recession and/or stagflationary environment, we want to be focused on necessity retail and healthcare industries where consumers will continue to need to spend money. We want to be in a position where Walmart, Kroger, CVS, Dollar General, and other similarly strong national tenants are responsible to pay the rent, taxes, insurance, and costs for maintaining our properties. We want to work with tenants that have multi-billion-dollar balance sheets that can help us and our investors bridge a very difficult economic climate.

Though the probabilities are rapidly increasing that we are heading into a very difficult period ahead, could things still turn out better than I am expecting? Of course! Anything is possible. The cure to high prices is high prices, so maybe inflation will moderate on its own regardless of the Fed’s actions. Maybe the Fed can strike a balance between keeping interest rates lower to avoid crashing an overleveraged economy without causing inflation to become further unhinged. That said, I would much rather be overly conservative and pleasantly surprised than overly optimistic and devastated. Our passion to help people be secure, free, and generous demands that we prepare for the very real risks ahead that could otherwise destroy our investors’ hard-earned wealth and income.

[1] https://www.dictionary.com/e/slang/hold-my-beer/

[2] https://www.businessinsider.com/stimulus-package-pandemic-surpass-great-recession-fiscal-plans-recovery-2021-3

[3] https://www.barrons.com/articles/massive-stimulus-spending-is-larger-than-the-new-deal-heres-how-they-stack-up-51618510257

[4] Modern Monetary Theory is the theory that money can be created out of thin air and distributed directly via fiscal stimulus to the public without necessarily creating significant inflation or a loss of confidence in the currency. Also, unicorns are real.

[5] This refers to a concept championed by former Fed chairperson Ben Bernanke that suggested that the government could create money out of thin air (as financed by the Fed) and distribute it to the public to fight deflation: https://www.brookings.edu/blog/ben-bernanke/2016/04/11/what-tools-does-the-fed-have-left-part-3-helicopter-money/

[6] https://data.nasdaq.com/data/FED/FL075035503_Q-interest-rates-and-price-indexes-commercial-real-estate-price-index-quarterly-levels-nsa

[7] https://fred.stlouisfed.org/series/CSUSHPISA

[8] https://data.bls.gov/timeseries/CUUR0000SA0?output_view=pct_12mths

[9] https://site.warrington.ufl.edu/ritter/ipo-data/