US Equity REITs Trade at Median 27.6% Discount to NAV on Oct. 3

October 7, 2022 | S&P Global Market Intelligence

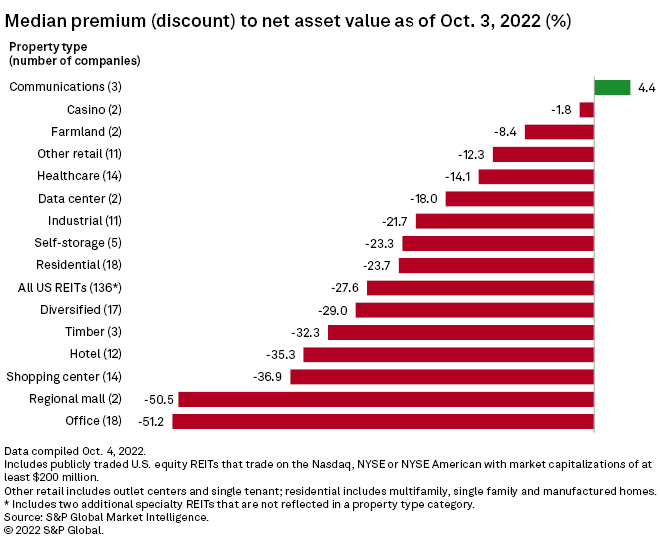

Publicly listed U.S. equity REITs traded at a median 27.6% discount to their consensus S&P Capital IQ net asset value per-share estimates as of Oct. 3, a further plunge from the 19.1% discount at which they traded as of August-end.

Offices, regional malls saw huge median discounts

Office REITs still traded at the largest discount to NAV, at a median of 51.2%. Within the office sector, Hudson Pacific Properties Inc. traded at a discount of 69.6%, the second-largest discount to NAV among all U.S. equity REITs above $200 million in market capitalization. Office Properties Income Trust followed, trading at a discount of 60.7% and was in seventh place in the overall top discount rankings. Two other office REITs included in the overall biggest discount list were Brandywine Realty Trust at 59.3% and Paramount Group Inc. at 57.6%, which held the eighth and ninth spots, respectively.

The regional mall segment also traded at a large discount next to the office sector, at a median of 50.5%. Regional mall owner Macerich Co. closed Oct. 3 at $8.07, 64.2% below its consensus NAV estimate of $22.55, also the sixth-biggest discount to NAV across all U.S. equity REITs with at least $200 million in market capitalization. Likewise, mall giant Simon Property Group Inc. traded at a discount of 36.8% as of Oct. 3.

Communications solely got a median premium

The communications sector was the sole property type that posted a median premium to NAV as of Oct. 3, at 4.4%. Within the communications sector, American Tower Corp. traded at a premium of 5.1%, the seventh-largest premium among all U.S. equity REITs above $200 million in market capitalization. SBA Communications Corp. is another communications REIT that ranked ninth on the top premium list, trading at a premium of 4.4%.

Multifamily REIT Bluerock Residential Growth REIT Inc. nabbed the first spot on the overall list of REITs with the highest premiums across all sectors, trading at 39.9%. Healthcare-focused LTC Properties Inc. and single tenant REIT Agree Realty Corp. followed, trading at premiums of 16.3% and 11.7%, respectively.