What Every RIA Needs to Know About Alternative Investments

August 22, 2019 | James Sprow | Blue Vault

On August 14, Blue Vault presented a webinar entitled “What Every RIA Needs to Know About Alternative Investments.” The webinar was moderated by Darren Whissen of Aliso Advisors. The panelists were:

• Steven Bohn, Institutional Advisory Consultant, Griffin Capital

• Alan Feldman, CEO, Resource Real Estate

• David Pittman, EVP, Strategic Blueprint, LLC

The following is an edited summary of the discussion and selected slides. For the full webinar recording, see the link at www.bluevaultpartners.com/past-webinars.

Darren: Here’s what we view as “An Alternative Investments Lifecycle”

Darren asked about the “Business Case for Alternatives”

For example, what are the deficiencies that exist around some common investments?

Alan Feldman: Stocks and bonds are great investments, but they have extreme amounts of volatility. Over the long term, we all know that stocks will outperform bonds, but the level of volatility may not be appropriate for all investor portfolios.

Alternatives can provide medium to long-term discipline and can help manage the liquidity question of when to sell. Investors can be their own worst enemy when they tend to sell low and buy high, and alternatives can provide that needed discipline.

Steve Bohn: There are assets that are not accessible, such as in the high-yield market or leveraged loan markets, you may find markets that don’t actively trade.

David Pittman: With regard to alternative investment disadvantages or challenges:

• Illiquidity

• Higher fees

• Limited research, still some holes that can be filled, lack of data. Difficulty of portfolio construction models creation. It would be helpful if someone could standardize the proxies. To stress-test the portfolios, it is challenging.

• Time consuming due diligence that doesn’t necessarily generate additional income for RIAs Takes more time to do the due diligence, especially for the stand-alone RIA.

• Inefficient work flows. Subscription agreements, etc.

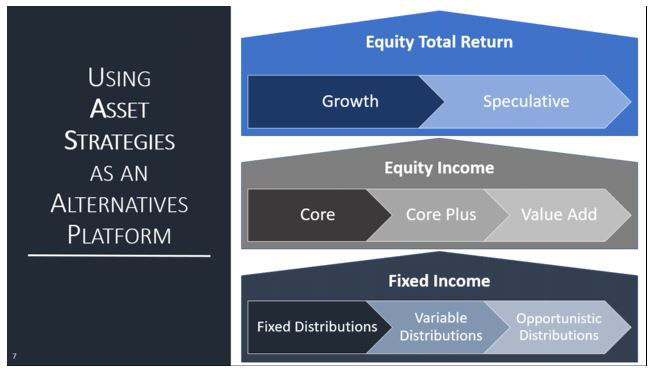

Darren discussed how one might implement an alternative platform by looking at the many types of alternatives.

Darren Whissen looks at a framework with these groups of alternatives.

David Pittman: Implement guidelines. Not strict limits. The liquidity needs will differ between clients. They don’t place a high percentage of their investments in any given private placement, etc.

Alan: No question that these investments are less liquid than traditional stocks and bonds. All investments carry risk, so liquidity isn’t the only measure. It’s important for the RIA to know his clients. These investments are typically lower on the risk side of the spectrum. They are not taking inordinate risks either through leverage or their investments. They provide a lot of disclosure. They are more risky only on the liquidity side.

Steve Bohn: The premise behind alternatives has traditionally been from the institutional perspective. What are the best practices that those people have followed? Two-part process: You should have an investment policy statement. Clearly defined goals and rules. Regarding due diligence, if you have the people inside your organization you can do the due diligence. You need to have the experience or background to do the due diligence. You need the expertise in that asset class.

What other third-party due diligence parties do you use as sources? Blue Vault, AI Insight, etc.

Dave Pittman: We are outsourcing, also. We have shared services from a DD standpoint. To avoid confirmation bias, whoever does the due diligence doesn’t have a vote on the investment decision.

Alan Feldman: Other outside resources that they use. Look at track records. Particularly for the 40 Act funds. Many of them have long, multi-year track records. There is very limited subjectivity. Between the independent BDs and the wirehouses, there are a lot of other firms looking at the space that have vast resources available to them. Use the larger firms that have looked at the space.

Steve: Resources for RIAs. If you don’t have a home office research office to leverage off of, you will see more and more outsourcing.

If you’re going to use any alts, you have to update these documents. Each one of these has an important component. Let’s talk about how an RIA creates efficiency in the back office.

What makes for an RIA-friendly product?

Alan: There are no secrets in what we do. If the product a good product and it addresses a problem: income, risk-aversion; does it have a good team? Is it the kind of investment that you would feel comfortable recommending to a relative. There is a saying, “An educated consumer is our best customer.” If we think a product makes sense and we invest in it ourselves, then it is a good product to recommend. Do we have the team to assist the RIA? That is important.

Darren: Steve, you work with a lot of custodians. What advice can you give to an RIA in dealing with a custodian?

Steve: What makes an investment RIA friendly? It depends on the book of business. If your book is not primarily accredited qualified investors, then it is more difficult to go into Reg. D products. When dealing with custodians, understand their timelines for liquidating your positions. You may come across groups that won’t hold the long-term investments (7 to 10-year holding periods).

Darren: What if the custodian won’t hold the investment?

David: If they don’t have a BD, they can hold it directly with the sponsor. If a DST feed is not available, then you have manual entry. We will actually put a manual entry net of fees. You have to update your fee agreement to attribute your fee to the alternative within Black Diamond so it doesn’t look like you are under-performing in the managed account that you’re pulling the fee from.

Darren: What are the minimum disclosures with the client that need to be made?

David: Share the reasons why you are considering alternative investments. Acknowledge the risks. You’re looking at their portfolio in its entirety. Make sure you’re very transparent. Show the total costs.

Advisors are so focused on providing a positive experience for their client as investment management has become so commoditized.

There is risk that the liquidity may not be there. It’s important to discuss the time frame of liquidity, hold period of the investment, the potential gateway of liquidity. Tell a clear story on why it is beneficial to include alts in the portfolio.

Darren: From a practical perspective, what are the top three disclosure that an RIA should provide to the client with regard to alternative investments?

Steve: I’ll go back to the investment policy statement. From a relationship perspective, go back to the investment policy statement. It points to everything you are doing. It is always updated, and as you are making changes it is always documented.

Darren: The policy statement is also important in protecting in arbitration.

Alan: As it relates to an interval fund, the limitation on liquidity is important. The fact is that liquidity is often over-rated when considering the total price. If the RIA is worth their salt, then they understand what their client’s liquidity needs are. I think the answer is, specifically for an interval fund, liquidity is important. An investor should never have to sell their entire position in our funds to achieve liquidity. The financial advisor would be guilty of over-allocating to illiquid assets.

Question:What are sponsors doing to assist RIAs in coming up with fair-value statements and IRS regulations.

Alan: Our interval funds are pretty easy. They are priced daily by the market. We have very tight daily pricing to provide fair value to the underlying assets. We are making a market in those every day. If they are not 40 Act funds, it’s a little more challenging as the values are more opaque. No individual investment makes up a large portion of the fund.

It’s going to depend upon the underlying asset. There is no one easy answer to that question. If people invest in real 7 to 10-year investments. How do you mark your book?

From the RIA’s perspective, we tell the investor we only charge on the valuation given to us by the sponsor. We ask for that valuation at least once a year. We get an attestation on the value on an at least an annual basis. Our fee could be higher or lower than what it would be on a fair value basis.

Question:From the sponsors, where is the lack of illiquid premium on these products?

Steve Bohn: What you’re looking for: low correlation and low volatility. Some of the premium is going to come from giving you more predictable returns. It can be viewed as an illiquidity advantage.

Darren: Historically, a lot of the illiquidity premium was mitigated by the higher internal costs. Now we are starting to see better handle on their internal control and some of the illiquidity premium is being realized.

Question:From the sponsor’s perspective, what’s actually going on from your perspective, how many of the RIAs are using alts? What kind of trends are you seeing in the RIAs utilizing alts?

Alan: The trend is clear that looking at the shares, over the last five years the percentage of those shares keep going up. Loads are going away or coming down. A lot of these alts like interval funds lend themselves to that. Our dedicated team is small and some are targeted just on RIAs. But all of the IBDs and wirehouses have RIA or advisory-type practices within their firms, within their individual books of businesses. To a certain extent when you’re marketing to an advisor who is not getting a commission but is in the asset management model, we have to operate the same way. There may be hybrid RIAs, but most of the RIAs are more purist.

Steve: The market is forcing the style of the RIA.

For access to the recorded webinar, visit www.bluevaultpartners.com/past-webinars