Johnathan Rickman | Blue Vault |

With traditional stock and bond funds having performed poorly in 2022, many advisors are embracing alternative investments with uncorrelated and potentially higher returns. Most so-called “alts” are illiquid private funds that require investors to lock up their money for long periods of time before they can redeem shares, underscoring the investment principle that potential return rises with an increase in risk. Interval funds have emerged as a way for advisors to wade into alts investing, but they don’t operate the same way as their mutual fund brethren, despite being cut from the same legislative cloth.

While both are pooled investment vehicles that offer diversified strategies, mutual funds and interval funds have key differences in terms of liquidity and fees as well as overall strategy and structure.

“Interval funds make alternatives more accessible and share some features with mutual funds like 1099 tax forms and independent fund board oversight, but advisors must consider the trade-offs that come with investing in illiquid alternative investments,” cautions Kimberly Flynn, Managing Director of XA Investments. “While some interval funds have daily NAV, which allows for electronic ticketing and makes them easy to purchase, interval funds have limited quarterly liquidity and are subject to proration upon exit,” she adds.

Still, advisor interest in interval funds is rising in tandem with fundraising. As of Q4 2022, interval fund assets under management rose more than 225% since 2007, reporting over $63 billion in net assets.1 In a recent poll of advisors conducted by Cerulli Associates, interval funds were the most preferred limited liquidity structure among nearly 40% of respondents, with non-traded REITs coming in second at 18%. 2

“With the significant increase in demand for alternative investments, driven by investors’ needs for durable income, lower volatility and greater diversification in their individual portfolios, interval funds continue to exhibit considerable year-over-year increases in capital inflows into a wide array of strategies that were previously only available to large, institutional investors”, noted Josh Hoffman, Managing Director at Bluerock which manages the nation’s largest real estate sector focused interval fund.

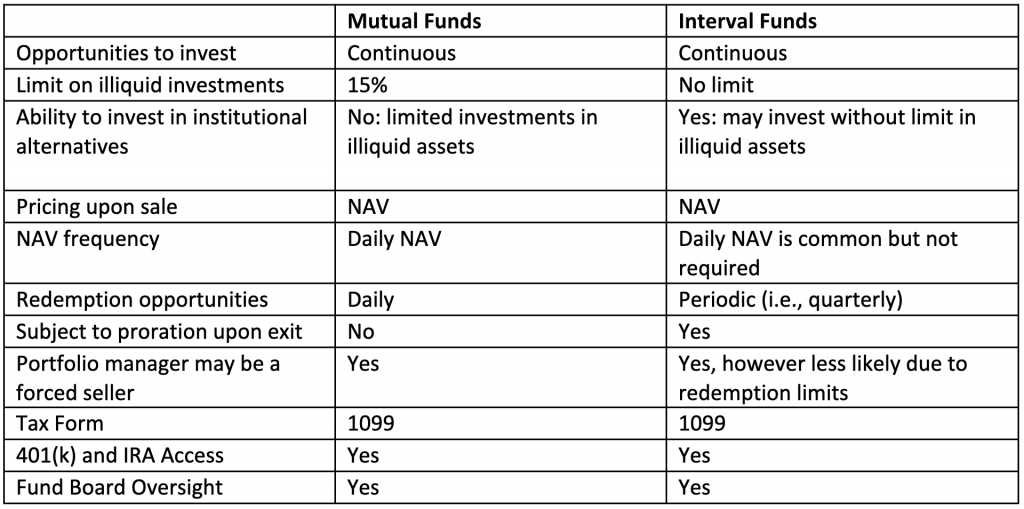

Understanding the differences between mutual funds and interval funds can help advisors create balanced portfolios for investors, especially for the perennial client seeking steady streams of income. Let’s look at how these two investment vehicles stack up on that point and other factors:

Mutual Funds vs. Interval Funds: The Basics

Mutual Funds

A mutual fund is a type of investment company or fund that pools money from multiple investors into a diversified portfolio of stocks, bonds, money market instruments, cash, and other assets. Mutual fund portfolios are professionally managed to ensure the fund’s investment strategy is implemented per its prospectus — be it growth, income, or both — and to generate income for the fund’s various investors. Mutual funds and their adviser-managers are registered with the SEC and are subject to SEC regulation.

Mutual funds are open-ended, meaning they continuously issue and redeem shares based on the net asset value (NAV) of the fund — minus any fees the fund may charge at redemption. When investors want to sell shares in a mutual fund, the shares can be sold back on a daily basis to the fund or to a broker representing the fund.

Interval Funds

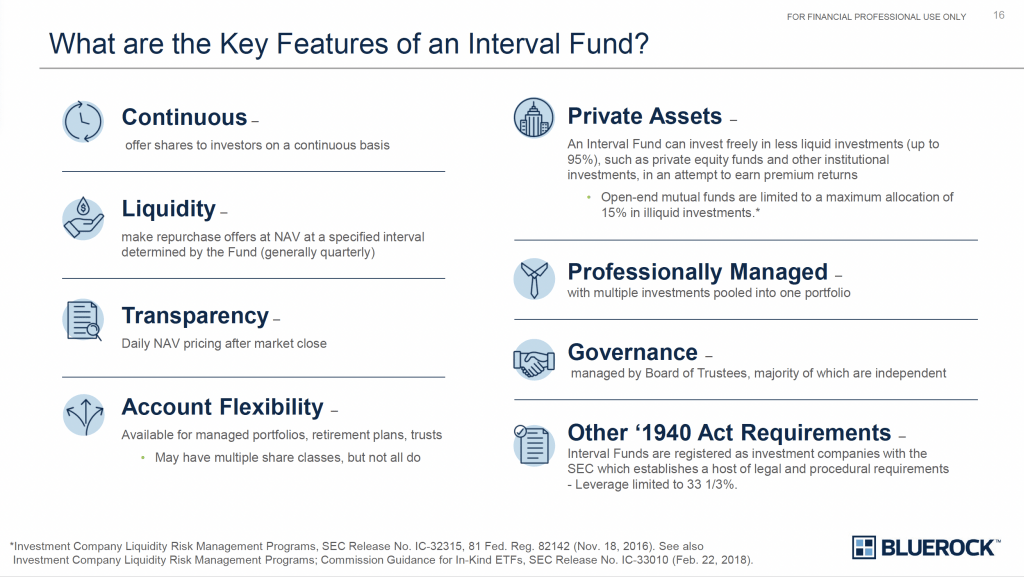

An interval fund is a type of SEC-registered, non-listed, closed-end investment fund that combines features of both traditional mutual funds and listed closed-end funds. Shares of interval funds with daily NAV are purchased electronically through subscriptions from the fund just like mutual funds. To provide liquidity, interval funds periodically offer to repurchase a limited portion of their outstanding shares from investors at set intervals (such as quarterly, semi-annually, or annually).

Likewise governed by the Investment Company Act of 1940, interval funds are perpetual, continuously offered, and sold by financial advisors such as RIAs, independent broker-dealers, and wirehouse advisors.

Interval funds are not listed on an exchange, so they must be onboarded at brokerage and clearing firms. Not all interval funds have a daily NAV, but most do. Learn more about interval funds.

Liquidity Profiles

Mutual funds offer daily liquidity. Investors can buy or sell mutual fund shares at the end of each trading day at the fund’s NAV. The fund company must then redeem shares at the end-of-day NAV price. Mutual funds are subject to the SEC’s Liquidity Rule, which prohibits mutual funds from investing more than 15% of their net assets in illiquid investments. If mutual funds allocate to alternative investments at all, they might invest in liquid derivatives or less-liquid credit securities. To meet daily redemptions, the SEC also requires mutual funds to adopt a liquidity risk management program to assess their liquidity risk.

Interval funds offer liquidity in pre-defined intervals. Interval funds provide limited opportunities for investors to sell shares back to the fund, typically at intervals that are set monthly, quarterly, or annually. Most interval funds have quarterly tenders at NAV (i.e., up to 5% per quarter). Legally, interval fund repurchase intervals are set before the fund is launched and must range from 5% – 25% of the total assets per repurchase period.

If shareholders demand more liquidity than the interval fund is offering that period, the repurchase is subject to proration and investors may receive less liquidity than requested and may have to wait multiple periods to be fully redeemed.

Investment Strategies

Mutual funds have diverse investment objectives and strategies. Mutual funds may focus on different asset classes, as well as on different sectors and regions. Mutual funds typically provide a wide range of options to suit different investor preferences and risk profiles.

Interval funds offer access to illiquid and alternative investments. These could include real estate, private equity, venture capital, distressed debt, private credit, infrastructure, and other alternative investments. The interval structure allows fund managers to invest in assets that might require longer investment horizons for valuation and divestment. Shareholders will necessarily have longer investment horizons in mind (i.e., 3 to 5 years) for portfolio allocations to interval funds given the illiquid nature of their portfolios.

Fees

Mutual funds may have various fees, including the so-called “expense ratio,” which encompasses management fees and other operating expenses — a sum that typically ranges from 1-3% of total funds under management. 3 Mutual funds may also assess marketing and distribution fees and sales charges.

Interval funds on the other hand have comparatively higher fees than mutual funds due to the nature of their underlying alternative investments. Interval fund fees are more in line with private fund fee levels for similar investment strategies. According to FINRA, interval fund investors can expect to pay management fees in excess of 1.5%, service fees of up to 0.25%, and more than 3.5% in annual fees.

Interval funds that are considered “fund-of-funds” allocate to private funds and will have two layers of fees to consider: 1) interval fund fees, and 2) acquired-fund fees from private funds, which may include management fees and incentive fees. It is helpful to study the expense table and related footnotes in the prospectus to decipher the various fees and expenses of interval funds. Fee averages vary widely because of the various alternative asset class categories in the interval fund marketplace.

Comparison Table

Use the following chart 4 to compare the primary differences between mutual funds and interval funds:

Watch this space for more insights and analysis on interval funds, including data on active offerings.

To learn more about Interval Funds, click here.

Sources

1 Intervalfundtracker.com

2 Cerulli, Blue Vault

3 Investopedia, mutual fund fees

4 XA Investments, August 2023