Will Office Occupancies Ever Return to Pre-Pandemic Levels? [Subscriber Exclusive]

March 20, 2023 | James Sprow | Blue Vault

“Many employers are eager for pre-pandemic, in-office operations to resume, but many workers remain reluctant to return. Yet recent reports indicate that increasing pressure from executives, as well as fears of potential layoffs, may be encouraging workers to be in the office on a more regular basis” according to NAREIT.

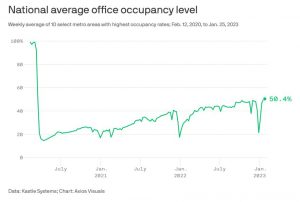

According to the NAREIT report, “Kastle Systems, which uses keycard, fob, and app access data to determine weekly office tenant occupancy rates for 10 U.S. metropolitan areas, found that as of the week of March 1, 2023 (the most recent data available), the 10-metro average occupancy rate was 50.1%.”

At this point, it’s important to differentiate between vacancies and occupancies. Vacancies refer to the square feet of office space that are not currently leased. Occupancies refer to the utilization of the space that is leased. A property that is 80% leased and 50% occupied could only be utilizing 40% of its square footage. The impact of increased vacancies and reduced occupancies during the pandemic on the downtowns of the U.S. is the product of those two metrics.

“As COVID-19 fades in the rearview mirror, we expect office utilization rates to stabilize between 50-60% of pre-COVID levels over the next two years, as hybrid work arrangements crystalize to have two to three fewer days per week in the office,” Moody’s wrote. “The office sector will continue to lag other commercial real estate (CRE) sectors in the post-COVID recovery, but ultimately return of workers to the office—even part-time—will eventually support performance of office properties in the coming years.

Source: Axios

According to CommercialEdge, the national vacancy rate for offices nationwide was 16.6% in February 2023. The stock of available office space is growing with under-construction space totaling 123.6 million square feet at the end of January 2023, representing 1.9% of stock, with another 262 million square feet in planning stages. In January 2023 Manhattan had a total vacancy rate of 15.4%. National vacancy rates averaged 16.6% in January, up from 16.5% in December.

Office-using sectors of the labor market grew 3.1% year-over-year in January, with professional and business services adding 82,000 workers in the month, financial activities adding 6,000 and information losing 5,000, according to the Bureau of Labor Statistics.

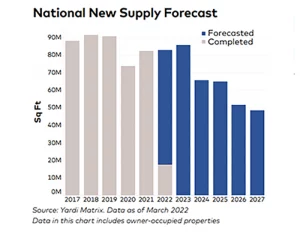

The pandemic accelerated the trend toward remote work and as employers want to see more employees in their offices, they’ve been forced to compromise and, in many cases, allow for a hybrid model of accommodating part-time office presence with remote work. These revised models of office work mean lower demand for square footage with existing office stock and lower demand for new construction. Expect this lower demand for new space to result in decreasing supply provided. The chart below shows forecasted square feet of new office space.

Sources: Axios; Moodys; NAREIT, www.globest.com; CommercialEdge