Credit Void in Banking

Submitted by CION Investment Group, LLC

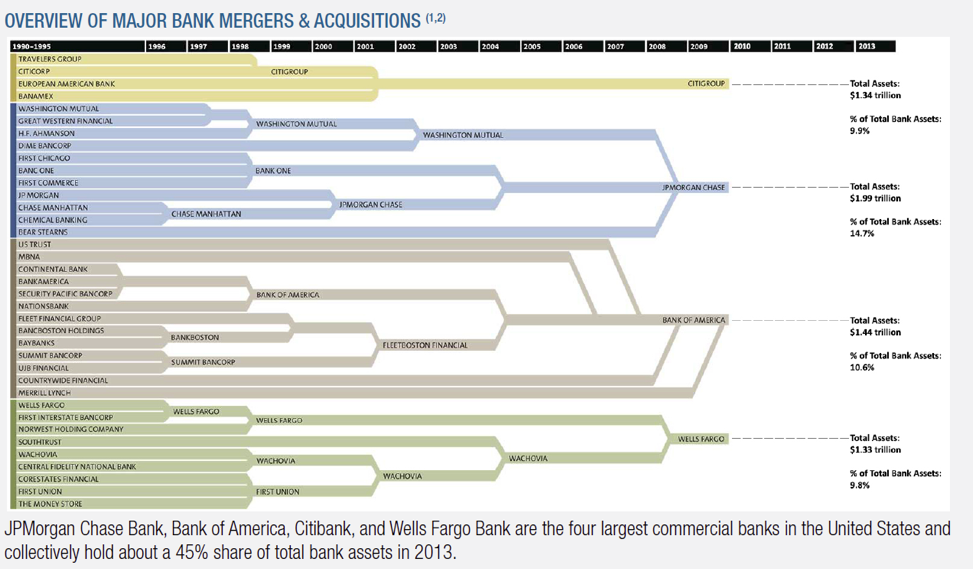

Between 1992 and 2013, the number of commercial banks in the United States has decreased from 11,463 to 5,937, or approximately -48%. The decrease can be attributed to bank mergers, acquisitions and consolidations, which resulted in the fall of small banks and the growth of large and giant banks.

COMMERCIAL BANKS: 1992 VERSUS 2013

In 1992, there were over 11,000 small commercial banks that make up 97% of all commercial banks in the United States. Shares of bank assets, as well as commercial loans and leases, were almost evenly distributed among small, mid-sized and large banks. In 2013, there are fewer than 6,000 small and midsized banks remaining. They collectively hold 17% of all commercial bank assets and make up only 21% of commercial loans and leases. In contrast, there is a total of 89 large and giant banks that collectively control 83% of all commercial bank assets and are responsible for making 79% of commercial loans and leases.

The underlying shift in the traditional banking sector, along with the 2007 global financial crisis, created

a credit void in bank lending. Large and giant banks control access to capital and continue to maintain tightened lending standards. The decline in lending participation by these large and giant commercial banks is also occurring due, in large part, to regulations such as Dodd-Frank(3), the Volcker Rule(4), and Basel III(5).

As a result, only the largest and most credit-worthy companies have access to credit. This leaves many small, middle, and even large companies seeking alternative sources of financing to run and expand their businesses.

Definitions:

Small banks: assets of less than $1 billion; Mid-sized banks: assets between $1 billion and $9.9 billion; Large banks: assets between $10 billion and $99.9 billion; Giant banks: assets of $100 billion or more

1. “How Banks Got Too Big to Fail.” Mother Jones, February 2010.

2. “Assets & Liabilities: Commercial Banks.” FDIC – Statistics on Depository Institutions Report, December 31, 1992 and September 30, 2013.

3. Dodd–Frank Wall Street Reform and Consumer Protection Act.

4. The Volcker Rule is a specific section of the Dodd–Frank Wall Street Reform and Consumer Protection Act.

5. Third Basel Accord, Basel Committee on Banking Supervision.

The information presented herein is provided for educational purposes only and is not indicative of the future behavior of the American economy

Credit Void in Banking in PDF format.