May NTR and BDC Sales

June 12, 2018 | James Sprow | Blue Vault

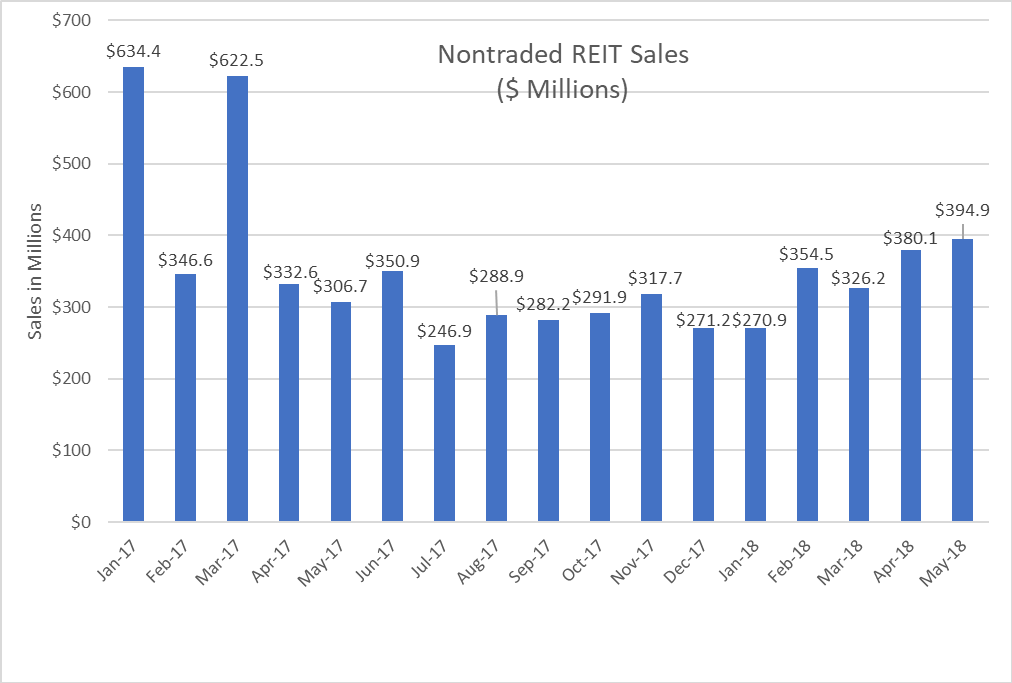

Led by Blackstone REIT’s increase in sales of $11.8 million in May versus April, the nontraded REIT offerings raised a total of $394.9 million in May, a 3.9% increase over the $380.1 million raised in April.

May 2018 NTR capital raise continued the upward trend observed in April as the same 21 programs raised $380.1 million compared to the March total of $326.2 million, an increase of 16.5%.

After Blackstone REIT’s May capital raise (including DRIP proceeds) of $256.5 million, the capital raise leaders among REITs in the NTR space were Griffin-American Healthcare REIT IV, Inc. with $23.9 million, Black Creek Diversified Property Fund, Inc. with $20.7 million, Cole Real Estate Income Strategy (Daily NAV), Inc. (sponsored by CIM Group) with $17.7 million, and Black Creek Industrial REIT IV, Inc. with $13.7 million.

The sponsor with the largest absolute increase in capital raise from April to May was Blackstone with capital raise increasing from a total of $244.7 million to $256.5 million. In terms of percentage increase in capital raised between April and May, CIM’s Cole Credit Property Trust V, Inc. led all effective programs with an increase of 54.3%, from $1.94 million in April to $3.0 million in May.

Griffin Capital raised $26.3 million with its two effective NTR offerings in May, compared to $23.3 million in April, for an increase of 13%. Black Creek Group’s two effective NTR offerings increased combined capital raise by 7% from April to May. CIM Group (formerly Cole Capital) saw a small decrease of 4% in its total NTR capital raise for its three effective NTR offerings from April to May.

A new entrant to the nontraded REIT space, Cantor Fitzgerald raised $5.0 million in May 2018 compared to $7.8 million in April and $11.5 million in Q1 2018.

Among the REITs with significant increases in capital raised between April and May, after Cole Credit Property Trust V, Inc.’s 54% increase month-to-month, Black Creek Diversified Property Fund had a 45% increase, and KBS Strategic Opportunity REIT II, Inc. saw sales increase almost 32%.

Nontraded BDC sales increased from $34.7 million in April to $39.4 million in May, a jump of 13.5%, made more impressive by the fact that two BDCs that raised funds in April did not raise funds in May. Owl Rock Capital Advisors again led nontraded BDC sponsors with sales of $31.7 million, 81% of all nontraded BDC sales in May. CION Investments was a distant second with $4.2 million in sales for an 11% share of all BDC sales. Only four nontraded BDC programs reported sales in May compared to six in April, as Terra Capital Partners and Triton Pacific Capital had no BDC sales in May.