Urban Land Institute’s Optimistic Real Estate Economic Forecast

October 1, 2018 | James Sprow | Blue Vault

The ULI released the results of its latest survey that was completed in September, reporting a consensus forecast for 27 economic and real estate indicators based on the median of the forecasts from 45 economists/analysts at 33 leading real estate organizations.

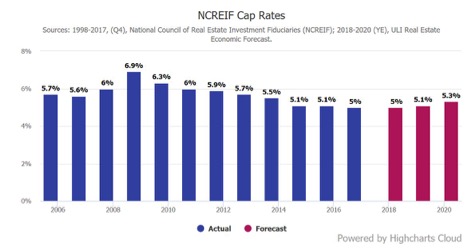

In 2018, 17 real estate indicators are projected to be better than their 20-year averages, while 6 are expected to be worse. Also, inflation is expected to be above its long-term average, while the 10-year Treasury rate and the NCRIEF capitalization rate are projected to be below their long-term averages.

The key findings:

• Following a post-recession high of $569 billion in 2015, transaction volume reversed direction with $511 billion in ’16 and $490 billion in ‘17. Annual volume is forecast to further decrease to $475 billion in ‘18 and $415 billion in ‘20. Still, these are among some of the highest annual volumes and remain well above the long-term average.

• Issuance of commercial mortgage-backed securities (CMBS), a source of financing for commercial real estate, has rebounded since a low in ‘09 but to a much lower level than pre-recession. Issuance is forecast to remain essentially level in ’18 and ‘19 at $90 billion and $88 billion respectively, before decreasing slightly in ‘20 to $80 billion.

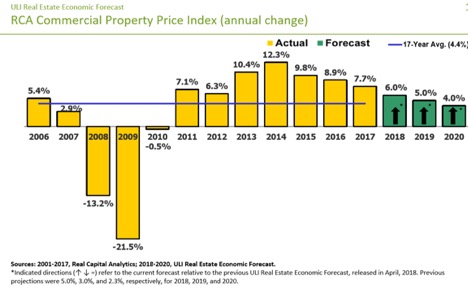

• Commercial real estate prices are projected to grow at slowing rates relative to recent years, at 6.0% in ‘18, 5.0% in ‘19 and 4.0% in ‘20, which would be below the long-term average growth rate of 4.4% for the first time since 2010.

• Institutional real estate assets are expected to provide total returns of 6.5% in ‘18, moderating to 5.0% by ‘20. By property type, 2018 returns are expected to range from 11.4% for industrial to 4.5% for retail. In ‘20, returns are expected to range from 7.2% for industrial to retail’s 3.9%.

• Both apartment and office vacancy rates are expected to plateau in ’18 from their ‘17 rates, before edging up in both ‘19 and ‘20. Both industrial and retail availability rates are expected to see a slight decline in ’18 before seeing an increase in ’20 to rates above their 2017 levels. The hotel occupancy rate is forecast to increase slightly in ’18, plateau in ‘19, and then decline slightly in ’20.

• Commercial property rent growth is expected to continue in the next three years in all sectors, although at more subdued rates than in recent years. In 2018, rent increases will range from 3.9% for industrial to 1.8% for retail. Rental rate growth rates in all four sectors are expected to decelerate in both ’19 and ‘20. Rent increases in 2020 will range from 2.4% for industrial to 0.6% for retail. Hotel RevPAR is expected to increase by 3.0% in 2018 and 1.5% in 2020.

• Single-family housing starts are projected to increase from their 2017 level of 848,900 units to 900,000 in ‘18, and 930,000 in ’19. This completes eight straight years of growth, bringing annual starts to their highest level since 2007. Starts are then projected to moderate somewhat to 900,000 in ‘20.

According to the ULI Real Estate Economic Forecast, capitalization rates for NCREIF portfolios are expected to climb slowly over the next two years from 5.0% in 2018 to 5.3% in 2020.

The Real Capital Analytics Commercial Property Price Index is expected to increase 6.0% in 2018 and have declines in price growth to 5.0% in 2019 and 4.0% in 2020.

Source: Urban Land Institute