Comparing 2nd Quarter 2019 NTR and Interval Fund Sales

July 26, 2019 | James Sprow | Blue Vault

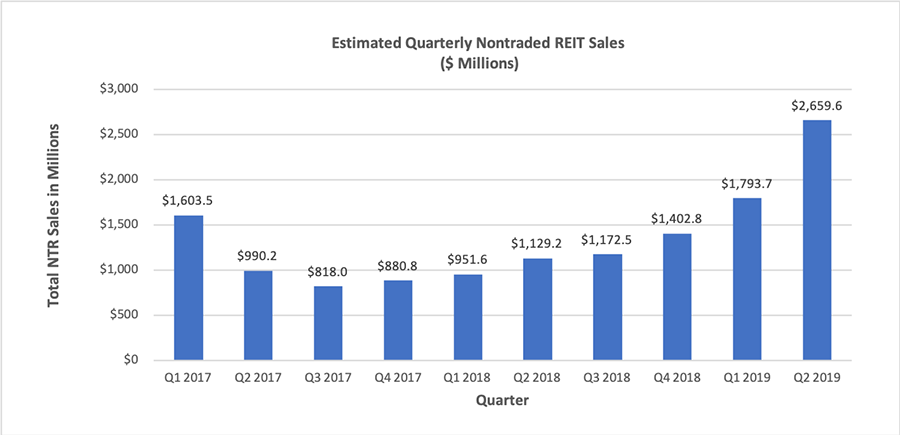

While sales of nontraded REIT shares were up substantially in the 2nd Quarter of 2019 compared to the year-earlier 2nd Quarter of 2018, there is more to learn from the sales trends as we dig deeper into the individual programs that were raising capital in both periods.

Overall, for the nontraded REIT programs which reported sales to Blue Vault for both the 2nd Quarter of 2018 and the 2nd Quarter of 2018, sales were up 134%, from $1.069 billion to $2.501 billion. For the first six months of 2019 vs. the first six months of 2018, sales for those nontraded REITs were up 294%, from $1.955 billion to $4.213 billion. Blackstone REIT, the nontraded REIT program with 76.8% of NTR sales by reporting firms for Q2 2019, increased sales by 165% from Q2 2018, and from its 72.4% share in Q2 2018. The REIT increased its sales by 70.1% from Q1 2019, raising $1.922 million in Q2 2019 compared to $1.130 million in the prior quarter.

In Q2 2019, the sales of Jones Lang Lasalle Income Property Trust increased 282% to $108.7 million from $28.5 million, year-over-year from Q2 2018. The NTR program that raised the second most capital in its offering in Q2 2019 was Hines Global Income Trust, raising $127.0 million for a 4.7% share of the total reported. Third in Q2 2019 was Jones Lang Lasalle Income Property Trust with $108.7 million (4.3% share), followed by Black Creek Industrial REIT IV with $79.0 million (3.2% share).

Among nontraded REIT programs that didn’t report sales to Blue Vault, Starwood REIT raised an estimated $135.1 million in Q2 2019. That would rank the REIT at second for the quarter among all nontraded REIT offerings. FS Credit Real Estate Income Trust raised an estimated $20.5 million in Q2 2019. Another nontraded REIT program, Nuveen Global Cities REIT, raised an estimated $2.3 million in June but did not report monthly sales to Blue Vault. Phillips Edison Grocery Center REIT III suspended its offering as of June 14, 2019, with just slightly more than an estimated $1.4 million raised in Q2 2019.

Interval Fund Sales

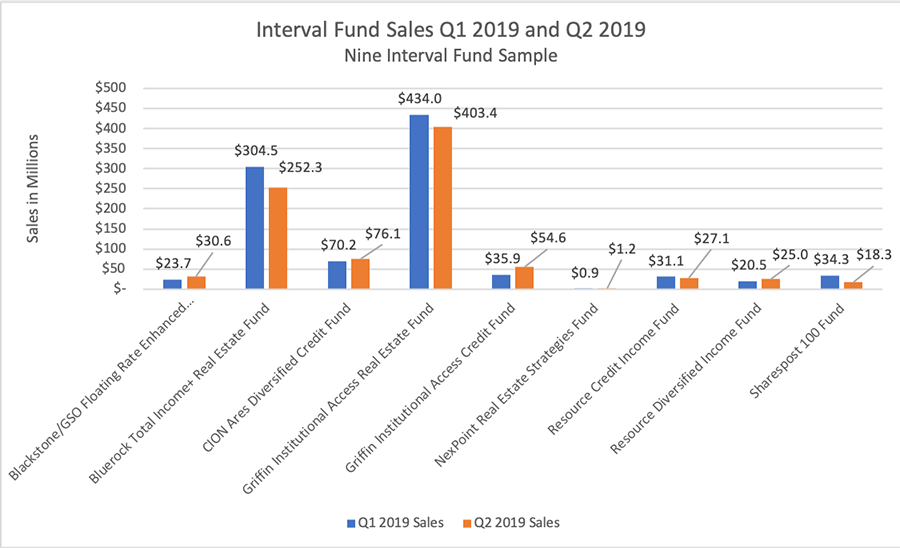

Blue Vault has received sales reports from eight interval funds each quarter for 2018 and 2019, and nine interval funds for each quarter in 2019. A comparison of sales by those interval funds shows that the eight interval funds that reported six-month sales in the first halves of 2018 and 2019 had an increase in sales from 2018 to 2019 of 80.3%. For the nine interval funds that reported sales for both Q1 2019 and Q2 2019, total sales decreased 6.9%, from $955 million to $889 million.

Of the nine interval funds reporting sales so far in 2019, Griffin Institutional Access Real Estate Fund led the group with total sales of $434 million in Q1 2019 and $403 million in Q2 2019. This fund’s total sales for the first six months of 2019 totaled $837 million compared to $500 million for the first six months of 2018, a year-over-year increase of over 67%. Bluerock Total Income+ Real Estate Fund saw the first half of 2019 sales increase by more than 167% versus the same period in 2018, from $208 million to $557 million. From Q1 to Q2 2019, the fund’s sales were down 17.1%, but Q2 2019 sales were up year-over-year from Q2 2018 by over 213%, from $118 million to $252 million.

Of the nine reporting interval funds, the largest increase in sales from Q1 2019 to Q2 2019 was reported by Griffin Institutional Access Credit Fund, with sales in Q2 2019 of $54.6 million, up over 52% from Q1 2019 sales of $35.9 million. Year-over-year that fund increased sales by 123% for the first half of 2019 compared to the same period in 2018, and had a year-over-year increase for Q2 2019 of 226% compared to Q1 2018, with $54.6 million compared to the year-earlier $24.2 million. Resource Diversified Income Fund increased year-over-year sales in Q2 2019 over Q2 2018 by 230%, from $10.9 million to $25.0 million. CION Ares Diversified Credit Fund increased sales by over 170% in Q2 2019 vs. Q2 2018, and for the first six months of 2019 was up 120% versus the same period in 2018. While sales for the nine funds reporting were down 6.9% in Q2 2019 from Q1 2019, CION Ares Diversified Credit Fund was up 8.5%, to $76.1 million for the quarter.

Sources: Blue Vault, SEC, Reporting NTR and Interval Fund Sponsors