Griffin Capital Essential Asset REIT Reports Status of Offering, NAVs, and Q1 2020 Distributions

January 2, 2020 | James Sprow | Blue Vault

On December 27, 2019, Griffin Capital Essential Asset REIT reported the status of its public offering and the history of its NAVs per share. The REIT commenced its follow-on public offering of up to $2.2 billion in shares of the common stock on September 20, 2017, of which up to $2.0 billion in shares will be issued pursuant to the primary offering and up to $0.2 billion in shares will be issued pursuant to the DRP. The REIT is offering to the public five classes of shares of common stock in its primary offering: Class T shares, Class S shares, Class D shares, and Class I shares. The share classes have different selling commissions, dealer manager fees, and ongoing distribution fees and eligibility requirements. It is also offering all share classes pursuant to the DRP.

On December 27, 2019, Griffin Capital Essential Asset REIT reported the status of its public offering and the history of its NAVs per share. The REIT commenced its follow-on public offering of up to $2.2 billion in shares of the common stock on September 20, 2017, of which up to $2.0 billion in shares will be issued pursuant to the primary offering and up to $0.2 billion in shares will be issued pursuant to the DRP. The REIT is offering to the public five classes of shares of common stock in its primary offering: Class T shares, Class S shares, Class D shares, and Class I shares. The share classes have different selling commissions, dealer manager fees, and ongoing distribution fees and eligibility requirements. It is also offering all share classes pursuant to the DRP.

Status of the Offering

As of December 10, 2019, the REIT had received gross offering proceeds of approximately $78.0 million from the sale of approximately 8.1 million shares in its follow-on offering, including proceeds from the DRP. As of December 10, 2019, approximately $2.1 billion in shares remained available for sale pursuant to the follow-on offering, including shares available for sale through the DRP. On August 8, 2019, the board of directors extended the termination date of the follow-on offering from September 20, 2019, to September 20, 2020, which is three years after the effective date of the follow-on offering. The board of directors reserves the right to further extend the follow-on offering, in certain circumstances, or terminate the follow-on offering at any time prior to September 20, 2020.

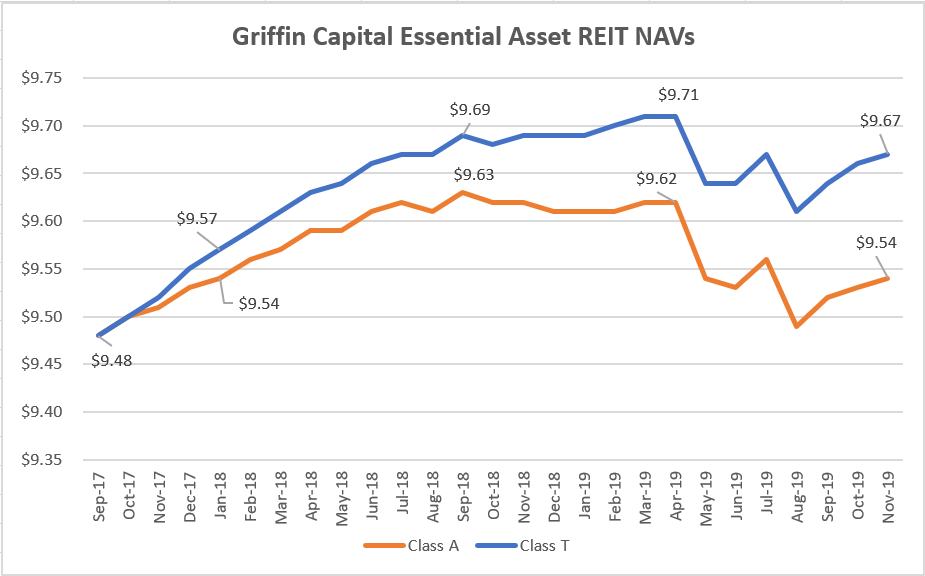

NAV Per Share History

The REIT’s NAV per share as of April 30, 2019, reflect NAV prior to the consummation of the Mergers of Griffin Capital Essential Asset REIT and Griffin Capital Essential REIT II on April 30, 2019. The NAV per share as of May 31, 2019, reflects the value subsequent to the consummation of the Mergers on April 30, 2019.

Declaration of Q1 2020 Distributions

On December 18, 2019, the board of directors declared a cash distribution at a distribution rate based on 366 days in the calendar year, of $0.001502732 per day, subject to adjustments for class-specific expenses, per Class E share, Class T share, Class S share, Class D share, Class I share, Class A share, Class AA share and Class AAA share of common stock, for stockholders of record at the close of each business day of the period commencing on January 1, 2020 and ending on March 31, 2020. (Based on the most recent NAV, the annualized distribution of $0.55 would provide a yield for Class A shares of 5.77% and for Class T shares of 5.69% before fees and 4.69% net of fees.) The REIT will pay such distributions to each stockholder of record at such time after the end of each month during the period as determined by the REIT’s Chief Executive Officer.

The board of directors also declared a stock distribution at a monthly rate of $0.008333333 worth of shares per Class E share, Class T share, Class S share, Class D share, Class I share, Class A share, Class AA share and Class AAA share of common stock, (equivalent to a 0.10 per share annualized stock distribution), for stockholders of record at the close of business on February 3, 2020, March 2, 2020, and April 1, 2020. The REIT will pay such stock distributions to each stockholder of record at such time after each record date as determined by the REIT’s Chief Executive Officer.

Changes to The Share Redemption Program

On August 8, 2019, the board of directors amended and restated the share redemption program, effective as of September 12, 2019, in order to (i) clarify that only those stockholders who purchased their shares from the REIT or received their shares from the REIT (directly or indirectly) through one or more non-cash transactions (including transfers to trusts, family members, etc.) may participate in the share redemption program; (ii) allocate capacity within each class of the common stock such that the REIT may redeem shares equal to a value of up to 5% of the aggregate NAV of each class of common stock; (iii) treat all unsatisfied redemption requests (or portion thereof) as a request for redemption the following quarter unless otherwise withdrawn; and (iv) make certain other clarifying changes.

On November 7, 2019, the board of directors amended and restated the share redemption program, effective as of December 12, 2019, in order to (i) provide for redemptions sought upon a stockholder’s determination of incompetence or incapacitation; (ii) clarify the circumstances under which a determination of incompetence or incapacitation will entitle a stockholder to such redemptions; and (iii) make certain other clarifying changes.

Sources: SEC, Blue Vault