A Brief History of Alternative Investments (and the Current State of Play)

September 20, 2023 | Johnathan Rickman | Blue Vault

The history of alternative investments is a story of diversification, innovation, and adaptation to changing financial landscapes. Alternative investments refer to a broad category of assets that extend beyond conventional investments like stocks, bonds, and cash. “Alts” have garnered increased interest over the years as investors seek new ways to boost portfolio returns, reduce risk, and access fresh opportunities.

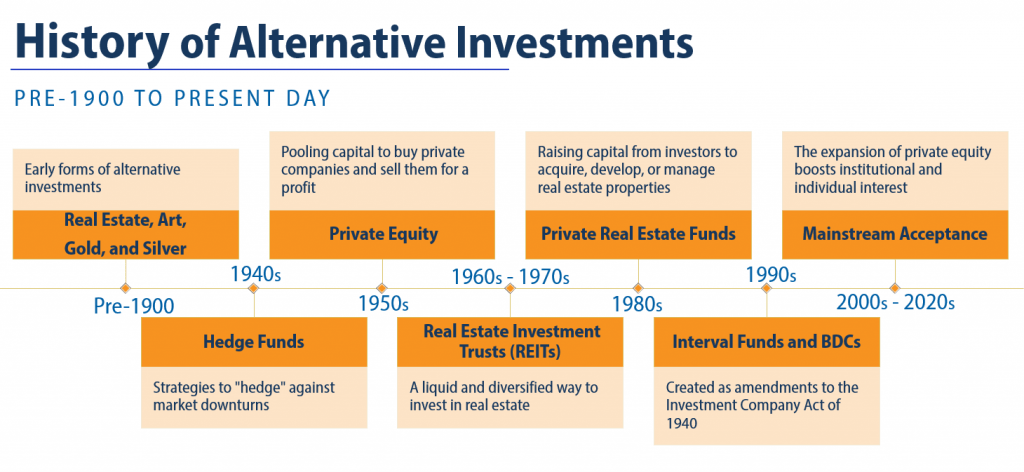

Alternative investments in the United States have come a long way since the 18th century when real estate, art, and commodities like silver and gold were the only “alternatives” to stocks and bonds being sold on the nascent Philadelphia and New York stock exchanges, founded in 1790 and 1792, respectively.

The emergence of hedge funds in the 1940s, and the rise of private equity strategies in the Fifties, were key developments that helped kickstart the modern-day alts phenomenon, which, fast forward to 2023, continues to develop new ways of generating positive returns regardless of market conditions:

Innovation in alternative investment structures and strategies has often taken place during periods of market malaise. Private equity as an alternative investment grew exponentially following the Great Recession of 2007-2009, with buyout firms like Blackstone and KKR becoming major players steeped in technology, healthcare, infrastructure, and other strategic sectors.

The pandemic further accelerated growing interest in alts, generating new liquidity opportunities for institutional and individual investors alike. Alternative investments offer diversification benefits, low market correlation, and the potential for higher returns, albeit with higher risk. Now that we’ve taken a brief look back, let’s review how far the alts industry has come with the help of real-time Blue Vault data:

Nontraded REITs

Real estate investment trusts (REITs) were created as part of the Cigar Excise Tax Extension of 1960. They were designed to spur investment in large-scale, diversified portfolios of income-generating real estate via the purchase and sale of liquid securities. The first REIT, American Realty Trust, was founded by Thomas J. Broyhill, the cousin of U.S. Congressman Joel Broyhill, who pushed for the creation of REITs.1

According to the National Association of Real Estate Investment Trusts, some 150 million Americans live in households invested in REITs through their 401(k), IRAs, pension plans, and other investment funds.2 Publicly listed REITs have an equity market capitalization of more than $1.3 trillion, the trade group says.3

The nontraded REIT industry, which Blue Vault closely tracks, is just as prosperous. In terms of capital raise, the industry jumped from raising $11.2 billion in 2018 to $35.0 billion in 2022. The industry’s record-breaking year for capital raises was 2021, when it raised a record total of $35.7 billion.

Capital raises are on the rise again this year, with Q1 sales posted at $7.09 billion, following $5.29 billion in Q4 and $7.00 billion in Q3 2022. Altogether, active nontraded REITs in Q1 2023 have raised a total of $130.6 billion in their public offerings, including dividend reinvestment plan (DRIP) proceeds, since inception.

Blackstone REIT led the sector with $5.78 billion in capital raise in Q1 2023 for an 82% market share, having raised an estimated total of $75.0 billion since inception. The REIT was introduced in late 2016 and has dominated the sector’s capital raise ever since. The REIT’s total assets as of March 31, 2023, were $140.7 billion, amounting to more than 59% of the nontraded REIT industry’s total of $236 billion.4 Total assets held by the industry have jumped by leaps and bounds over the last five years since posting total assets of $23.43 billion at the end of 2018.

Runners up included JLL Income Property Trust, FS Credit Real Estate Income Trust, Inc., Starwood REIT, Hines Global Income Trust, and Ares Industrial REIT, which posted the largest capital raises compared to their other non-Blackstone peers.4

For the quarter ending March 31, 2023, FS Credit exceeded its peers in distribution yields at 6.17%. FS Credit also posted an impressive funds-from-operations (FFO) payout ratio of 83% for the same period, while Ares Industrial REIT and Brookfield REIT had payout ratios exceeding 500%. The median FFO payout ratio for all nontraded REITs paying distributions was 91% for the same period. 4 The ratio of total distributions (cash plus DRIP) paid to a REIT’s FFO gives insight into a REIT’s ability to maintain distributions at current rates.

The nontraded REIT industry has swiftly evolved over the last decade to provide more diversification and potentially higher yields compared to many of the offerings on the S&P 500. For instance, nontraded REIT investments typically enjoy lower volatility of valuations compared to REITs listed on a public exchange. The tax laws applicable to public non-listed REITs may also reduce, defer, or eliminate taxes.

However, there are some so-called “zombie” nontraded REITs that have not paid distributions for years and have seen their net asset values decline over time. Stacy Chitty, Managing Partner of Blue Vault, discussed zombie REITs in a recent Blue Vault Minute video.

As with all alternative investments, it pays to do your research and pick the right sponsor, which is where Blue Vault comes in! Explore more nontraded REIT performance data in our subscription database today.

Business Development Companies

A business development company (BDC) is an SEC-registered investment company that invests in primarily private U.S.-based businesses. BDCs were created by Congress in 1980 as amendments to the Investment Company Act of 1940. BDCs are typically taxed as regulated investment companies. Like REITs, BDCs are required to distribute at least 90% of taxable income as dividends to investors, and the company itself pays little or no corporate income tax.

Although regulations for BDCs were passed in 1980, the creation of these companies did not come about until the late 1990s and early 2000s. Furthermore, they did not begin to gain popularity until Apollo Investment Corporation raised $930 million over three months in 2004.

The nontraded BDC industry now has $93.4 billion in assets under management, up from $45.0 billion in 2021 and $86.7 billion at the end of 2022. That’s a big leap from its 2018 total of $20.9 billion.

More recently, the industry raised about $3.0 billion in public offering proceeds in Q2 2023, up from $2.2 billion in Q1 2023. On top of that, nontraded BDCs raised a total of $1.8 billion via private offerings in the second quarter. Much of this capital infusion flowed from new products introduced by Blackstone and Blue Owl (formerly Owl Rock) in early 2021. These new BDCs prompted a resurgence of interest in the industry, with new sponsors entering the fray. 5

The industry had strong total returns in Q2 2023, posting a median return of 5.03% through the first six months of the year. Through the first half of 2023, the Morningstar LSTA Leveraged Loan Index posted a return of 6.37%, with the ICE BofA High Yield Index posting at 5.41%. Apollo Debt Solutions BDC led the pack in performance returns at 8.73% for the first half of 2023, with HPS Corporate Lending Fund, BlackRock Private Credit Fund, Ares Strategic Income Fund, and Blue Owl Technology Income Corp. following in succession. 5

Pandemic concerns slowed distribution yields in 2020 and 2021 but have since rebounded. The industry’s average distribution yield at the end of Q2 was an impressive 7.50%, up from 6.47% in Q4 2022. 5

As of June 30, 2023, there were 14 active nontraded BDCs raising capital and nine closed funds. 5

Blue Vault tracks capital markets data summarizing capital raising, performance, and new issuance of nontraded BDCs, while also covering individual funds’ performance metrics in our subscription database.

Interval Funds

Interval funds are a type of SEC-registered, closed-end fund that expands investor access to illiquid alternative investment strategies through low investment minimums, frequent valuations, and 1099 tax forms. Governed by the Investment Company Act of 1940, interval funds are perpetual, continuously offered, and sold by financial advisors such as RIAs, independent broker-dealers, and wirehouse advisors.

They first made their appearance in 1993 when the SEC, after calling for a new structure halfway between open-end and closed-end funds, adopted Rule 23c-3 establishing the interval fund structure under the Investment Company Act. Since 2010 they have been housing illiquid alternative investments, spurring increased investor interest.

Over the last 10 years, the interval fund industry’s total assets under management ballooned from $4.53 billion in 2013 to $84.03 billion at the end of the first quarter of this year. Over the last five years, capital raise more than doubled from $10.88 billion in 2018 to $25.85 billion in 2022. As of March 31, 2023, the industry has so far raised $5.87 billion. 6

The credit-focused Cliffwater Corporate Lending Fund last year lead the industry in capital raise, pulling in $5.1 billion to capture 19.7% of the industry. As of Q1 2023, Cliffwater continues to dominate the space, with $15.12 billion in total assets under management, translating to 18.0% of the industry’s total assets. Other major players in the space include ACAP Strategic Fund, Bluerock Total Income + Real Estate Fund, Apollo Diversified Real Estate Fund, and PIMCO Flexible Credit Income fund. 6

Because interval funds have differently timed fiscal years and filing schedules, the data provided is aggregated from sponsors’ most appropriate and recently available financial statements.

Explore performance data of dozens of individual interval funds through our subscription database.

Nontraded Preferreds

Blue Vault also tracks individual performance data of nonlisted preferred stock issued by listed REITs. This type of security has become a significant source of capital for several listed REITs. Preferred stocks are unique among the different types of financial instruments in that they have characteristics of both equity and debt. Learn more about nonlisted preferreds and their liquidity potential, dividends, and yields.

Throughout history, the landscape of alternative investments has evolved to accommodate changing investor preferences and market conditions. Alternative investments are now accessible to a broader range of investors, and they continue to play a crucial role in portfolio diversification and risk management. Stay in touch with Blue Vault as we track the performance of alternative investments.

References

1 https://en.wikipedia.org/wiki/Real_estate_investment_trust

2 https://www.reit.com/data-research/research/nareit-research/150-million-americans-own-reit-stocks

3 https://www.reit.com/data-research/data/reits-numbers

4 Blue Vault Nontraded REIT Industry Review First Quarter 2023

5 Blue Vault Nontraded BDC Industry Review Second Quarter 2023

6 Blue Vault Database: Interval Funds