James Sprow | Blue Vault |

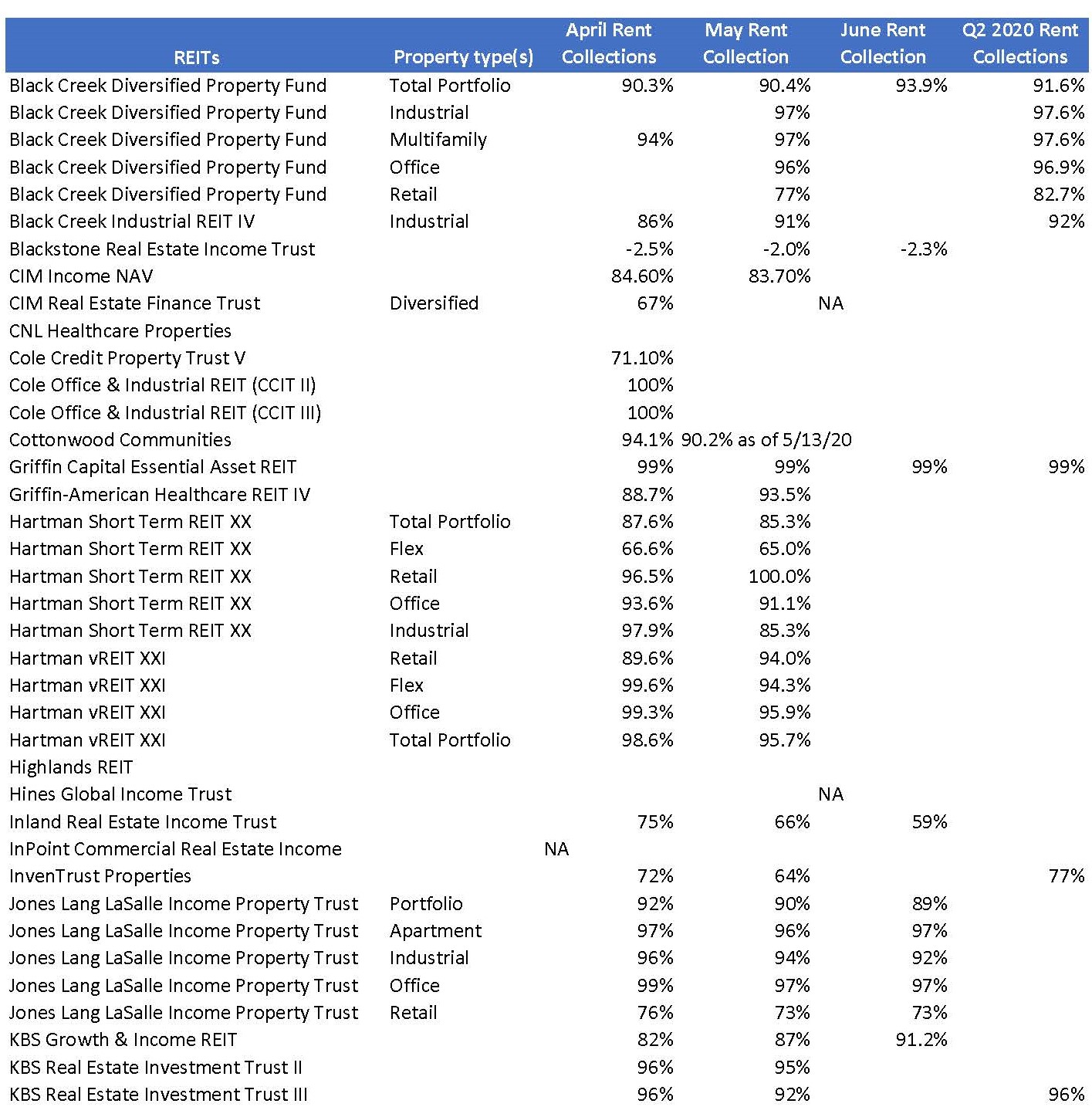

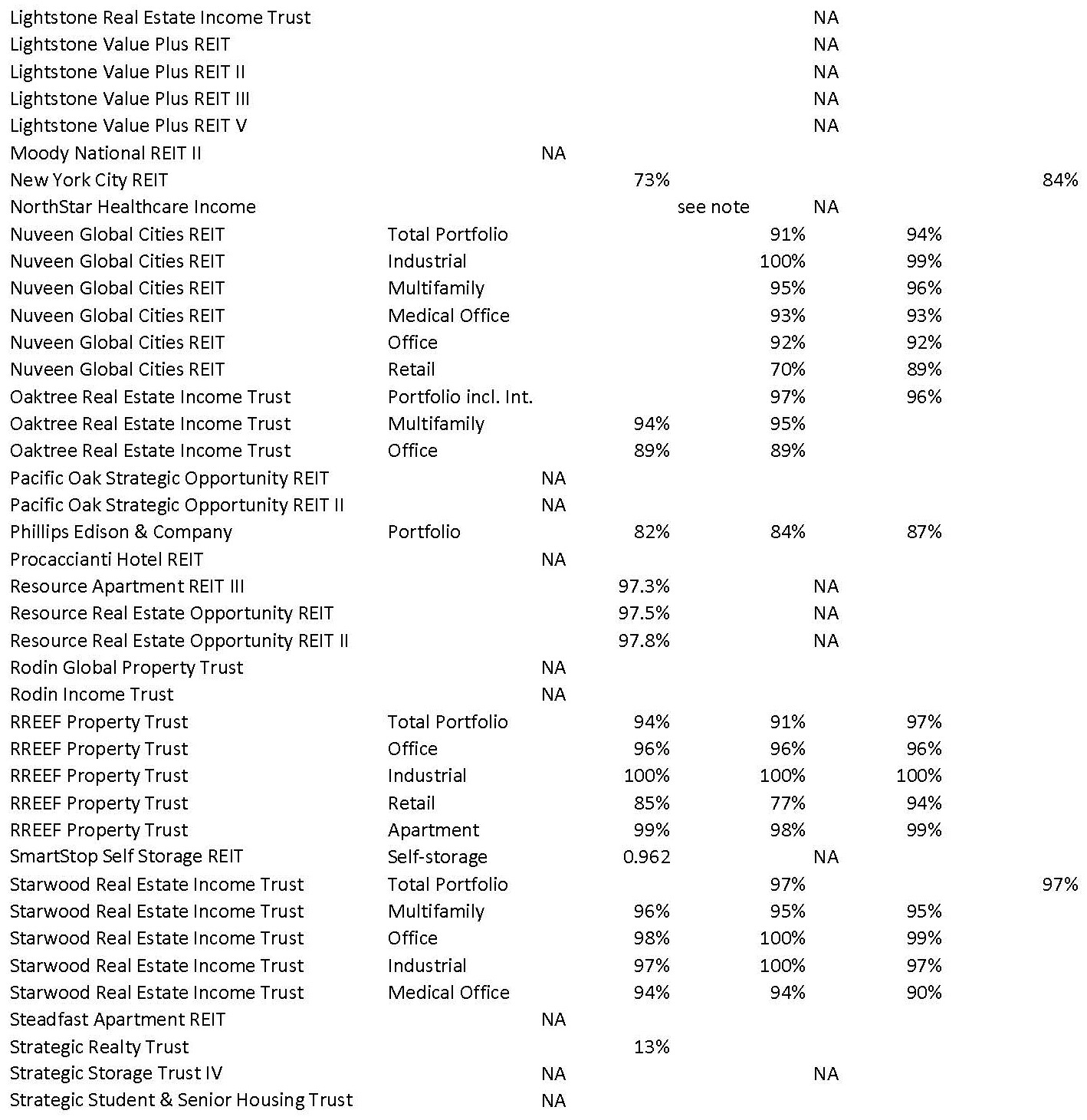

In trying to compile a comprehensive survey of the rent collections by nontraded REITs during the second quarter of 2020, it is quickly evident that the reporting by nontraded REITs on their success of collecting rents during the COVID-19 pandemic is spotty at best. Blue Vault examined all public filings by nontraded REITs since March 2020 looking for data describing rent collections. Several REITs and their sponsors were very forthcoming in reporting their rent collections. For example, Black Creek, Hartman, Nuveen, RREEF and Starwood are sponsors that provided monthly collections detail by property type and/or quarterly collection data for Q2 2020. For many other nontraded REITs we found only April rent collections data or none at all. Blackstone REIT reported their rent collections only in terms of comparisons to the same months in 2019, without providing the base numbers from which to calculate the actual percentages of rents collected.

Those same REITs that provided the most thorough monthly collections data also broke down their respective rent collections by property type within their diversified portfolios. Due to the diversity of those REIT portfolios, it is not possible to make peer to peer comparisons. Following are some observations based upon very limited sample sizes.

The six REITs that broke out collections for multifamily properties had a group average of 96% collections for the 2nd Quarter 2020. RREEF Property Trust had an average near 99% for the quarter. Among the REITs that reported collections for industrial or flex properties, the group average was about 93%, but excluding Hartman Short Term REIT XX, the average was 95.9%. RREEF Property Trust again had the highest percentage at 100% for April thru June.

For the eight nontraded REITs that reported rent collections for office properties, the average for the monthly percentages was 95%. Black Creek Diversified Property Fund was the only REIT to report their Q2 2020 collections percentage, at 96.9%.

Only five nontraded REITs reported their average collections experience for the entire Q2 2020 period for their total portfolios. Griffin Capital Essential Asset REIT had a 99% quarterly collection record. At the low end of the group, InvenTrust Properties reported just a 77% quarterly collections experience, with a low of 64% collected in May.

Due to the small sample size and diverse property types across all REITs, monthly averages for rent collections are not likely to be indicative of the total for all nontraded REITs. Nevertheless, the trend was 87% for April, 88% for May and 89% for June, using only those reporting.

Below are the results reported by all the nontraded REITs and those that did not report collections.

Sources: SEC filings, individual REIT websites