Bluerock

How Increasing Demand And Long-Term Limited Supply Combine To Create A Compelling Investment Thesis Hiding In Plain Sight

The industrial sector’s best-kept secret may be the light industrial, small-bay property subsector. Light industrial properties are distinguished by, in part, their smaller sizes compared to large, bulk distribution properties. These property types generally comprise 50,000 – 100,000 square feet. While they aren’t physically that different from their larger distribution brethren (single story, 30 feet+ ceiling height, mostly warehouse configuration), the similarities end there and understanding the differences in today’s market creates a highly compelling investment thesis in the in-demand industrial real estate world.

Light industrial, small bay properties tend to have much smaller suite sizes than larger industrial buildings, are many times multi-tenanted, and serve different needs. Small bay properties tend to be “infill” and closer to end consumers, many are called “last mile” facilities as they represent the final shorter distance where goods are shipped to consumer homes or businesses. Because of this, metro level and intra-urban locations become highly coveted with continued future population growth. These urban, high-amenity infill locations have limited development opportunities, which increases rent growth opportunities for property owners in this sub-sector.

Investment Thesis

For most real estate investors seeking an allocation to the industrial sector, large bulk distribution properties have been, by far, the most popular choice due to this property type’s key role in logistics, name brand tenants with long-term leases, modern buildouts, and large transaction sizes which maximizes ease of capital deployment. This combination of factors has significantly driven up property values. Conversely, light industrial properties have much smaller transaction sizes, require more extensive and thorough due diligence, typically have fewer brand-name national tenants and shorter-term leases. For these reasons, these properties have garnered far less attention from most institutional real estate investors. But for savvy real estate investors, this property subsector provides several potential opportunities, including: 1) lower weighted average lease terms (WALT), 2) better inflation protection, 3) higher demand due to less availability, 4) e-commerce multipliers, and 5) long-term new supply constraints (i.e. less competition).

Small Bay Benefits

A shorter weighted average lease term is beneficial when rents are increasing. For example, when prevailing market rents exceed current contract rents, shorter WALTs allow a quicker path to increase rents to market which increase property values. In addition, shorter lease terms provide an enhanced inflation protection as property owners can strike market rents faster rather than being locked into long-term fixed rate leases. Small bay buildings historically have a higher number of releasing prospects compared to single-tenant bulk distribution facilities. With several smaller spaces to sub-lease, there is typically a much larger pool of prospective tenants in the market vs. large vacant spaces appealing to much fewer large industrial users.

Additionally, small bay “last mile” tenants can be highly crucial in the e-commerce delivery cycle and the only way to achieve faster delivery times. The continued growth of e-commerce and its increasing share of the retail market from store-based sales is forecast as a strong long-term driver of “last-mile” small bay space. As this demand continues to grow, significant new supply is limited as 1) infill locations are already predominately built-out, 2) physical and regulatory barriers to entry can be high (including NIMBYism), and 3) high-demand urban locations are typically zoned for much higher land use development needs such as mid-rise residential housing.

Combined, these factors form a structurally inherent rent growth opportunity for light industrial space across economic cycles.

Proving Out The Thesis: Current Market Fundamentals

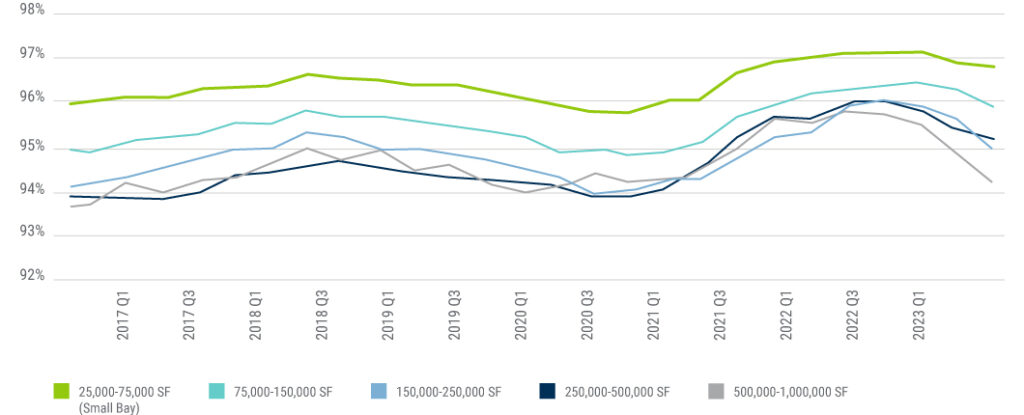

While industrial spaces of all sizes are currently performing well, small bay properties (25,000-75,000 square feet) have the highest occupancy rate and have since 2017. The consistency of higher occupancy rates further validate the embedded structural forces discussed above.

Small Bay Spaces Have Had Consistently Higher Occupancy Rates

Warehouse Occupancy by Building Size

Source: Costar Insight, February 2024

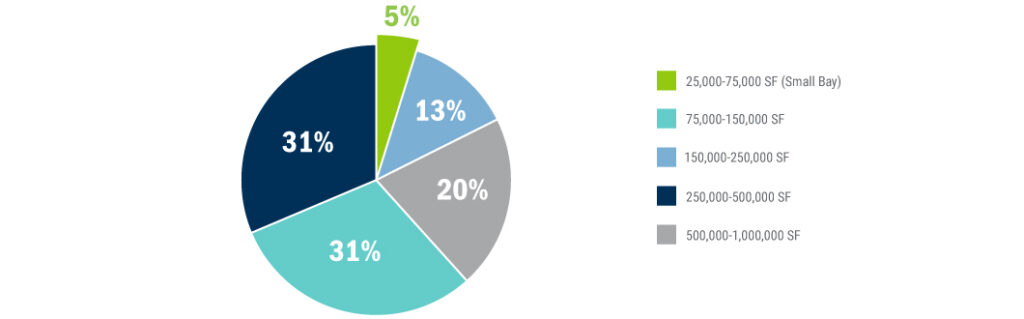

The higher occupancy rates are due, in part, to less development of smaller bay buildings as the graphic below shows with only approximately 5% of the total industrial space currently under construction comprised of building sizes of between 25,000-75,000 square feet.

New Development Concentrated in Large Buildings

Industrial Square Feet Under Construction

Source: Costar Insight, February 2024

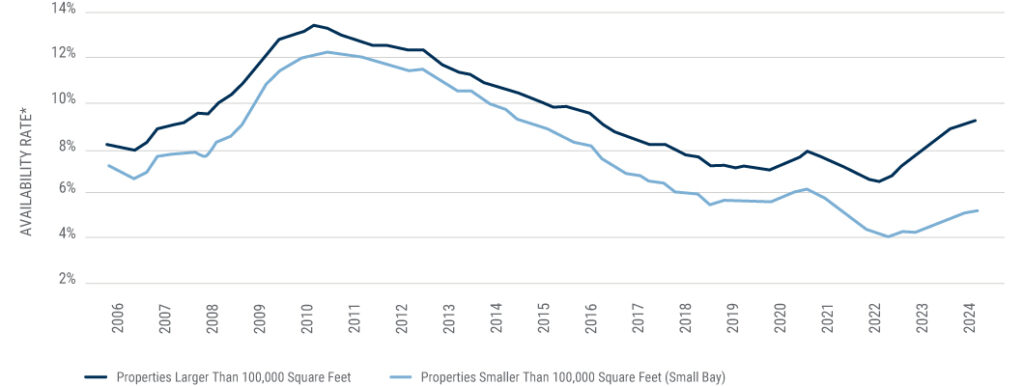

This has led to a distinct difference in the availability rates (vacancy rates) of smaller vs. larger properties.

Smaller Industrial Spaces Have Lower Availability Rates

Development Wave Lifts Availability of Large Industrial Spaces

Source: Costar Insight, February 2024

Market Selection

As with all real estate, market and site selection is critical. Larger bulk distribution centers and many other industrial property types need locations near ports, highways, and airports to best serve their intended use and purpose. However, light industrial small bay properties deliver greatest value when they offer easy access to population clusters and the growth of these clusters serves to further enhance long-term demand and performance.

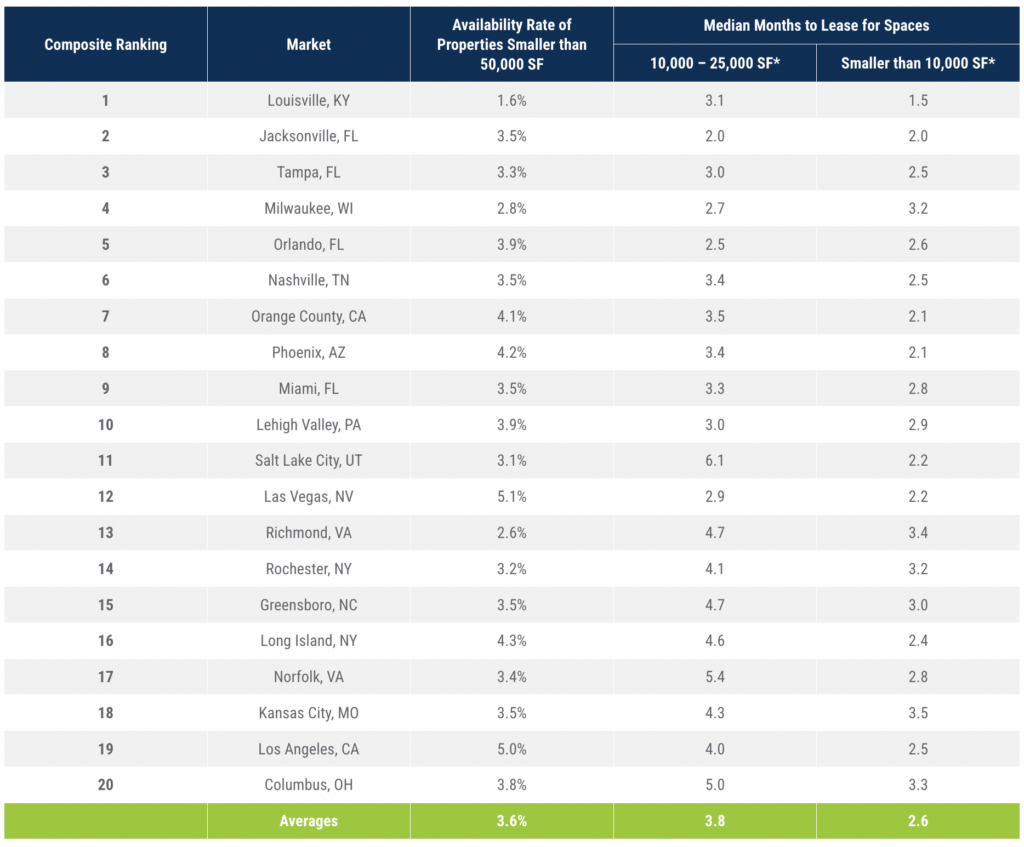

A recent analysis from real estate data provider, Costar, revealed the tightest 20 markets for small bay industrial spaces with availability rates ranging from only 1.6% to 5.1% and months to lease ranges are incredibly short — from only 3-6 months (reflected in the table below). For spaces less than 10,000 square feet, the lease timing further declines to only 1-3 months due to tremendous demand. This demand strength corroborates the large base of potential tenants in the market for such spaces and the lack of supply of them. It’s no surprise that many of the top 20 markets are what Costar refers to as “migration magnets”, excessive demand driven by population growth.

Tightest 20 Markets are Migration Magnets, Critical Port Cities

* Median months to lease are calculated for spaces in properties built in the 1970s or 1980s.

Source: CoStar, March 2024