Apollo Global Management Launches Nontraded REIT

September 22, 2022 | James Sprow | Blue Vault

Apollo Realty Income Solutions, Inc. is a newly organized corporation formed to invest primarily in a portfolio of diversified institutional quality, income-oriented commercial real estate primarily in the United States. It is externally managed by ARIS Management, LLC. The Adviser is an affiliate of the REIT sponsor, Apollo Global Management, Inc., a global, high-growth alternative asset manager.

The public offering will be on a continuous basis for up to $5 billion in shares of common stock, consisting of up to $4 billion in shares in the primary offering and up to $1 billion in shares pursuant to the DRIP. The REIT is offering to sell any combination of nine classes of shares of common stock, six classes of which are being offered to all investors in the offering (Classes S, D, I, F-S, F-D and F-I). Three classes of “anchor shares” are being offered through certain financial intermediaries (Classes A-I, A-II and A-III).

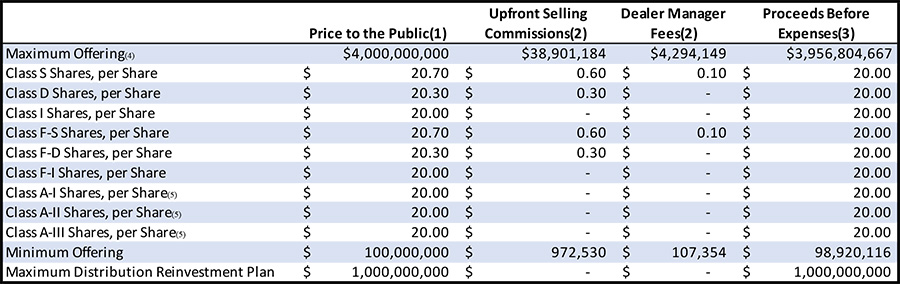

Below is the break-out of fees associated with each share class:

(1) The price per share shown will apply until funds are released to us from the escrow account. Thereafter, shares of each class will be issued on a monthly basis at a price per share generally equal to the prior month’s NAV per share for such class, plus applicable upfront selling commissions and dealer manager fees.

(2) The table assumes that all shares are sold in the primary offering, with 1/9 of the gross offering proceeds from the sale of Class S shares, 1/9 from the sale of Class D shares, 1/9 from the sale of Class I shares, 1/9 from the sale of Class F-S shares, 1/9 from the sale of Class F-D shares,1/9 from the sale of Class F-I shares, 1/9 from the sale of Class A-I shares, 1/9 from the sale of Class A-II shares and 1/9 from the sale of Class A-III shares.

(3) Proceeds are calculated before deducting stockholder servicing fees or organization and offering expenses payable by us, which are paid over time.

Investment Objectives

The REIT’s investment objectives are to invest in assets that will enable it to:

• provide current income in the form of regular, stable cash distributions to achieve an attractive dividend yield;

• preserve and protect invested capital;

• realize appreciation in NAV from proactive investment management and asset management; and

• provide an investment alternative for stockholders seeking to allocate a portion of their long-term investment portfolios to commercial real estate with lower volatility than public real estate companies.

Investment Strategy

Apollo applies a value-oriented approach across a wide spectrum of alternative asset classes including real assets, credit and private equity. As of June 30, 2022, Apollo had total assets under management of approximately $514.8 billion, comprised of assets under management of approximately $375.8 billion for its yield strategy, approximately $56.1 billion for its hybrid strategy and approximately $82.9 billion for its equity strategy, including approximately $64.0 billion in its real estate business globally.

The REIT’s investment strategy is to acquire primarily a portfolio of diversified institutional quality, income-oriented commercial real estate primarily in the United States that provide current income and potential capital appreciation, which they consider to be comprised of stabilized net lease commercial real estate and “core plus” real estate in the United States. Specifically, they expect to execute an asset-focused acquisition strategy that targets primarily substantially stabilized commercial real estate assets that have attractive long-term fundamentals in the United States. To a lesser extent, they may invest in real estate debt or real estate-related debt securities primarily in the United States on a selective basis or to provide a source of liquidity for the share repurchase plan, cash management and other purposes or other real estate assets.

The investments will focus on a range of asset types. These may include office, hotel, industrial, multifamily and retail assets, as well as others, including, without limitation, healthcare, student housing, life sciences, hospitality, senior living, data centers, manufactured housing and storage properties.

Source: SEC