August 2021 Nontraded REIT Sales Reveal Strong Y-O-Y Rebound

September 14, 2021 | James Sprow | Blue Vault

Blue Vault received August sales totals for 10 effective nontraded REIT program offerings as of September 10, 2021. Sales reported by those 10 NTRs totaled $496.3 million compared to $390.5 million for the 10 reporting REITs in July, an increase of $105.8 million, or 27.1%. Blackstone REIT, the largest nontraded REIT with $48.0 billion in total assets as of June 30, 2021, did not report their sales to Blue Vault. That REIT’s total net asset value totaled $35.0 billion as of July 31, 2021, and its net asset value per share had increased to $12.90 as of that date from $11.55 as of December 31, 2020, for Class I shares. Six additional nontraded REITs have previously suspended their offerings or did not report sales for August (Cottonwood Communities, Griffin Realty Trust, Moody National REIT II, Oaktree REIT, and Strategic Student & Senior Housing Trust).

Blue Vault received August sales totals for 10 effective nontraded REIT program offerings as of September 10, 2021. Sales reported by those 10 NTRs totaled $496.3 million compared to $390.5 million for the 10 reporting REITs in July, an increase of $105.8 million, or 27.1%. Blackstone REIT, the largest nontraded REIT with $48.0 billion in total assets as of June 30, 2021, did not report their sales to Blue Vault. That REIT’s total net asset value totaled $35.0 billion as of July 31, 2021, and its net asset value per share had increased to $12.90 as of that date from $11.55 as of December 31, 2020, for Class I shares. Six additional nontraded REITs have previously suspended their offerings or did not report sales for August (Cottonwood Communities, Griffin Realty Trust, Moody National REIT II, Oaktree REIT, and Strategic Student & Senior Housing Trust).

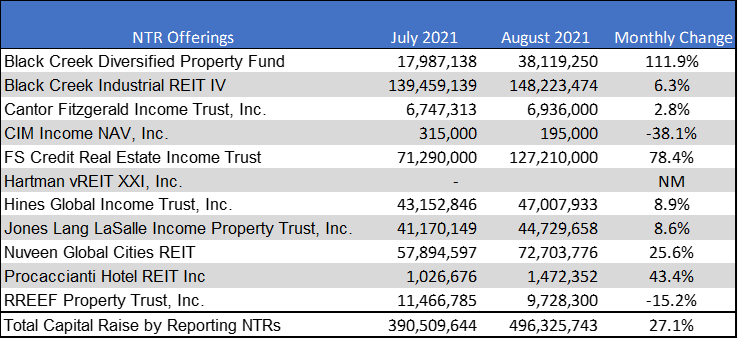

Black Creek Industrial REIT IV’s offering again led the 10 reporting NTRs with sales of $148.22 million, up 6.3% from $139.46 million in July. FS Credit Real Estate Income Trust raised $127.21 million, up 78.4% from July’s $71.29 million. Nuveen Global Cities REIT raised $72.70 million in August, up 25.6% from $57.89 million in July. Hines Global Income Trust raised $47.01 million, up 8.9% from $43.15 million in June. Jones Lang LaSalle Income Property Trust raised $44.73 million, up 8.6% from July when it raised $41.17 million. All sales reported include distributions reinvested in shares of the REIT (DRIP).

Table I shows month-to-month comparisons for those REITs reporting sales for July and August 2021.

Table I

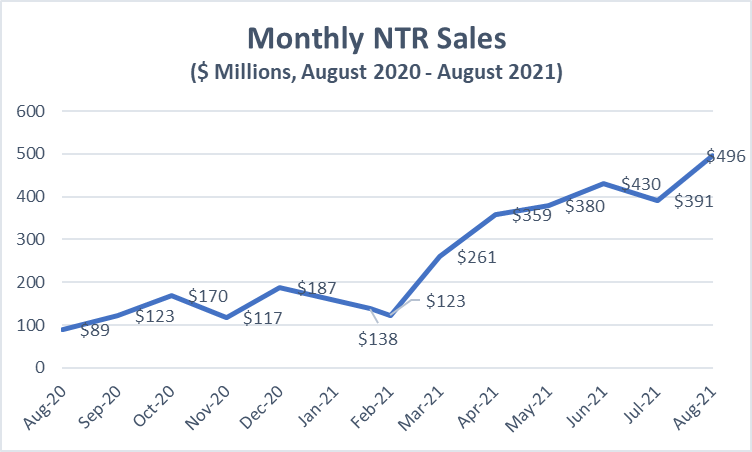

Chart I illustrates the strong resurgence of nontraded REIT capital raise since August 2020, which was the low point for sales due to the COVID-19 pandemic.

Chart I

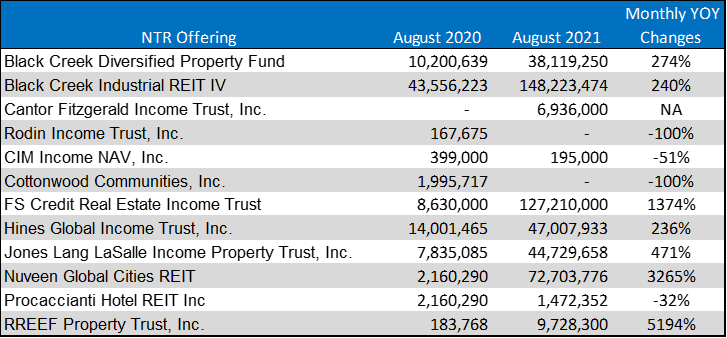

Table II shows August Y-O-Y comparisons for 12 nontraded REITs that have reported sales either in August 2020 or August 2021, or both. The most significant Y-O-Y increases were for RREEF Property Trust (+5194%), Nuveen Global Cities REIT (+3265%) and FS Credit Real Estate Income Trust (+1374%). For all of the reporting REITs, sales increased from $91.3 million to $496.3 million, an increase of 444% from the depths of the first wave of the COVID-19 pandemic. Sales were up 560% Y-O-Y in August 2021 for the 10 reporting nontraded REITs.

Table II

Nontraded BDC Sales

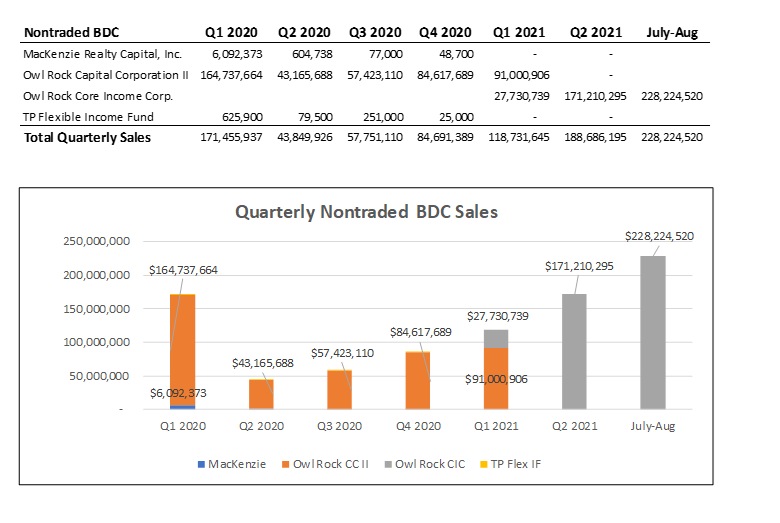

Just one nontraded BDC was raising funds in August 2021 and reported sales to Blue Vault. Owl Rock Core Income Fund raised $133.58 million in August, up 41% from $94.67 million in July and 78% in one month of the total raised by the same fund in the three months of Q2 2021. Owl Rock Capital Corporation II closed its offering in April 2021 after sales of $17.46 that month. MacKenzie Realty Capital last reported nontraded BDC sales in October 2020 of $48,700 and closed its offering in December 2020. MacKenzie recently changed its legal structure to a nontraded REIT. Prospect Flexible Income Fund last reported sales for October 2020 of $25,000 and closed its offering in February 2021.

On a quarterly basis, Owl Rock BDCs raised a four-quarter total of $331.37 million from Q3 2020 through Q2 2021. Table III and the accompanying chart show quarterly totals for all reporting nontraded BDCs and July through August 2021 sales for Owl Rock Core Income Fund.

Table III

Nontraded Preferred Stock Issued by Reporting Sponsors

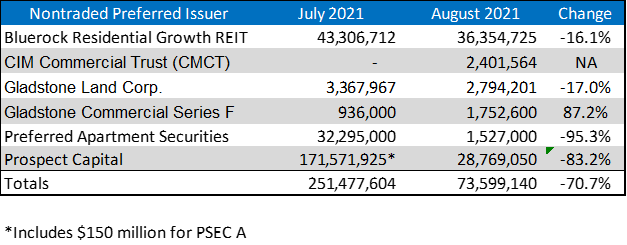

Five listed REITs reported their nontraded preferred stock issuances in August 2021 to Blue Vault. The five listed REITs reported total sales of nontraded preferred in August of $73.60 million, down 70.1% from $251.48 million in July. Prospect Capital reported $150 million raised by PSEC A in July which caused the August totals by comparison to fall significantly. In June, Prospect Capital issued just $35.48 million of nontraded preferred. Bluerock Residential Growth REIT issued $35.35 million of its preferred stock in August, down 16.1%% from $43.31 million in July. Preferred Apartment Communities reported preferred sales of just $1.53 million in August, down from $32.30 million for July. Gladstone LAND issued $2.79 million in nontraded preferred in August, down 17.0% from July’s $3.37 million. For August 2020 four listed REITs reported sales of $39.68 million in nontraded preferred stock, for a same-month Y-O-Y increase of 85% to the August 2021 total of $75.60 million.

Table IV shows July and August sales of nontraded preferred stock by reporting listed REITs.

Table IV

Source: Blue Vault