by James Sprow | Blue Vault

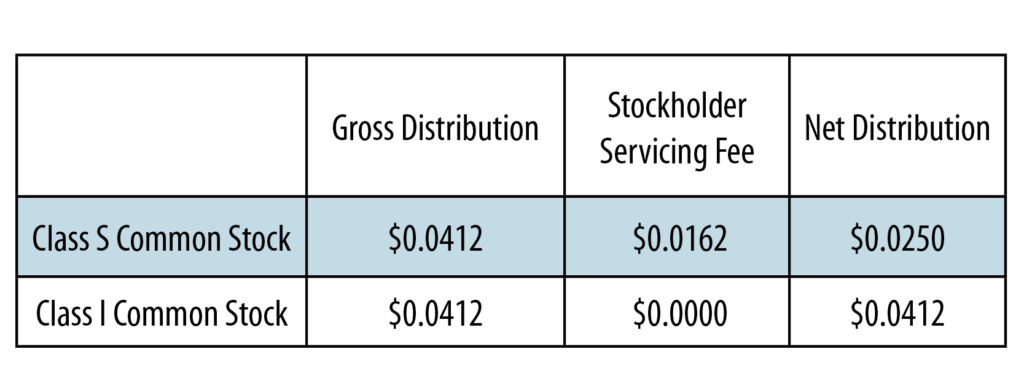

On March 30, 2017, Blackstone Real Estate Income Trust, Inc. declared distributions for each applicable class of its common stock in the amount per share set forth below:

The net distributions for each class of common stock (which represents the gross distributions less stockholder servicing fees for the applicable class of common stock) are payable to stockholders of record immediately following the close of business on March 31, 2017 and will be paid on or about April 20, 2017. These distributions will be paid in cash or reinvested in shares of the Company’s common stock for stockholders participating in the Company’s distribution reinvestment plan.

The Class S and Class I shares are currently being offered to the public at $10.02 and $10.03 per share, respectively. The net distribution rates represent annualized distribution yields of approximately 3.00% and 4.93% respectively.

As of March 22, 2017, the REIT had issued and sold 47,755,125 shares of its common stock (consisting of 40,507,678 Class S shares and 7,247,447 Class I shares; no Class T or Class D shares were issued or sold as of such date).

Blackstone REIT was formed on November 16, 2015, and is externally managed by BX REIT Advisors L.L.C., a Delaware limited liability company. The Adviser is an affiliate of Blackstone, the REIT’s sponsor.