Blackstone REIT’s Share Redemptions Story Far From Over

October 18, 2023 | James Sprow | Blue Vault

One of the hottest topics in the nontraded REIT space, beginning in November 2022, has been the share redemption requests submitted by the shareholders of Blackstone Real Estate Income Trust (“BREIT”) and the REIT’s capping of repurchases at 2% of aggregate NAV per month and 5% per quarter. All of the current 16 continuously offered nontraded REITs have redemption limits in their prospectuses, in most cases with the same limitations. The two largest of those nontraded REITs, Blackstone REIT and Starwood REIT, became the focus of the redemptions drama and related news articles, for having to cap redemptions and fulfilling less than 100% of redemption requests beginning in November 2022.

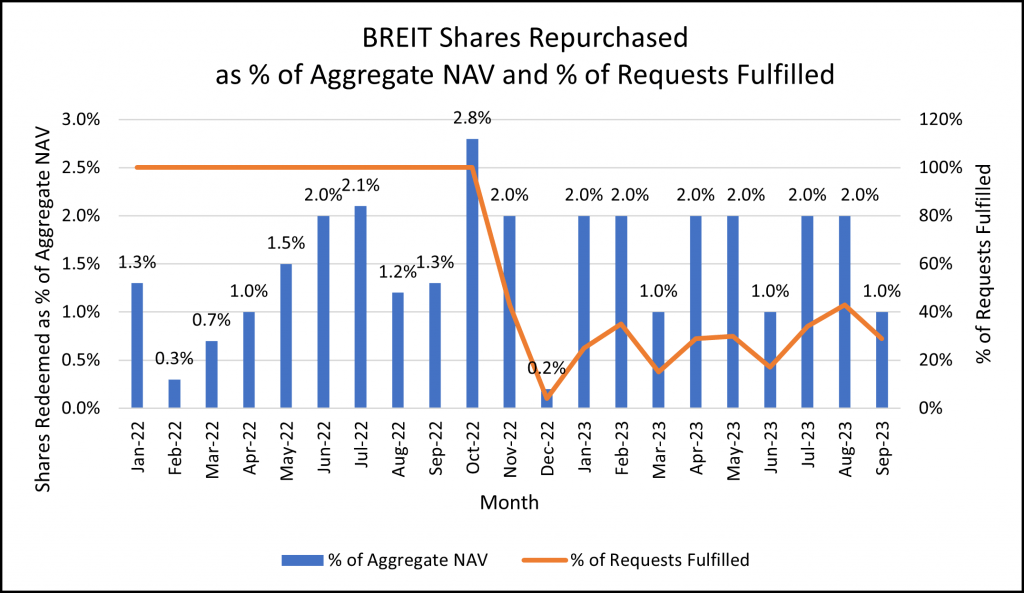

In Chart I we illustrate the trends in Blackstone REIT’s common share redemptions, both as a percentage of the REIT’s aggregate NAV and as a percentage of requests fulfilled. While the spokesmen for the REIT can accurately report that share redemption requests were lower in August 2023 relative to the previous months, the REIT was still capping redemptions at 2% of aggregate NAV per month and 1% per quarter. Hence, every month’s redemptions hit the 2% cap in the first two months of each quarter, then, in the third month of the quarter, the cap lowers to 1% due to the quarterly limit of 5% of aggregate NAV.

As shareholders who request redemptions and do not receive 100% of their requests fulfilled in a given month must re-submit their requests, the backlog of requests does not necessarily decrease. The best face that Blackstone can put on the situation is to point to a lower % of aggregate NAV in monthly request trends.

Chart I

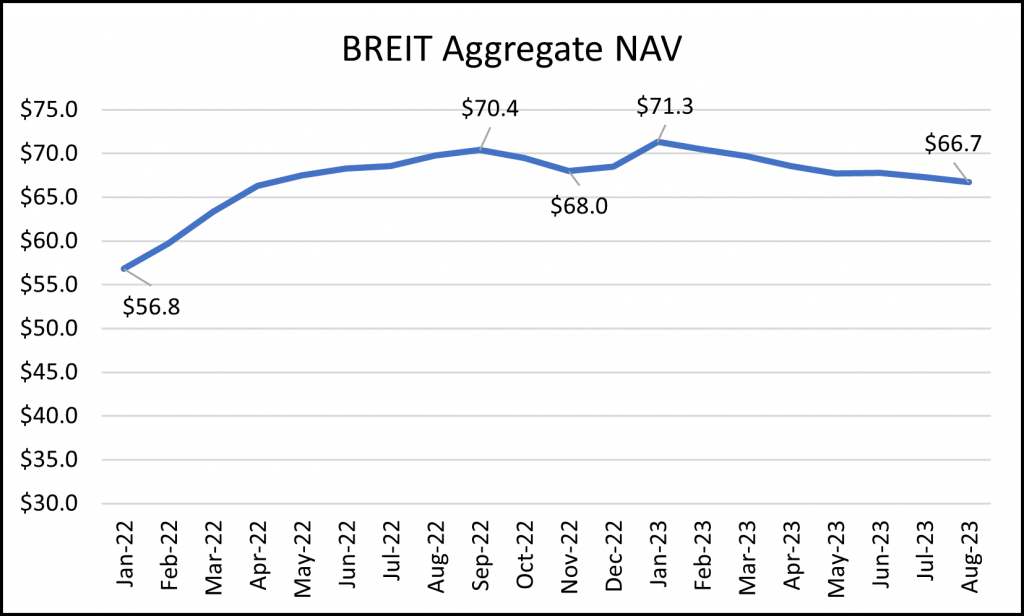

In Chart II we see that the overall aggregate NAV of Blackstone REIT has been decreasing since January 2023. This trend is not due to the decrease in the valuation of the REIT’s portfolio, since the monthly NAVs per share have actually held steady or even increased at times slightly over the course of the last 12 months. Rather, the aggregate NAV is decreasing due to the continuing requests for share redemptions. The only exceptions to the trend occurred when capital raise through common share sales exceeded redemptions, and particularly in January when the REIT was able to receive a $4.0 billion investment by the Regents of the University of California.1

BREIT also sold its 49.9% interest in MGM Grand Las Vegas and Mandalay Bay Resort on January 9, 2023, for cash consideration of approximately $1.3 billion, resulting in a gain on sale of $430.4 million. Both the investment by UC and the sale of the property in Las Vegas were efforts by the REIT to increase liquidity to support the ongoing share redemptions.

BREIT’s capital raise fell to $998 million (including DRIP) in Q2 2023, down from $5.78 billion in Q1 2023. This severe drop in common share sales will have impacts upon both the aggregate NAV of the REIT and its ability to fund future redemptions.

Chart II

Conclusion

While the trends in share redemption requests and share redemptions fulfilled may be viewed optimistically by the REIT’s management, it is clear that the high levels of redemptions that first appeared in the fourth quarter of 2022, and the capping of redemptions, have not really ceased. The REIT may be continually faced with the need to raise cash via asset sales to meet the demand for repurchases.

Footnotes

- Blackstone contributed $1.0 billion of its current holdings in the Company as part of the strategic venture, which provides a waterfall structure with UC Investments receiving a 11.25% minimum annualized net return on its investment in the Company’s shares (supported by a pledge of Blackstone’s contribution) and upside from its investment.

Sources: SEC, Blue Vault